As an existing business with a relatively steady income stream from credit card transactions, there is a fairly fast and easy way to get money for your business needs. It is called a Merchant Cash Advance, or MCA for short. An MCA is a good funding option for businesses and owners with poor credit history and little or no collateral to secure typical debt financing.

A merchant cash advance is a mechanism that allows a business to sell its future revenue from credit card transactions at a discounted rate to a lender or credit issuer for a lump sum advance. A merchant cash advance is not technically a loan like the one you think of when financing debt with a fixed principal and interest rate. Instead, an MCA is a lump sum cash advance paid to the business within one to three days of application in exchange for a revenue split on future credit card sales until the payback amount is reached. A merchant cash advance is sometimes referred to as “Revenue Lending.”

What sets MCAs apart is that they are easier to get since it is not based on the creditworthiness of the business. Unlike debt financing, which can take weeks or months to get approved, an MCA is funded in just one to three days. A merchant cash advance is a specific type of cash flow financing. Whereas some forms of cash flow financing look at all sources of cash flow, an MCA lender and credit issuer only looks at cash flow from credit card transactions. Moreover, while some forms of cash flow financing have fixed payment schedules, the payment schedule for an MCA is variable and occurs automatically. A small percentage of each credit card transaction amount is used to pay off the payback amount. Usually, payments are made daily based on the total amount of credit card transactions for the day. However, anything that removes a detailed analysis of a borrower during an application process, making it faster and easier for most people to qualify, can become an expensive source of money. Indeed, additional risk implies a greater reward for the lender or credit issuer.

Generally, a consistent income stream for six months or more is all that a company needs to get a merchant cash advance. What lenders and credit issuers are primarily looking for is that the business does not have a lot of chargebacks on its merchant account and that its revenues exceed its expenses, leading to a positive cash flow at the end of each month. Essentially, the lender or credit issuer wants to see that the business is not overdrawing the account or has a history of non-sufficient funds (NSF), indicating that the company has a handle on managing its bank account responsibly.

If a company meets these requirements, usually they can qualify for a merchant cash advance because there is no credit score or collateral requirements. In most cases, if the business or its owners have a credit score of 500 or better, most lenders and credit issuers will issue an MCA. Therefore, even if they have experienced credit issues in the past, most can get approved.

A merchant cash advance is unsecured. All the business needs is a history of consistent cash flow from credit card purchases to get approved.

Determining how much money a company can get approved for often takes less than 72 hours and maybe as little as 24 hours. The lenders and credit issuers will look at how much the business has in credit card transactions on an annualized basis and often authorize an MCA for as much as 10 to 15 percent of the company’s annual credit card transactions.

For example, if a business does $100,000 per year in credit card transactions, the lender or credit issuer might authorize a merchant cash advance of $10,000 to $15,000. Therefore, the higher the credit card revenue, the higher the company’s potential approval amount.

The MCA Process

A merchant cash advance lender or credit issuer only looks for three things:

- Three to six months of bank statements to verify that the business is managing its bank account responsibly.

- Three to six months of merchant account statements to verify the consistency of credit card transactions and ensure that there is no overabundance of chargebacks.

- Proof of your identity, such as a driver’s license or other ID.

Typically, the company only needs to provide its bank and merchant account statements and proof of identity to get approved. Once approved, lenders and credit issuers are ready to advance the funds. However, read the offer carefully to make sure you understand the terms of the cash advance.

What You Need to Know About an MCA

When dealing with a merchant cash advance, there are a few important aspects that the business has to understand to compare an MCA to other forms of financing.

Advance Amount

The advance amount is the agreed-upon amount that a lender or credit issuer will give the business as an advance. The amount requested should not be taken lightly, as the cost of a merchant cash advance can be pretty high. The advance amount depends on how much the business needs and how long the company feels comfortable being on the hook for paying a portion of all credit card sales to the lender or credit issuer until the payback amount is paid off.

Factor Rate

Unlike more traditional debt financing, where a company’s payments are based on an Annual Percentage Rate (APR) and the borrower is aware of the monthly payments required each month to pay off the loan, an MCA uses what is known as a Factor Rate. The factor rate is the multiplier amount applied to the initial cash advance amount. Typically, factor rates range between 1.1 and 1.5. Once calculated, the factor rate never changes throughout the term and is used to determine the payback amount.

