As a business owner, you will need to know how to compute the value of a company be it your own business or one that you hope to acquire. The following topics about business valuation are discussed.

Table Of Contents:

- 5 Reasons for Conducting a Business Valuation

- Factors That Affect a Business Valuation

- How To Value an Existing Lifestyle or Micro-Business

- Rule of Thumb Valuation Appraisal Method

- EBITDA Valuation Appraisal Method

- Discounted Cash Flow Valuation Appraisal Method

- Comparable Company/Transaction Valuation Appraisal Method

- Asset Accumulation Valuation Appraisal Method

- Liquidation Valuation Appraisal Method

5 Reasons for Conducting a Business Valuation

There are many reasons to conduct a business valuation. Some valuations are pretty straightforward while others can be quite complicated. If there is a good possibility that the valuation will be challenged on legal grounds or by the IRS, it is often best to have the valuation performed by a qualified appraiser.

That said, I have counseled scores of clients on computing the value of a company issues and I have come to the conclusion that there are five primary reasons for conducting a business valuation.

- The first and clearly the most popular reason for conducting a business valuation is related to some form of merger & acquisition (M&A) activity. Most of the time, it is the buyer that is attempting to computing the value of a company they are considering buying.

- Another reason to computing the value of a company is related to estate planning. When a family-owned business is passed on, there may be estate and gift taxes involved. The American Tax Relief Act of 2012 set the exclusion of estate and gift taxes at $5 million with a maximum of 40% estate tax above this threshold.

- As new members enter and exit a closely held business, there is often a need to establish shareholder or membership values for some form of buy/sell arrangement.

- Intergenerational transfers of ownership often involve transferring a mix of assets to several parties. Allocating them among the parties requires an understanding of the value of the asset.

- Finally, some owners choose to convey their ownership to their employees through an Employee Stock Ownership Program (ESOP), which requires credible evidence of the value of the company.

Factors That Affect a Business Valuation

There are several factors that can positively and negatively affect a business valuation from the point of view of the buyer. Some common factors that add value to a business valuation include:

- The organization, including its employees and internal processes

- Its reputation in the industry

- How well the business fits with the acquiring business, including the culture

- Terms of the final deal

- How “hot” the industry is and if it’s getting hotter

- Overall market conditions

- Other intangibles

- Timing of the offer

- Number of competing offers

In the following video Ron Chernak, a business broker talks about intangible assets that add value to a business valuation.

When I sold my first business, the payment was to be made in the acquiring company’s public stock. Since it was during the dot-com era, stock prices reflected the good market conditions and were on the rise. Also, the acquiring company had a hard deadline for the transaction since it needed to complete the transaction prior to its year-end close. This deadline added value to my business so I began to increase my demands as the closing date got closer. Therefore, I was able to leverage several factors that enhanced the value of my business from the perspective of the buyer.

On the flip side, there are factors that can discount the value of a company from the perspective of the buyer, including:

- Employment-related liabilities

- Environmental liabilities

- Litigation liabilities

- Tax liabilities

- Product warranty liabilities

- Contract liabilities

- Duress by seller such as health or monetary issues

- Lack of time to complete the deal on the part of the seller

- Not using an intermediary to remove emotions

- Coming to an agreement too quickly/easily

- Only one offer

- Overall seller naivety since a buyer may buy many businesses while a seller often only sells a business once

In the following video Ron Chernak and John Zayac two owners of large M&A brokerage houses, explain ways to enhance or detract from a company’s business valuation.

How To Value an Existing Lifestyle or Micro-Business

When it comes to buying a business, size does matter. Most lifestyle or micro businesses have under 1 million in annual sales. When it comes to lifestyle and micro businesses, the owner is also the top manager.

For valuation purposes, a good rule of thumb for a marketable lifestyle or micro business is that the owner should generally earn about 10 to 20% of the gross sales.

Therefore, a lifestyle or micro business that does $400k in revenue should have an owner that earns between $40k to $80k per year from owning and working in the business.

Often when the million-dollar gross sales per year threshold is eclipsed, the owner’s income drops to about 10% or less. This drop is mostly due to the need to increase management, which leads to thinner margins, and higher inventory or carrying costs.

The important issue for you as a buyer of a micro business is how much can I expect to earn?

When it comes to lifestyle and micro businesses where the owner is responsible for managing employees, taking care of customers, and other day-to-day activities, the owner likely views bookkeeping as a low priority. If anything, he relies on compiled financial reports and is far less inclined to use these reports to run their business. Therefore, any financial records provided by the seller may be less accurate and require more due diligence on the part of the buyer.

From the perspective of an accountant or a banker, the value of a company is purely based on historical financial statements, which can be an incomplete view of a company’s real value.

