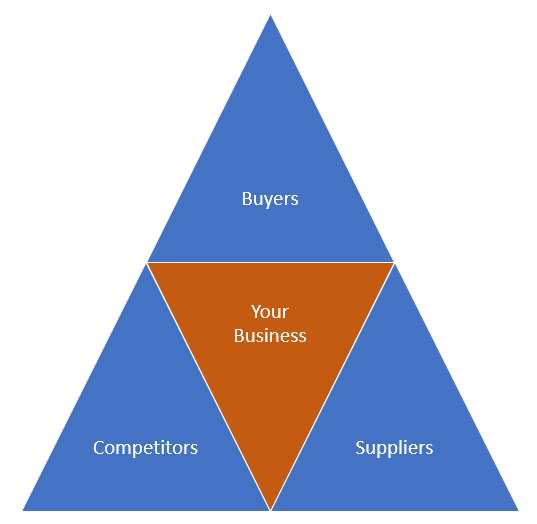

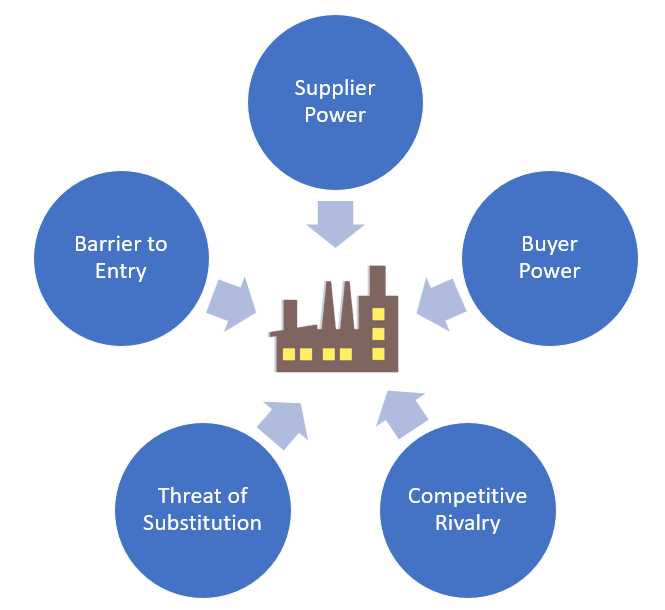

What if there was a way that a business could systematically assess the micro-environmental forces to determine their strengths and weaknesses, in an effort to predict the company’s ability to succeed? Well, thanks to Harvard Business School professor Michael Porter, there is such a model and it is called Porter’s Five Forces model.

Porter’s Five Forces looks at the contact area between your company and your customers or buyers, your suppliers, and the competitors to assess the business’s ability to succeed in a specific industry.

The model was designed to help you assess the following:

- What are your business’s strengths in your industry?

- How easy or how hard is it for new competitors to enter the market?

- If suppliers can force you to pay higher prices or customers can force you to lower your prices?

Basically, the Porter’s Five Forces model is an assessment tool that answers the question:

“Who has the most power in a transaction?”

The Porter’s Five Forces model came about when economists began to look at why different industries were more profitable than others and tried to define a model to explain why some had low-profit margins such as airlines and cafes, while other industries had high-profit margins such as soft drinks and drug manufacturers. Their result was Porter’s Five Forces model that Michael Porter defined.

The five forces in Porter’s model are:

- Supplier Power

- Buyer Power

- Competitive Rivalry

- Threat of Substitution

- Barrier to Entry

Let’s look at each of Porter’s five forces in more detail

Supplier Power – Porter’s Five Forces

Supplier power is determined by how easy it is for suppliers to increase their prices and make you accept these higher prices. Essentially, their power lies in how expensive they could make their offering before your business would be forced to switch to another supplier or other option. Of course, this leads to the question, how many potential suppliers do you have? If you only have one supplier, they will hold a lot of power over your business. Another point of supplier power is how unique is the product or service that the supplier provides to you?

High supplier power is defined when it is easy for a supplier to drive up your costs. This is much easier if you have only one supplier and limited opportunity for substitutes, or when a supplier’s product or service is critical to the delivery of your end products or services and there are no real viable substitutes.

Labor is a supplier to business and through collective bargaining intermediaries can exert significant supplier power on a business. This is especially true with low-income jobs, where either the government can mandate a business pay their workers a minimum wage, or where unions can withhold workers in exchange for concessions.

Another way suppliers can have a high degree of power is if they control scarce resources or materials. For example, as we discussed in De Beers’s – A Story about Controlling Supply and Creating Demand, De Beers controls the world’s Diamond supply.

Similarly, collusion between key suppliers can force businesses to pay the prices for the supply they control. For example, OPEC can exert undue power over the price of crude oil, and therefore force

Yet another source of supplier power is related to switching costs. If you paid a freelancer to develop a custom coded web site, you give away some of your power to the coder since if you decide to fire the current web developer, a new web developer may not readily understand the former developer’s coding schemes, making switching to the new provider harder.

