My first employer-based business was a documentation and training company. My team crafted user manuals and service guides and developed training courses for a variety of customers. Some of our clients were a dream to work with; they provided clear requirements, paid on time, and kept coming back for more projects. Other clients seem to treat my team members as their personal assistants, frequently demanding revisions, stretching deadlines, changing the scope of work, and constantly complaining about our rates, saying they were too high, hoping we would reduce them.

This example illustrates a universal truth for businesses: not all customers are created equal. While some helped our business thrive, others quietly drained our resources. This is why Customer Profitability Analysis (CPA) is crucial. CPA helped us identify which customers were profitable (“ideal”), which were not profitable but helped cover most expenses (“laggards”), and which were actively harmful (“losers”).

Let’s explore how CPA works and how a company like mine could use it to transform its customer base and the bottom line.

What Is Customer Profitability Analysis?

Customer Profitability Analysis is the practice of breaking down all revenues and costs associated with individual customers to determine their overall profitability. It’s not just about how much money a customer brings into the business as revenue but about understanding the total cost of serving them.

Costs fall into two main categories:

- Direct Costs: Expenses tied directly to the work you perform, such as salaries and benefits.

- Indirect Costs: Overhead and back-office costs such as administrative time, rent/utilities, insurance, and other costs necessary to operate the business.

After identifying direct and indirect costs, the next step is to allocate these indirect costs to specific customers using Activity-Based Costing (ABC). Traditional costing methods often distribute overhead expenses uniformly across all customers, regardless of their actual consumption of resources. This approach can lead to inaccuracies, as it fails to account for the varying demands each customer places on your business. ABC resolves this by tracing indirect costs back to the activities that drive them, and then assigning these costs proportionally to the customers who consume these activities.

For example, consider a technical documentation company where project requirements vary significantly. Some projects require specialized software with associated licensing fees, while others do not. Other projects involve staff working on-site at the client’s location, thereby not incurring the costs associated with office space and infrastructure, such as utilities and Internet connectivity. Using Activity-Based Costing (ABC), the company would identify key activities for each project. Each activity would be assigned a cost driver; for example, the allocation of software licenses or hours spent on-site vs off-site. By linking costs to specific activities and the customers responsible for them, ABC provides a clearer understanding of how indirect costs are incurred and distributed, enabling a more accurate analysis of profitability.

By subtracting total costs (both direct and indirect) from revenues generated by a customer, you can determine their actual profitability. Based on this analysis, customers can be categorized into three distinct groups:

- Ideal Customers: These customers are highly profitable, easy to work with, and dependable. They are perfectly aligned with your business goals and should be prioritized and nurtured to sustain and grow their value to the company.

- Laggard Customers: While these customers generate enough revenue to cover their direct costs and most of their indirect costs, they do not always fully cover their share of indirect costs. Despite this, losing their revenue could hurt the company’s overall profitability, as fixed indirect costs would need to be redistributed among your ideal customers, lowering their profitability. Laggard customers represent an opportunity to refine processes or strategies to improve their profitability.

- Loser Customers: These are unprofitable customers who often fail to even cover their direct costs. Additionally, they place a disproportionate burden on indirect costs by consuming excessive resources. These customers drain profitability and should be fired, so they become the competition’s problem.

When Interleaf, the public company that acquired my documentation and training business along with several other similar businesses, hired me as Vice President of Operations, they were themselves acquired eighteen months later. Interleaf’s service division – which I managed – was slated for closure. I was tasked with finding a new home for our documentation and training clients. Using CPA, my team and I identified our ideal customers. One of my former partners and I created a new company specifically to continue to serve these ideal customers. Additionally, we selected a few laggard customers that we believed could be transformed into ideal clients with some effort. I offered the remaining customers, categorized as laggards or losers, to our competitors.

Many of these competitors, unaware of the principles of CPA, eagerly accepted these unprofitable customers, focusing only on their revenue potential. Over time, the strain of serving these laggard and loser customers took its toll on many businesses, leading some to even close. Their closure meant shedding their formerly ideal customers as well. We were ready and prepared to step in and absorb our competitors’ ideal clients, which strengthened our position in the market. By understanding and applying CPA and ABC, we not only avoided the pitfalls that plagued our competitors, but it also allowed us to remain profitable and position ourselves for sustainable growth.

A Tale of Three Customers

Let’s look at how a company can apply CPA to evaluate three different clients. I’ll use the example of a documentation and training company like mine.

Ideal Customer: Innovative Tech Solutions

Innovative Tech Solutions is a SaaS company that consistently contracts the documentation firm to create user-friendly product manuals and training videos. They provide clear project requirements upfront, are responsive during the feedback process, and always pay invoices within 30 days, as agreed.

Revenue is strong, costs are minimal due to their efficiency, and the relationship has led to referrals of similar clients. This client is the textbook definition of an “Ideal” customer.

Laggard Customer: Regional Manufacturing Inc.

