As consumers flow through their peak spending years their attitudes and behaviors change based on the life experiences of their generation. Here are few key demographic attributes you should keep in mind as you try to attract the most fertile segment of the market.

When a typical consumer is in their 20s they are building a career and starting a family, which they raise through their 30s and 40s. Therefore, 20-somethings are buying their first new cars and starter homes, while 30 and 40-somethings are buying bikes for their kids, traveling to Disney, and upgrading to a SUV to take kids to their sporting events. By their mid-40s through their mid-50s their kids have grown and consumers have reached their peak spending potential. They may be buying that sports car they always wanted or upgrading their home. Through their mid-50s until their mid-60s consumers get more conservative and begin saving more and making plans for retirement. From their mid-60s onward consumers downsize and live out their golden years in retirement.

NOTE: More detailed age-based spending trends can be found in Harry Dent’s demand curves.

A person’s age and life-stage can help predict their purchasing decisions. These predictable behaviors are a major driver of the US economy. However, there are a few more specific generational dynamics that have to be considered to provide a clearer picture of these economic drivers.

Silent Generation Attitudes and Behaviours

Silent Generation

Born 1928-1945 (17 years)

Population Size = 22 million

Members of the Silent Generation lived their formative years during an era of suffocating conformity, They lived through the postwar happiness and prosperity. Women were pre-feminist movement and women stayed home to raise children or worked as teachers, nurses, and secretaries while men pledged loyalty to the corporation. This generation was raised by parents that survived the great depression and lived thru the McCarthy era which shaped their attitudes and behaviors. They lived through a period of post-war prosperity but were reluctant to be activists except when it came to civil rights. They are avid readers, especially of newspapers. They are now retired and are the richest retirees in history and spend freely in their retirement.

Boomer Attitudes and Behaviours

Early Boomers

Born 1946-1954 (8 Years)

Population size – 33 million (4.1 million births per year).

Early Boomers lived their formative years with Vietnam and witnessed the assassinations of John F. Kennedy and Martin Luther King. They lived through the Civil Rights movement and in the end, are largely optimistic about the future. They had good economic opportunities growing up, which shaped their attitudes and behaviors. This generation spent freely during their peak spending years (late 40 to early 50s), fueling the .com era. They are now entering retirment and leave the workforce.

Late Boomers –

Born 1956-1964 (8 Years)

Population size – 39 million (4.9 million births per year).

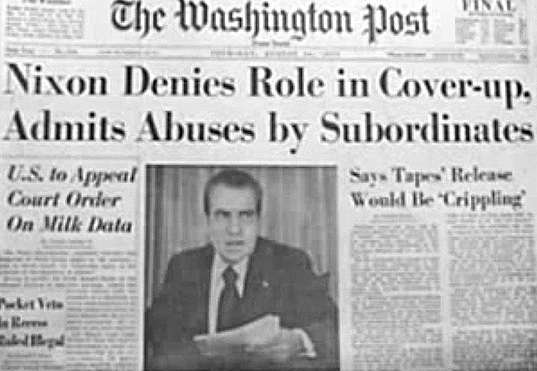

Late Boomers lived their formative years with Watergate, which shaped their general mistrust of government. The oil embargo and other economic struggles squelched their optimism about the future. The AIDS epidemic reinforced the “I’ve got to look out for number one” mindset. This generation has just passed their peak spending years, which fueled the housing bubble. They are entering their savings and investing period as they get ready for their retirement years.

Media Consumption: Baby boomers are the biggest consumers of traditional media like television, radio, magazines, and newspaper. Despite being so traditional, 90% of baby boomers have a Facebook account. This generation has begun to adopt more technology in order to stay in touch with family members and reconnect with old friends.

Banking Habits: Boomers prefer to go into a branch to perform transactions. This generational cohort still prefers to use cash, especially for purchases under $5.

Shaping Events: Post-WWII optimism, the cold war, and the hippie movement.

What’s next on their financial horizon: This generation is experiencing the highest growth in student loan debt. While this might seem counterintuitive, it can be explained by the fact that this generation has the most wealth and is looking to help their children with their student debt. They have a belief that you should take care of your children enough to set them on the right course and don’t plan on leaving any inheritance. With more Americans outliving their retirement fund, declining pensions, and social security in jeopardy, ensuring you can successfully fund retirement is a major concern for Boomers.

