Having an accounts receivable pipeline is part of running any business that invoices customers. Managing a business’s cash flow is time-consuming and creates stress on the company’s finances. As a business owner, you rely on invoice payments to pay your bills, purchase inventory, and fund other operational costs. When your business has lots of unpaid invoices and you’re low on cash to meet your financial obligations, you may need to consider accounts receivable factoring. Factoring is sometimes also referred to as accounts receivable financing or invoice factoring.

Many years ago, my business was doing about three million in annual revenue when we won a $1.2 million contract. As you might imagine, on the day we got the call that we won the contract, we were pretty happy. Fast forward about two and a half months and I was looking for ways to put myself out of my misery. You see, we were a service company. We would work for a month and then bill our client for the previous month’s work. For this contract, we were billing the client about $100,000 per month. Once invoiced, the client then had 30 days to pay us according to the terms of our agreement. After two months, we had billed $200,000. In spite of our net 30-day terms, the client had not yet paid and we were out of money. With payroll looming, we needed cash fast. That is when I learned about factoring.

A wiseman once told me:

“If your business is successful, you will need more money. If your business is unsuccessful, you will need more money.”

He was right, we were on a growth curve but our accounts receivable pipeline made us miss payments to our vendors, which had the potential of affecting our credit and of course the relationship we had with our employees if we were unable to meet payroll.

What is Accounts Receivable Factoring?

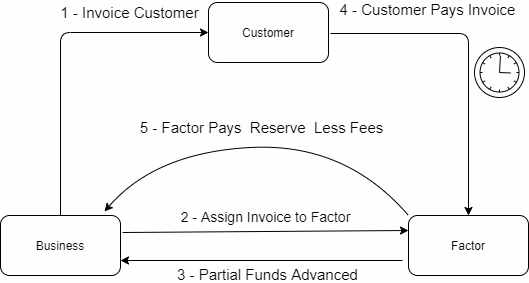

Factoring companies specialize in financing invoices from businesses that have cash flow issues. Accounts receivable financing companies don’t technically lend money like banks. Instead, they purchase the accounts receivable invoice from the business at a discount. The business gets immediate funds for the receivable. The accounts receivable factoring company holds the invoice and makes a profit when the invoice is finally paid by your customer.

When you sell an invoice to an accounts receivable factoring company (also known as the factor), the factor will usually pay you between 85-90% of the invoice’s face value within 24 hours. The balance is kept in reserve from which the factor will deduct its fees once the invoice is paid by your customer.

When you factor invoices, you get to choose which invoices you want to factor and which ones you want to get paid the old fashion way. We simply added a “Remit to” sticker on the invoices we sold to the factor, so our customer knew where to send the payment.

When your customer finally pays the full amount of the invoice to the factor, the factor deducts its fees from the reserve it still holds, and forwards any remaining reserve funds to you.

The main reason that companies factor their accounts receivable is to get their invoices paid quickly, rather than waiting the 30, 60, or even 90 days that it sometimes takes a customer to pay. How much a company factors will depend on its unique business needs. Some companies factor all of their invoices, while others may only factor invoices when they have a short-term cash flow need. With factoring, your business can increase its cash to pay employees, handle customer orders, and take on more business.

Companies of all sizes, from one-person businesses to Fortune 500 corporations, use accounts receivable factoring as a way to manage cash flow.

Two Kinds of Accounts Receivable Factoring

There are two main types of accounts receivable factoring. Recourse and non-recourse.

Recourse factoring means that you will ultimately take responsibility for the payment of an invoice if the factor cannot collect payment from your customer just as with a disputed invoice or if the client has not paid after 90 days.

Non-recourse factoring means the factor assumes some of the credit risk for collecting on an invoice. Generally, the risk is limited to the client filing for bankruptcy. As a result of the increased risk on the part of the factor, non-recourse factoring has higher fees than recourse factoring. In most cases, even if you are using non-recourse factoring and the client has not paid for 90 days or disputes the bill, the factor will request reimbursement of the advanced funds.

Factoring Advantages

The main advantage of working with a factor is that your cash flow improves immediately. You don’t have money tied up in slow-paying accounts receivable. Instead, you have cash on hand to pay expenses and take on new clients.

In addition to the cash flow advantage, factors can also help your business with credit decisions since they will rarely agree on buying invoices from your customers in financial difficulty. Factors can also help with collections.

Is Factoring an Option for Your Business

Factoring may be an option for your business if:

- Your clients pay net 30 to 60-days. Longer payment windows can make factoring very expensive since most fees are based on the invoice’s aging.

- Your clients have good credit, since factors may decline invoices from companies with bad credit or charge higher fees making factoring costs prohibitive.

- Slow payments or rapid growth are creating cash flow problems.

Setting Up a Factoring Account

Most factors can set up an account in 3 to 5 days. One issue that affects the length of time to set up a factoring account for a new customer is related to how long it takes you to review the documents and provide the information the factor requested as part of their due diligence process. The second issue that affects the time to set up a new customer account is the length of time it takes your customer to acknowledge the Notice of Authorization, that gives the factor the right to manage your receivables.

Factors List

Factoring can be a confusing topic for many small business owners. Each factor has slightly different programs and tends to focus on different industries. The following is a list of several of the most popular factoring companies:

- BlueVine

- altLINE

- Triumph Business Capital

- Breakout Capital

- TCI Business Capital

- Riviera Finance

- Paragon Financial

Is factoring your accounts receivable a viable option for your businesses cash flow needs?

Related Posts:

- Retirement Account Funds New Business

- Using a 401k Loan to Fund Your Business

- The 5 Stages of a Funding Plan

- Angel Investors

- The Debt Continuum

- A Step by Step Guide to Business Financing

- The Hidden Value of Crowdfunding

- Understanding Bonds and Royalties to Fund Business Growth

- The 5 “C’s” of Credit

- What Goes Into Your Credit Score

For more ideas about funding options check out Funding Your Small Business Startup and to see where factoring fits in check out What You Need To Know About The Debt Continuum

I’m impressed, I have to admit. Rarely do I encounter a blog that’s both equally educative

and engaging, and without a doubt, you’ve hit the nail on the head.

The problem is an issue that too few people are speaking intelligently

about. I am very happy that I stumbled across this in my hunt for something regarding this.