When it is time for an owner to sell his business, the wise seller will “recast” his financial reports to create a clearer and often better impression of his business for the buyer to see. If you are the buyer and the seller has not done a recasting of their financial statements, you’ll want to recast them yourself to get a better picture of the true value of the business.

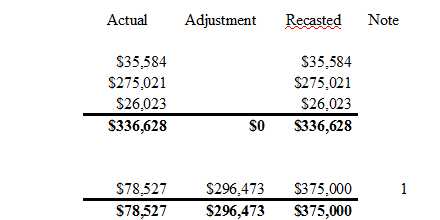

To recast the financial reports, the seller will start with his Profit and Loss Statement (P&L), also known as an income statement. I recommend exporting the P&L into a spreadsheet and adding three additional columns to the right. One column, label “Adjustments.” Label the next column “Recast,” which is the adjusted value after accounting for the adjustment. Finally, label the third column “Note.”

When I counsel the seller, I have them examine each discretionary expense and add an adjustment to remove any operating expense or portion of an operating expense that was for their own benefit as well as many other nonrecurring operating expenses. Some example of expenses that benefit the owner includes personal auto usage, insurance, travel, cell phone charges, and other expenses that are clearly for the benefit of the owner and not necessary for business operations. Additionally, the seller will add adjustments to remove any depreciation, amortization, and interest since after the sale these will change.

Moreover, all P&L line items need to be normalized to adjust for non-recurring income and expenses. For example, I once had a major project that was canceled unexpectedly. Rather than lay off the employees involved when the funding stopped, I kept them for way too long in the hopes of getting the new work. When none materialized, I then gave them a generous severance package. When I recast my financial reports, I adjusted out the salaries of the affected employees as well as the cost of the severance package since a new owner may have handled the situation differently.

In addition, the owner’s salary is also backed out as well since the new owner will choose his own salary. For each of the adjustments, I add a footnote number in the last column and provide a description for each adjustment at the end of the document that corresponds to the footnote number.

For more information on buying to selling a business, check out our FREE course Buying or Selling a Small Business.

Do you recast your financial reports to determine a clearer picture of a company’s value?