Gen X Attitudes and Behaviours

Gen X

Born 1965-1980 (15 Years)

Population 65 million (4.3 million births per year).

Members of Gen X were left alone to fend for themselves. Most were dropped off at daycare as very young children. When they reached school age they returned home to an empty house. Commonly, either both of their parents worked or they were a product of a broken home. Although they are generally well educated, the fact that they grew up without a cohesive family unit has impacted this generation. Gen X pays little attention to the news or social issues and is characterized by cynicism and an attitude of “What’s in it for me”. This generation is just now reaching their peak spending years but is 20 percent smaller in size than the previous generation which will lead to some economic contraction.

Media Consumption: Gen X still reads newspapers and magazines, listens to the radio, and watches TV (about 165 hours’ worth of TV a month). However, they are also digitally savvy and spend roughly 7 hours a week on Facebook (the highest of any generational cohort).

Banking Habits: Since they are digitally savvy, Gen X will do some research and financial management online, but still prefer to do transactions in person. They believe banking is a person-to-person business and demonstrate brand loyalty.

Shaping Events: End of the cold war, the rise of personal computing, and feeling lost between the two huge generations.

What’s next on Gen X’s financial horizon: Gen X is trying to raise a family, pay off student debt, and take care of aging parents. These demands put a high strain on their resources. The average Gen Xer carries $142,000 in debt, though most of this is in their mortgage. They are looking to reduce their debt while building a stable savings plan for the future.

Millennials (Gen Y) Attitudes and Behaviours

Millennials

Born 1981-1996 (15 Years)

Population size 72 million (4.8 million births per year)

Gen Y’s are the children of the Baby Boomers. They lived their formative years with technology and grew up watching cable TV and playing on the Internet. Gen Y is known as “Digital Pioneers” and bore witness to the explosion of technology and social media. As a result, they are inoculated against most traditional marketing efforts. While this generation was also often raised in single-parent households or homes where both parents worked, their family units were much more intact than those of Gen X. This generation is just now starting their careers and beginning to raise their families.

Media Consumption: 95% still watch TV, but Netflix edges out traditional cable as the preferred provider. Cord-cutting in favor of streaming services is the popular choice. This generation is extremely comfortable with mobile devices, but 32% will still use a computer for purchases. They typically have multiple social media accounts.

Banking Habits: Millennials have less brand loyalty than previous generations. They prefer to shop products and features first, and have little patience for inefficient or poor service. Because of this, Millennials place their trust in brands with superior product history such as Apple and Google. They seek digital tools to help manage their debt and see their banks as transactional as opposed to relational.

Shaping Events: The Great Recession, the technological explosion of the internet and social media, and 9/11

What’s next on their financial horizon: Millennials are powering the workforce, but with huge amounts of student debt. This is delaying major purchases like weddings and homes. Because of this financial instability, Millennials choose access over ownership, which can be seen through their preference for on-demand services. They want partners that will help guide them to their big purchases.

Gen Z Attitudes and Behaviours

Gen Z

Born 1997-2012 (15 Years)

Population size 68 million (4.5 million births per year)

Members of the Gen Z generation, sometimes referred to as Zoomers, lived their formative years during the COVID-19 pandemic and witnessed many of their Gen Z parents quitting their corporate jobs during the big quit or leaving the office to work from home. Gen Z is known as “Digital Natives” and were born into a world of peak technological innovation, where information was immediately accessible and social media increasingly ubiquitous. Another characteristics of Gen Z is racial diversity. Gen Z will be the last generation that is predominantly white. The backdrop of their early years included the country’s first Black president and the legalization of gay marriage. They are more likely to have grown up in a multi-racial household, or a household in which gender roles were blurred. As a result, they are less fazed than previous generations by differences in race, sexual orientation, or religion. Mental health challenges are a characteristic of Gen Z since they spent endless hours online, using smartphones and binge watching Netflix, fostered feelings of isolation and depression. Gen Z vs. More time spent less time fostering meaningful relationships and fell prey to the “compare and despair” trap that social media presents.

Media Consumption: The average Gen Zer received their first mobile phone at the age of 10.3 years. Many of them grew up playing with their parents’ mobile phones or tablets. They have grown up in a hyper-connected world and the smartphone is their preferred method of communication. On average, they spend 3 hours a day on their mobile device.