Lenders and credit issuers generally use four criteria to compute the factor rate:

- Average Monthly Credit Card Sales – If the lender or credit issuer sees strong sales, demonstrating that it is highly likely that the business can repay the advance, the company’s factor rate will be lower.

- Length of Time in Business – The longer the company has been in business, the more likely it will be able to continue doing business and pay back any advances, the less risk it presents to the lender or credit issuer, and the lower the factor rate.

- Business Industry – Some industries present more risk than others. Industry risk plays a role in the factor rate. The less risky or volatile the industry, the lower the factor rate.

- Bank Account History – Lenders or credit issuers will review several months of banking statements to look for any history of overdrafts or non-sufficient funds. The absence of overdrafts and NSF indicates the business is managing its bank account responsibly. Additionally, they will look at the frequency of chargebacks. The more responsible the business and the fewer the number of chargebacks, the lower the factor rate.

Payback Amount

The payback amount is the sum of the cash advance multiplied by the factor rate. The payback amount is calculated at the beginning of the advance. For example, a $40,000 cash advance with a 1.2 factor rate would mean the company will have to pay back $48,000. (1.2 multiplied by $40,000 = $48,000)

Withholding Rate

Lenders and credit issuers take their repayment via a percentage holdback on each credit card transaction. This percentage of sales will be “held back” by the payment processor and remitted to the lender or credit issuer. Don’t confuse the withholding rate with the interest rate. There are no interest rates used in a merchant cash advance. The withholding rate is only the percentage of each sale taken for repayment. MCA lenders and credit issuers commonly withhold between 10% to 20% of all credit card transactions to make payments to reduce the payback amount. Thus, a withholding rate of 10% would mean that for a $100 sale, the net proceeds the business would receive is $90, and the additional $10 would go toward the payment to reduce the payback amount.

The True Cost of a Merchant Cash Advance

By its nature, a merchant cash advance is a variable repayment method, not a debt payment with a fixed amount due to the lender or credit issuer each month. Since the withholding rate is based on credit card sales, some months, the business will pay down more of the payback amount, and other months it will pay down less.

If the company’s credit card sales transactions go up, the business will pay down the payback amount faster. However, unlike more traditional debt financing, where the company can save money on interest charges if they pay off the debt early, the compensation to the lender or credit issuer of an MCA is defined and fixed by the factor rate when the lump sum cash advance is provided. As a result, paying off the payback amount earlier with higher sales revenue only results in a higher APR.

o provide a basis for comparison, you can convert an MCA to a more traditional debt by looking at the APR.

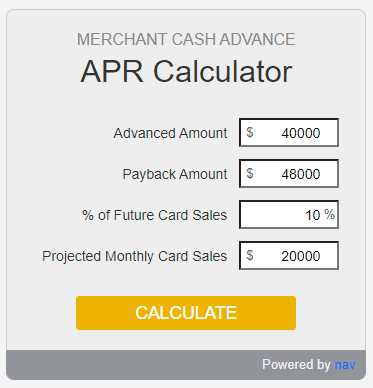

Let’s assume the following:

- Advance Amount: $40,000

- Factor Rate: 1.2

- Payback Amount: $48,000 ($40,000 multiplied by 1.2)

- Withholding rate: 10%

- Average monthly credit card sales: $20,000

Based on the above figures, you can use a Merchant Cash Advance to APR Calculator to compute the APR of the cash advance, you get a 19.06% APR. However, if the company’s average monthly credit card sales increased to $30,000, the computed APR jumps to 28.57%. So, unlike more traditional debt financing, where a company can save money by paying off debt early, an MCA is different in that the lender or credit issue’s compensation remains fixed and more sales translate into a higher APR.

Conclusion

In the world of traditional term loan debt financing, a borrower gets a lump sum of money from a lender or credit issuer by agreeing to repay the debt and interest with consistent monthly payments over the term of the loan. In contrast, a merchant cash advance is a type of financing where a lender or credit issuer provides a business with an advance based on future credit card sales, in exchange for a percentage of the business’s daily credit card receipts. Unlike a traditional term loan, the repayment of an MCA is not based on a set schedule. Instead, the lender takes a percentage of the business’s daily credit card sales until the payback amount agreed upon with the lender is repaid. This means that the amount repaid daily can fluctuate depending on the business’s credit card sales.

Related Post: What You Need to Know About Factoring Your Accounts Receivable

Is a Merchant Cash Advance (MCA) right for your business?