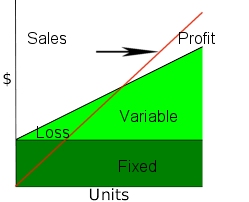

Business expenses can be categorized as either fixed expenses or variable expenses.

- Fixed expenses are expenses that your business must pay regardless of any sales it makes. For example, fixed expenses include the monthly rent you pay for your equipment, building, phone bills, as well as any indirect staff such as a manager or cashier. So, fixed expenses are the expenses that the business incurs each month regardless if the business makes $0 or $1,000,000 in sales.

- In contrast, variable expenses are expenses that are incurred only if you make a sale. For example, if you sell a product, your wholesale cost of the product is a variable expense. Also, direct employees or contractors hired to deliver a service and who could be cut loose if the work is not there are examples of a variable expense. So, variable expenses are the expenses you would not incur if you never made a sale.

A business with low fixed expenses but high variable expenses has less risk. If sales during the month are poor, the business incurs most of its expenses only when the business make sales. Therefore, a business with low fixed expenses but high variable expense business has less downside risk. However, these same businesses are generally less scalable because if the business makes lots of sales, profits will be small because each sale incurs a high variable cost.

On the other hand, a business with high fixed expenses but low variable expenses will suffer greatly if it experiences lower than expected sales volumes. However, because its variable expenses are low, profits will be higher if sales are higher than expected. Therefore, business with higher fixed and lower variable expense is far more scalable than businesses with low fixed expenses and higher variable expenses.

Would your business benefit from lower downside risk with higher variable expenses or higher upside with greater fixed expenses?