Regional Manufacturing Inc. contracts for employee training materials once a quarter. While they provide steady business, their projects often come with unclear expectations, requiring additional communication and rework. Payments occasionally occur after the agreed Net 30 payment term, and the team spends more time than they’d like resolving these issues.

Projects from Regional Manufacturing Inc. do not always return a profit to the company. That said, they consistently cover all their direct expenses and, in most cases, their share of indirect costs. However, there are times when they add to the company’s indirect costs, making their overall contribution less consistent. Despite this, customers like Regional Manufacturing Inc. are valuable during periods when revenue from other sources falls short, as their contributions help cover fixed indirect costs. With some targeted effort, this customer has the potential to become more profitable and a stronger long-term asset to the business.

Loser Customer: Retail Giant Co.

Retail Giant Co., despite its big-name appeal, is the company’s most challenging client. They insist on rock-bottom pricing, demand unlimited revisions, and regularly push back deadlines. Their payment terms are Net 30, but the actual payments often take 60 days or more, meaning the company often waits two to three months to be compensated for work already performed and delivered.

After running CPA, the company discovered that Retail Giant Co. accounted for 40% of their workload, but only contributed 32% of the company’s revenue, creating a significant drain on resources and contributing no profit to the bottom line. Moreover, the client frequently refused to pay for hours worked when deadlines – often missed due to their own delays – were not met. Additionally, their payment terms were so extended that the company sometimes had to factor their invoices to maintain sufficient cash flow, incurring extra costs that further eroded margins. In some cases, their projects didn’t even cover direct labor costs, let alone contribute to their share of indirect costs. This demanding client also created substantial stress for the team, leading to burnout and turnover, further compounding the negative impact on the business.

The CPA Process in Action

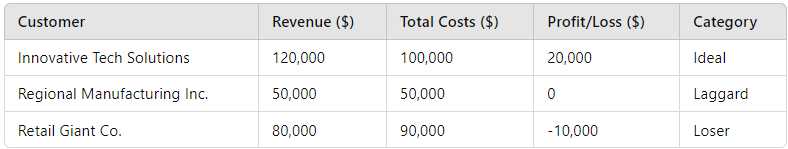

After the company conducted a CPA analysis to get a clear picture of profitability, here’s what they discovered:

Firing the Loser Customers

As the CPA shows, Retail Giant Co. was clearly a loser customer. While it’s never easy to part ways with a client that accounts for nearly one-third of the company’s revenue – especially a high-profile one at that – it became evident that letting them go was the right choice. To outsiders, the sharp drop in revenue might create the impression that the business was in trouble. However, in reality, the reduction in revenue was a calculated move that significantly boosted profitability. By eliminating this unprofitable client, the company doubled its profits for the owners, proving that prioritizing profit contribution over total revenue is the key to long-term success.

Turning Laggards into Ideal Customers

The company recognized the potential of Regional Manufacturing Inc. and took deliberate steps to improve the relationship by employing a 13-step onboarding process. They began by setting clear expectations and introducing a detailed project scope template to minimize miscommunication and ensure alignment on deliverables. To streamline processes and reduce inefficiencies, they assigned a dedicated account manager to oversee the client’s projects and handle communication. Additionally, they offered a small discount as an incentive for early payments, which successfully encouraged Regional Manufacturing Inc. to pay invoices before the Net 30 deadline. Within six months, these efforts transformed Regional Manufacturing Inc. into a more reliable client, increasing profitability and alleviating stress for the team.

Cultivating Ideal Customers

The company leveraged strategic account management principles to retain and grow relationships with its ideal customers, such as Innovative Tech Solutions. Unlike customer service, which is primarily reactive and focused on preventing client attrition, strategic account management takes a proactive and offensive approach. Its goal is not merely to address client needs but to actively grow sales within an account while uncovering new business opportunities.

Using these principles, the company went beyond exceptional customer service. While they consistently delivered projects ahead of deadlines and included thoughtful extras like executive-level support and complimentary project summaries for larger initiatives, their approach didn’t stop there. They scheduled quarterly check-ins, not just to resolve issues or ensure satisfaction but to discuss evolving client needs and identify growth opportunities. Recognizing the potential of client advocacy, they also created an active referral program, securing two new clients with profiles similar to Innovative Tech Solutions. This proactive, growth-oriented strategy helped reinforce customer loyalty, expand relationships, and generate new business, demonstrating the distinct advantages of strategic account management over traditional customer service.

Conclusion: The Power of Customer Profitability Analysis

Customer Profitability Analysis isn’t just a financial exercise – it’s a strategy for reclaiming control of your business. By understanding the true cost of serving each customer, you can make informed decisions about where to focus your time, energy, and resources.

Whether you’re running a technical documentation company, a coffee shop, or a software firm, the principles remain the same. Identify your ideal customers, nurture them, and find ways to turn laggards into ideal customers. And when necessary, don’t hesitate to let go of loser customers who hold you back.

The rewards – a more profitable business, a happier team, and better clients – are well worth the effort.

When was the last time you reviewed your customer list and conducted a CPA analysis to discover your ideal, laggard, and loser customers?