Another factor that drives the value of a company is its location, equipment, inventory, employees, patents, existing customer base, industry, vendor supplier relations, completion, and what you plan to do with the business after a sale. Therefore, you cannot rely on your accountant or banker to define a quantitative value of a company you are looking to buy.

Related post: Why Founders Must Acknowledge the Value Investor Mindset

Other value drivers aside, another rule of thumb is that businesses often sell for a little more than two times discretionary earnings.

To understand discretionary earnings, you must first understand that a small business is an economic entity that provides a product or service that customers buy in sufficient quantities to allow the owner to pay all costs and operating expenses, including the owner’s salary.

Let’s say that water represents revenue the revenue flowing into the business and a bucket represents the volume of all non-discretionary costs and operating expenses such as rent, employee salary (including a fair wage for the owner), marketing, insurance utilities, etc. The lip of the bucket represents the breaking even point of discretionary income. The water or revenue that overflows the bucket is considered discretionary income.

Let me be clear– discretionary income is not yet profit since the surplus revenue can be used in a variety of ways. The owner can use the surplus to buy more inventory, increase his promotional expenses, pay off debt, or pay himself more money.

It is the discretionary income that is most often used to value an existing lifestyle or micro business. According to a business broker friend, with over 15-years of experience, selling businesses, the average selling price for lifestyle and micro-business was 2.3 times the business’s discretionary earnings.

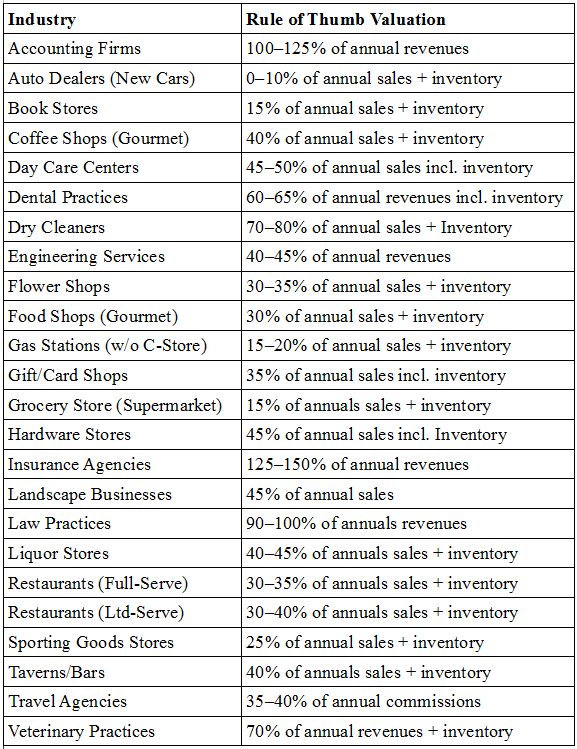

Rule of Thumb Valuation Appraisal Method

The Rule of Thumb Appraisal Method is a method often used to compute the approximate value of closely held small businesses. This method relies on a multiple of some unit of measure. The unit of measure changes based on the type of business or industry. It may be the number of subscribers, gross annual commissions, or even gross annual sales.

The following table comes from BizStats.com, which is a reliable source for Rule of Thumb valuations.

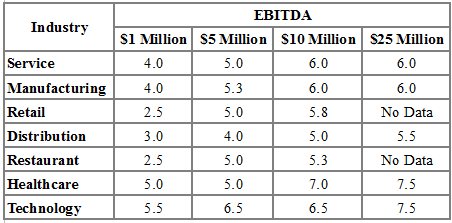

EBITDA Valuation Appraisal Method

EBITDA is an acronym for Earnings Before Interest, Taxes, Depreciation, and Amortization. The EBITDA Appraisal Method attempts to remove all the factors that are viable from one owner to the next in privately-held businesses. That said, the EBITDA Appraisal Method is most often used for public companies where their enterprise value can be computed.

In privately held businesses, one owner may have to borrow money while the next may pay in cash. Therefore, interest on the debt is removed as a consideration. Likewise, since taxes for any business other than a C-Corp can vary based on the owner’s tax bracket, taxes are removed to determine a common earning capacity. Since new depreciation and amortization values will be established after the sale, they too are removed. The EBITDA Appraisal Method is often used to appraise the value of larger businesses than those appraised with the Rule of Thumb Appraisal Method. However, similar to the Rule of Thumb Appraisal Method, the resulting earnings are calculated using the EBITDA Appraisal Method and then multiplied by some value based on comparable companies in that industry based on their earnings numbers.