Banking Habits: This generation has seen the struggle of Millennials and has adopted a more fiscally conservative approach. They want to avoid debt and appreciate accounts or services that aid in that endeavor. Debit cards top their priority list, followed by mobile banking.

Shaping Events: Smartphones, social media, never knowing a country not at war, and seeing the financial struggles of their parents (Gen X).

What’s next on Gen Z’s financial horizon: Learning about personal finance. They have a strong appetite for financial education and are opening savings accounts at younger ages than prior generations.

Gen A (Alpha) Attitudes and Behaviours

Gen A

Born 2013-2025 (13 Years)

Population size 50 million (3.8 million births per year)

Members of the Gen A generation, sometimes referred to as Generation Alpha, grew up in a world shaped by unprecedented technological integration and significant social upheavals. Their formative years have been shaped by global events such as the COVID-19 pandemic, which introduced them to concepts of global interdependence and remote living from a young age. As the children of Millennials, they are true digital natives, never knowing a world without smartphones, tablets, and AI-driven technologies, which fundamentally shape their learning and social interactions deeply influenced by technology from a very early age. This generation is witnessing the evolution of family dynamics, where diverse structures and fluid gender roles are becoming the norm, encouraging an early acceptance of a range of racial and gender identities. The backdrop of their formative years includes the global response to the COVID-19 pandemic, intensified environmental activism, and significant social justice movements, notably the protests following the death of George Floyd. These events are fostering a keen sense of justice and a commitment to inclusivity, with Generation Alpha more routinely using pronouns and engaging with concepts of identity from a young age. Mental health, a pivotal aspect of their upbringing, is approached with an openness that differs from previous generations. While Generation Z began to break down the stigma around discussing mental health, Generation Alpha is likely to witness an even greater normalization of these conversations.

Media Consumption: Generation A’s media consumption is characterized by a preference for digital platforms, reflecting their upbringing amidst rapid technological advancements. They are likely to favor interactive, on-demand content delivered through platforms like TikTok, YouTube, and emerging digital media that offer quick, visually engaging information. This generation values personalized content accessible on personal devices, indicating a trend towards more individualized and private media consumption habits. On average, they spend 4-6 hours a day on weekdays and more on the weekends, which is a significant increase from Gen Z.

Banking Habits: Digital natives through and through, Generation A is expected to prefer digital-first banking solutions, using apps and online platforms for financial transactions from a very young age. Traditional banking might seem obsolete to them as they lean towards innovations like mobile banking, digital wallets, and even cryptocurrencies. Their financial literacy is expected to be integrated early in their education, making them knowledgeable about savings, investments, and the usage of various digital financial tools.

Shaping Events: Generation A is influenced by the rapid evolution of technology. Artificial intelligence, augmented reality, and high-speed internet are parts of their everyday lives, impacting their educational methods, entertainment choices, and social interactions. These technologies are not only tools but also formative elements that will likely shape their approach to work, collaboration, and problem-solving.

What’s next on Gen Z’s financial horizon: The financial landscape for Generation A will be significantly shaped by advancements in technology, notably artificial intelligence (AI) and cryptocurrencies. AI will transform financial services, making transactions more efficient and personalized through AI-driven advising and smart wallets that optimize spending and savings. Additionally, Generation A may increasingly engage with cryptocurrencies as part of their financial dealings, drawn to its potential for decentralization and integration with AI technologies for secure, transparent financial transactions. These technological integrations will not only enhance their financial management but also align with their growing concerns for sustainability and ethical practices, marking a shift towards more innovative, responsible financial behaviors.

The Generational Divide is Closing

While a person’s attitudes and behaviors are influenced by their formative years, six forces are breaking down many of the traditional generational boundaries. According to Thomas Koulopoulos and Dan Keldsen the authors of the Gen Z Effect, factors such as increased life expectancy, the rise of influencers, increased access to education and lifetime learning, hyper-connectivity, easy-to-use technology, and the speed of innovation are six forced closing the generational gaps.

We will discuss the six forces that have contributed to “the Gen Z Effect” in much more detail in a future post.

Do you understand the attitudes and behaviors of your target demographic?