When a business is trying to raise the money it can sell assets (think stock) in the business, which is known as Equity Financing.

There are other options, too. The business can get a term loan and pay back the principal through scheduled periodic principal and interest payments, or it can get a revolving line of credit and pay interest payments only and a final principal balloon payment sometime in the future.

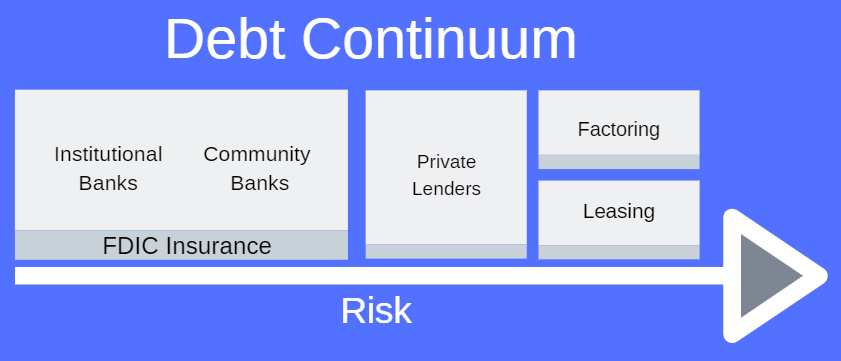

These other options all have something in common. Simply put, if you pay interest, you are using Debt Financing. However, within the world of debt financing, there is a continuum, as different lenders have different appetites for risk and reward.

On the conservative end of the continuum are Institutional Banks. Institutional banks like Wells Fargo and Chase are FDIC insured and as such are pretty risk adverse. Institutional banks are where most new entrepreneurs go to try to finance their start-ups, only to get turned down. Start-ups are risky and often outside the risk profile of institutional banks.

Within the banking arena, there are also what are referred to as Community Banks. Community banks, while still, FDIC insured and generally just as risk adverse, they are often more flexible. They make funding decisions at the local level and can make accommodations that institutional banks just can’t.

For example, a landscape client needed a loan to buy some new equipment. The institutional banks turned him down since he didn’t have sufficient cash flow in the winter to service the debt. The community bank reviewed his application and granted him the loan. They adjusted the payment schedule so he could make six annual payments, all during the summer months when cash flow was good.

Next on the continuum are private lenders, sometimes called Community Development Financial Institutions or CDFI’s. Private lenders like Accion are not FDIC insured, and as such are accepting of more risk. However, with taking on more risk they demand a higher reward in terms of a higher interest rate than a bank might charge.

At this point on the continuum, the path splits into specialized lending. Factoring companies lend money to accounts receivable (A/R or Invoices). Equipment leasing companies allow you to select the equipment you want, and then set up a lease-to-own program for you.

What is not commonly understood by nascent entrepreneurs looking for debt financing is that small business debt often comes from multiple sources. For example, a line of credit may come from your bank, while your A/R may be funded through a factoring company, and your equipment purchased through an equipment leasing company.

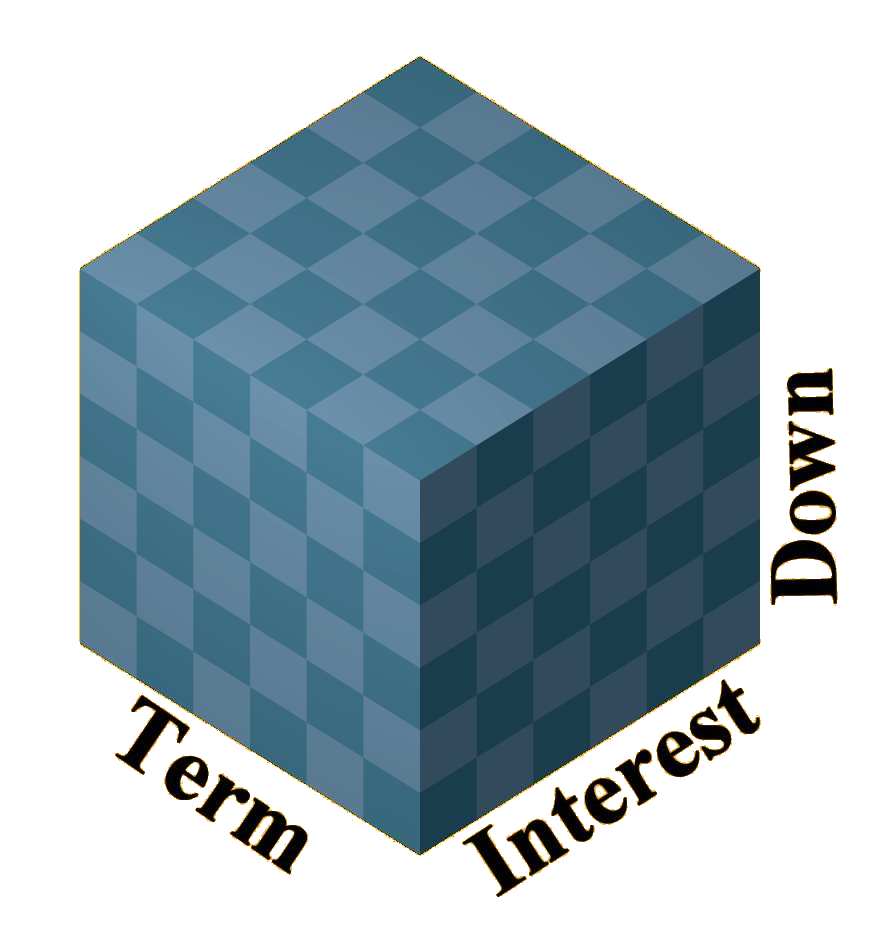

Risk for a lender is mitigated by the use of 3 dimensions at a lenders disposal. As consumers we often focus on interest rate since the higher the interest the risk for the lender the hire he interest rate. However, there are two

When a lender is trying to lower its risk, it can shorten the term of a loan. All things being equal, a lender may shorten a term from five years to just three years thereby making the borrower make larger principle payments each month so in the event of default part way through the loan term more of the principle has been paid down.

Another lever that a lender can use to lower risk is requiring the borrower to make a higher down payment. By requiring forty percent down vs twenty percent the lender has less money at risk in the event it needs to foreclose on the loan and ensures that the borrower has more skin in the game.

When it comes to lenders they all adjust the three levers of interest rate, term period, and down payment to find a satisfactory balance between risk and reward.

Where on the debt continuum is most appropriate for your debt financing needs?