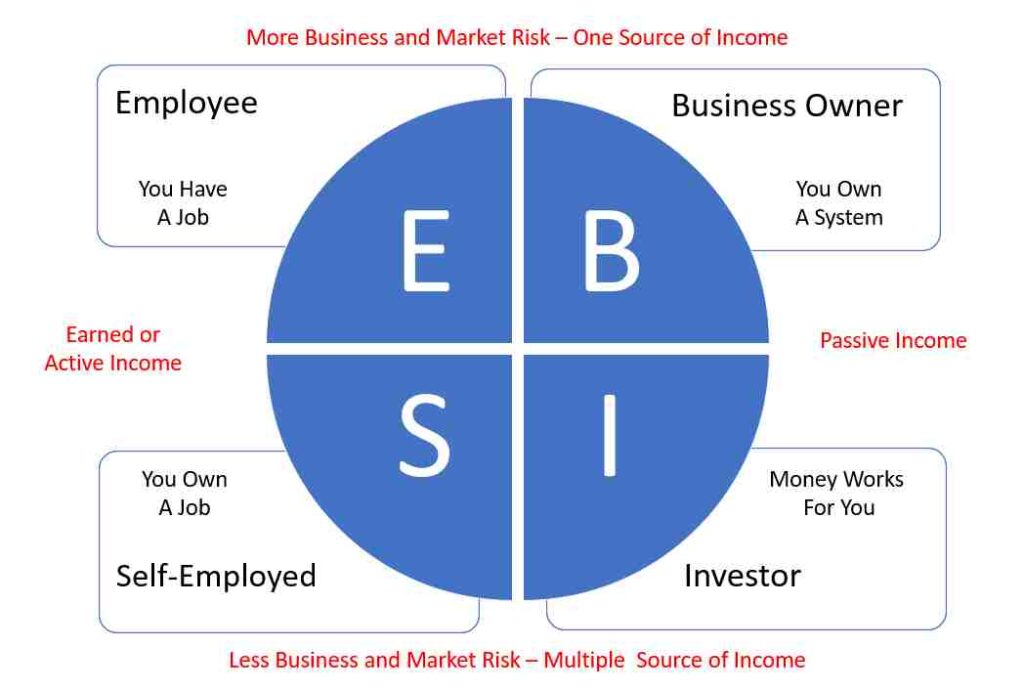

Cash Flow Quadrant – Why It Is So Important to Understand

Income can be earned from being an employee, form being Self-employed, form a Business Owner with employees, and by being an investor in several businesses.

Cash Flow Quadrant – Why It Is So Important to Understand Read More »