Buyer Power – Porter’s Five Forces

When it comes to buyer power, a business should ask how easy it is for buyers to drive your prices down. A buyer can exert significant pressure on a business if they have many other suppliers in your industry, they have low switching costs to take their business elsewhere, or if they know that they are a flagship client of yours that your business cannot afford to lose. With buyer power, the buyer can dictate the terms of their relationship with your business.

For example, Walmart does business with many businesses where they are their biggest customers. If a supplier does not agree to the terms set by Walmart, there are many other businesses that would love to take their place.

When what you do is a commodity, the buyer has the bulk of the power in the relationship and will often ask you for discounts or better terms if you want their continued business.

On the flip side when a business has a patent and the ability to enforce it, a business shifts all of the power from the buyer back to the business.

Competitive Rivalry – Porter’s Five Forces

Competitive rivalry looks at the number, strength, and desperation for market-share of your competitors. You should ask, how many competitors do we have? Who are they, and how does the quality of their products and services compare to ours?

In your quest to remove competitive rivalry, a business should seek their blue ocean by focusing on points of differentiation.

When it comes to competitive rivalry, the intensity of the rivalry increases in declining markets where all your competitors try to survive an economic downturn. Idle human resources or fixed expenses, like space, keep a company’s cost high and serves to increase their intensity to make sure revenue remains above break even.

Competitive rivalry is particularly intense when the industry has high sunk costs in illiquid assets, such as factories or specialized equipment. When the buyer has most of the power, substitution options are everywhere, and there are minimal switching costs so the intensity of competitive rivalry will be higher.

Competitive rivalry, however, is less intense in rapidly growing markets. This is particularly true where scale can’t meet demand, such as in a service industry where the bottleneck to scaling is based upon skilled consultants or workers.

Threat of Substitution – Porter’s Five Forces

The threat of substitution refers to the likelihood that your customers can find a different way of doing what you do for them, or they can find another similar solution.

For example, a few years ago my local newspaper doubled their annual subscription cost. Being the only local newspaper supplier, they thought that they had supplier power. However, the price increase caused me to completely rethink the problem of getting my news. I discovered several online resources for local and national news, canceled my subscription, and now read all my news from several news aggregation services on my iPad each day.

In another example for years I was a huge Dish Network fan but when a recent price increase hit, I looked at my options and replaced my Dish Network service with a Roku for all of my non-smart TVs and subscribed to Netflix, Hulu and Prime that now costs me collectively half the price of my old Dish Network subscription, with greater access to shows and no more need for a physical Digital Video Recorder.

Disruptive technology is often a catalyst that can render even the most entrenched and beloved businesses subject to the threat of substitution. For instance, movie theaters were a pretty stable industry for over half a century. Then in the

Barrier to Entry – Porter’s Five Forces

Your market position and the power that your business

Economies of Scale

Barriers to entry for new competitors can be based on economies of scale. For example, Walmart has huge buying power, as do large car companies. As such, new entrants have a hard time entering the market because of the economic costs to set up a new competitor. High barrier to enter

Regulation

Another barrier to entry may be caused by regulation. A pharmaceutical company not only requires a huge amount of risk capital to fund operations from the product development stage, through testing and finally to market which takes years but once developed, patents are used, and the business has a temporary monopoly to earn back their upfront costs unchallenged. Moreover, as we shared in Is Licensing Really Necessary many businesses, like barbers and liquor

Vertical Integration

Vertical integration is where a company like J.D. Rockefeller’s Standard Oil not only controlled the raw materials, production, as well as distribution similar to a Japanese Keiretsu, allows the business to strip out all sources of margin and profit from the supply chain and

Brand Loyalty

Brand loyalty, such as you may have with an airline or a hotel where the points earned by customers discourages buyers from switching or lose out on the benefits the buyer has accrued, is a switching force to prevent new competitors from entering the market.

Technology or Infrastructure

Access to technology or infrastructure like those possessed by FedEx or UPS, Human expertise like Google or SpaceX engineers and a company’s reputation like Microsoft or Amazon are additional barriers that prevent new entrants from entering a market segment.

Of the five forces in Porter’s model, the most important force is the barrier to entry to keep competition out.

Low barrier to entry industries are generally in the service sector and have low capital startup costs. Pet sitting, hair salon, tutors, and even many consulting businesses are all service sector businesses with low startup capital requirements and are considered low-profit industries.

High barrier to enter industries generally are in the product sector and have high upfront capital costs, Pharmaceutical companies and soft drink companies are product-based businesses with high upfront cost and are considered high-profit industries.

Low-profit industries mean that most or all of the five forces are working against the business, while high-profit industries have most or all of the five forces working for them.

While Porter’s Five Forces looked at micro-environmental forces that make up the contact area between your company and your customers, your suppliers, and competitors a PESTEL analysis assesses the macro-environmental forces that affect your business’s strengths and weaknesses due to external political, economic, social, technolical , environmental, and legal factors.

Here is a 13-minute YouTube interview with Michael Porter as he discussed the value of his five forces model.

How can you use Porter’s Five Forces model to accurately assess the macro-economic forces that will affect your business?