When entrepreneurs look at debt financing, their credit score (FICO) plays an important role in being able to get a loan. Most clients I speak to have a misunderstanding about how their credit score is actually computed.

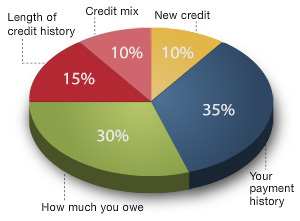

Essentially, your score is computed on five dimensions, each with a different weight.

1 – Payment History (35%)

The first and largest dimension and the one that most lenders look at previous credit performance. This dimension looks at if a person pays their bills when they are due and helps the lender determine the risk it will take when extending credit.

2 – Amount Owed (30%)

Next is your current level of Indebtedness, or how much you owe. Just owing money does not necessarily mean a person is high-risk to the lender. When a borrower is using a lot of their available credit it may indicate that they are overextended, Lenders interpret this to mean that the borrower is at a higher risk of defaulting.

3 – Length of Credit History (15%)

Next is credit history, or more specifically the time credit has been in use. What is the age of the oldest account, the age of the newest account, and the average age of all your accounts? A long track record without any major slip-ups suggests to the lender that a persons credit behavior will be similar in the future.

4 – Credit Mix (10%)

Next is the type or Mix of Credit, such as credit cards, home mortgage, auto loans, etc. Lenders like to see borrowers with a history of on-time payments across many types of accounts to demonstrate the borrower’s good at credit management.

5 – New Credit (10%)

The last dimension is the pursuit of new credit, or credit hits. Research has shown lenders that when a borrower opens several new credit accounts in a short period of time it represents a greater risk. This is especially true for borrowers who don’t have a long credit history. Most credit scores are not affected by multiple inquiries from auto or mortgage lenders within a short period of time. Credit agencies know this is common practice treat them as a single inquiry so they have minimal impact on a person’s credit score.

To maintain a high credit score you should make sure you consistently pay your bills on time, limit how many open lines of credit you have to 3-5, do not transfer balances frequently, and finally, keep credit in use on revolving lines to 25% or less of the credit limit.

What are you doing to make sure you have the best credit score possible?

Related Posts:

- Retirement Account Funds New Business

- Using a Self-Directed IRA to Fund Your Business

- Using a 401k Loan to Fund Your Business

- The 5 Stages of a Funding Plan

- Angel Investors

- The Debt Continuum

- A Step by Step Guide to Business Financing

- The Hidden Value of Crowdfunding

- Understanding Bonds and Royalties to Fund Business Growth

- The 5 “C’s” of Credit