The EBITDA Appraisal Method is used for many industrial and consumer industries, but not for banks, insurance, oil & gas, or real estate businesses. These industries do not use the EBITDA Appraisal Method because they have extenuating circumstances that affect their value. For these industries, the range of the earnings multiple is adjusted based on the business’s market dominance, lack of stock liquidity if they are private, any long-term debt, and of course risk. Generally, the bigger the company, the less risk there is and the higher a multiple they can command.

When it comes to public companies, you can often see valuations of 20-30 times EBITDA. However, this is generally not the case in privately held companies. One of the reasons for the higher multiple of public companies is size and liquidity. Since the stockholders of public companies can easily buy or sell their stocks, they have more liquidity. In comparison, the buying and selling of stocks are not very easily done with private companies.

The following table is an estimate of the EBITDA multiple by industry and size.

Discounted Cash Flow Valuation Appraisal Method

The Discounted Cash Flow Appraisal Method is also used for larger businesses similar to the EBITDA method. To understand the Discounted Cash Flow Appraisal Method, one needs to understand the concept of the “time value of money.” If you invest a dollar and it earns you a 10% annual return, that dollar would be worth $1.10 in one year. Therefore, if I agree to give you a dollar in one year, it is not actually worth the same as if I gave you a dollar today. Since you aren’t able to invest it and let it grow over time, you would only have $1.00 next year instead of $1.10. To determine what a dollar in the future is worth today, I have to discount the future value to get to the present value. Therefore $.91 today invested at 10% will be worth $1.00 in one year ($.91 + $.09 interest = $1.00).

This principle is the basis for the Discounted Cash Flow Appraisal Method. Generally, the Discounted Cash Flow Appraisal Method attempts to use past performance to project the free cash flow in the future. Generally, sellers and buyers agree on projected future earnings 5 years into the future. Then a discount is applied to the future cash flows in years 2-5 to determine their net present value. By adding up the net present values of future earnings, a valuation is determined. Of course, the discount applied to future cash flows is a subjective number and is broadly based on risk factors.

Comparable Company/Transaction Valuation Appraisal Method

Companies like Business Valuation Resources and Bizcomps are leading providers of information about private company transactions. They sell reports to business brokers, which they can use to do comparable company searches and evaluations. When it comes to valuations using comparable companies, the values are based on a lot of financial analysis data such as net sales, cash flow, net income, book value, gross profit, etc.

Inc. magazine used to publish this data every few years or so. However, they have not published this data since 2009. The data from the 2009 issue of Inc. is impossible to locate on the internet, but I saved a copy years ago as a reference for my clients. You can find the 2009 Inc. Magazine Business Valuation data under the Free Downloads tab of SteveBizBlog.com.

Not only does this reference provide comparable company valuations, it also looks at which appraisal methods are the most accurate and ways to predict their value based on industry type. While the data is a bit dated, it is free and should give you a rough idea of a company’s worth.

Asset Accumulation Valuation Appraisal Method

The Asset Accumulation Appraisal Method is used primarily for real estate holding companies, oil & gas companies, or other asset-heavy companies with earnings that do not support a value higher than the tangible assets. This method is sometimes used with profitable companies to represent the low end of the range of indications of value. This method also sets the bar that valuation methods based on earnings must overcome to show proof of goodwill value.

The Asset Accumulation Appraisal Method is the process for computing the market value of a company’s tangible and intangible assets and liabilities. This process starts with the sum of all tangible assets as reflected on the company balance sheet. A discount or step up is then applied to ascertain what it would cost to obtain comparable assets in a similar condition today. To determine the market value of comparable tangible assets, you can contact used equipment dealers and/or auctioneers.

From there, the sum of the business‘s tangible liabilities is deducted from the adjusted asset value. Then to the working value, you would add of any off-balance sheet or intangible assets, or in other words, the assets that wouldn’t normally appear on the balance sheet. Off-Balance Sheet/Intangible assets include:

- Trade/Service Marks

- Customer List

- Staff/Employees

- Licensing, Royalty, or Other Standing Agreements

- Use rights (e.g., drilling, water, or mineral)

- Service Contracts

- Trade Secrets

- Patented Technologies

Finally, you deduct a value for any contingent liabilities such as pending legal action judgments and costs associated with regulatory compliance to come up with the final valuation.

Liquidation Valuation Appraisal Method

When it comes to non-profitable businesses, the Liquidation Appraisal Method is used. For this method, only the value of the tangible assets is used. The reason behind this is the buyer is only purchasing the tangible assets.

Any liabilities of the business entity are the responsibility of the seller and are not factored into the appraisal valuation since the buyer is not buying the business, but just the tangible assets. When the value of the assets are calculated using the Liquidation Appraisal Method, it is assumed that they are being sold in an orderly selloff and not under any duress in the form of a fire sale.