An Unbelievably Simple and Overlooked Strategy to Crush Your Market

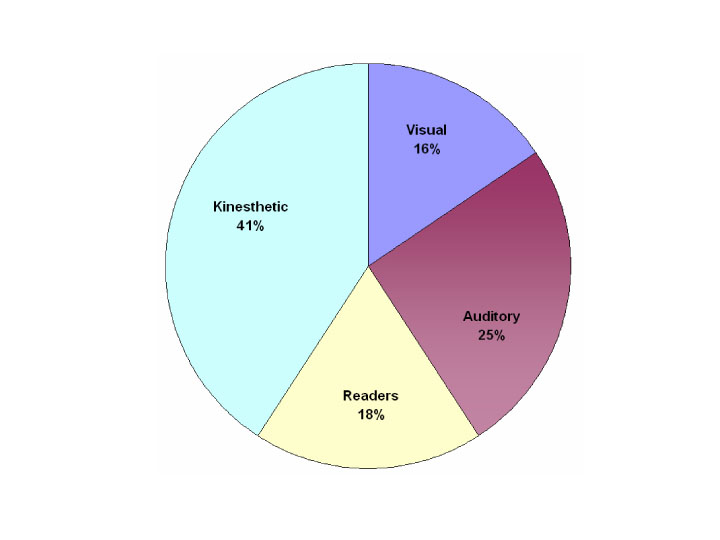

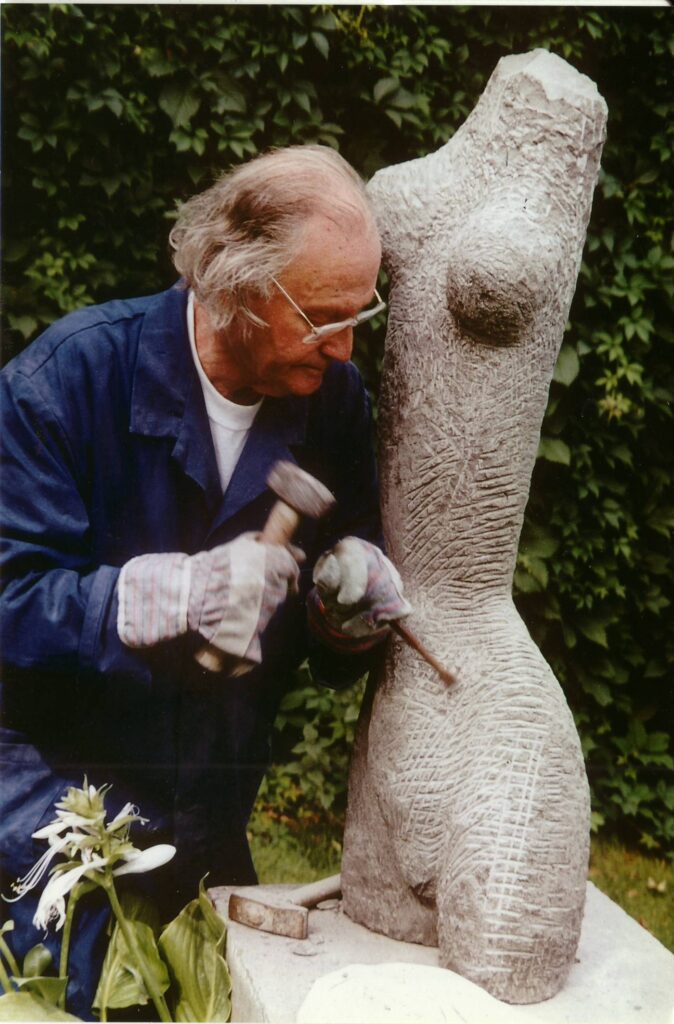

There are 2 kinds of customers out there: Do-It-Yourself and Do-It-For-Me customers. Most businesses only consider the same type of customers others in their industry are already targeting. Targeting the same customer with similar solutions leads to less opportunity for growth and tighter margins. Few businesses see the potential to offer an alternative solution.

An Unbelievably Simple and Overlooked Strategy to Crush Your Market Read More »