When in need of money that we do not have, most of us turn to lenders to borrow it. All lenders, with perhaps the exception of mom and dad, are in the business of making money with their money. Since risk follows reward, the riskier the loan the more reward the lender requires. This post discusses how lenders control risk and reward.

Before we get too deep into a discussion of how lenders control loan risk and reward, I would like to make it abundantly clear that most lenders do not lend money to unproven business models or unprofitable businesses. In most cases, debt funding is used to scale a business that has a proven business model and the ability to cover principal and interest payments from existing operations. Therefore, when it comes to the matter of controlling risk and reward, we are primarily focusing on existing businesses with already good cash flow.

Risk

Many factors weigh heavily into the lender’s risk calculation when it comes to granting a loan. One of the most popular ways lenders assess risk is by applying the 5 C’s of credit to the borrower. In addition to the 5 C’s, many lenders will assess the business’ future prospects using a PESTEL analysis and by applying Porter’s 5 forces to assess market conditions.

Lenders will have the borrower complete a credit application and provide the company’s financial statements. With the borrower’s income statement and balance sheet in hand, they will subject the business’s financial information to a series of industry-specific benchmark ratios. A book that nearly every lender will have and one you can find in most public libraries is the Risk Management Associates, Annual Statement Study. This book is compiled every year and allows lenders to determine how one business compares to industry averages.

Lenders prefer to grant loans based on tangible assets that can be used as underlining collateral for part or all of the debt. If the borrower fails to keep up with the payments, the lender can repossess the asset and sell it to recoup some or all of the principal.

Another factor lenders use to assess the risk and reward, is the liquidity of the asset if they are compelled to foreclose and sell the underlining asset on the open market. A lender prefers to have collateral such as a pickup truck which, if repossessed, can be easily sold on the open market and turned into cash quickly as opposed to a cement mixer, where the lender would likely have to steeply discount the price and expect it to take much longer to turn the asset into cash.

Another factor lenders use to assess risk and reward of a given loan relates to the nature of the borrower. A loan to a business is viewed as riskier than a loan to an individual. A business is far more likely to file for bankruptcy protection which complicates the process of collections. As an example, I like to tell the story about when my son bought a brand new Jeep Grand Cherokee from a dealership. He financed it for seven years, put nothing down, and I believe the interest rate was about 1%. If you wanted to buy that exact same vehicle as a fleet vehicle for your business, it would likely be financed for three years (not seven), come with a 5% interest rate (not 1%), and require a 30% down payment (not zero). Same vehicle, just two different risk and reward profiles for the lender.

Reward

Most people, when they want to get a bank loan, really only focus on the interest rate. They know that a secured loan has a lower interest rate than an unsecured one and that people with bad credit have to pay higher interest rates. However, the interest rate is just one of three controls that lenders have at their disposal to manage loan risk and reward.

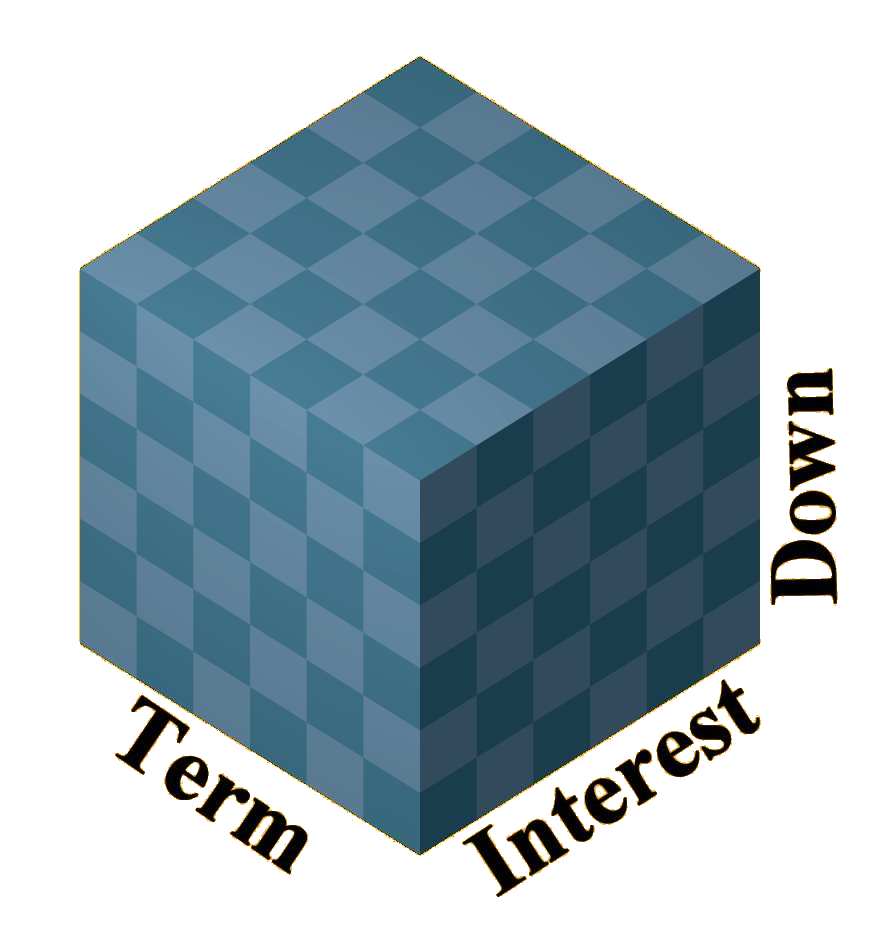

The three axes that a lender can use to control risk and provide an acceptable return are 1) interest rate, 2) the term or how many months or years it takes to reach the end of the loan period, and 3) the down payment.

As someone who is dyslexic, I see the three controls that lenders use to control risk and reward in terms of a three-dimensional cube. Each axis represents a control and collectively, they define the volume of the cube which is the lender’s reward based on their perceived risk. The larger the overall volume of the cube, the more the lender feels there is a greater risk. The smaller the overall volume of the cube, the less reward the lender demands to cover their perceived risk.

When you reduce one axis, the lender has to adjust the other two to maintain the volume. For example, if you do not have the required down payment, the lender may consider reducing the down payment axis. To maintain the volume, the lender may bump up the interest rate or shorten the term of the loan to rebalance the volume.

In the end, lenders, be it a bank or a private person or entity, have many ways to control the risk and reward when it comes to debt financing.

Do you simply focus on a loan’s interest rate when comparing loan options regardless of the term or down payment required or other factors that will define your risk profile?