How to Pay a Non-Manager Member of a Multi-Member LLC

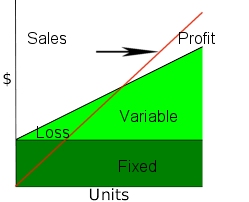

When you have an investor in your LLC, who works less than 500 hours in a given tax year for the LLC, and they do not participate in its management, they are considered limited in their liability and their income is usually considered passive income subjecting the income to only federal and state income taxes based on their marginal tax rate.

How to Pay a Non-Manager Member of a Multi-Member LLC Read More »