Robert Kiyosaki is a well-known personal finance author and speaker, best known for his book “Rich Dad, Poor Dad.” In this book, Kiyosaki introduced the Cash Flow Quadrant, a framework for understanding how people make money and how they can improve their financial situation.

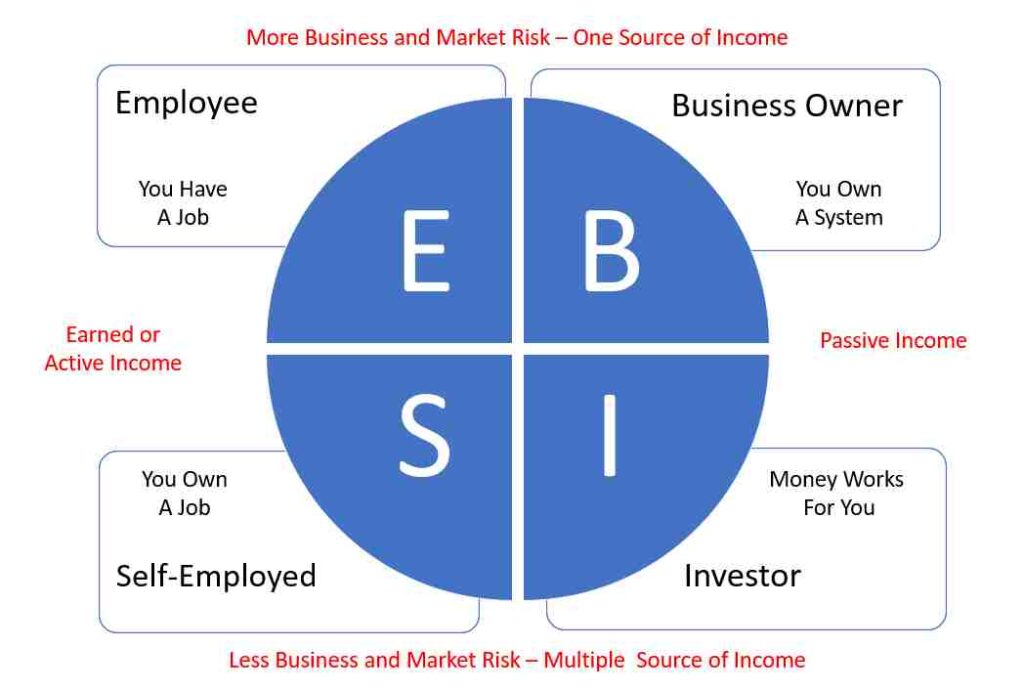

According to Robert Kiyosaki, The Cash Flow Quadrant represents the different methods by which income or money is generated. Different methods of income generation require different technical skills, different educational paths, and different types of people.

In this post, we will look at how income is generated in each of the four quadrants. Of course, income can be earned from a single quadrant or from a combination of quadrants, but we will look at each quadrant separately. The four quadrants are named E, S, B, and I. “E” stands for Employee, “S” for Self-Employed, “B” for Business Owner, and “I” for Investor.

Left Quadrants:

If you divide the quadrant of income generation in half vertically, the left side contains quadrants E and S: Employee and Self-Employed. Here, your income is considered earned income or active income. That is, for the quadrants on the left side, you get paid for the number of hours you work. The two quadrants on the left are the playing field of the poor and the middle class.

Right Quadrants:

On the right side of the quadrant are Business Owner “B” and Investor “I”, where your income is considered passive income. This means that you earn income from the labor of others. The two quadrants on the right are the primary paths to financial freedom and the playing field of the rich and financially independent.

Moving from the left side to the right requires capital, education, and a new mindset.

Top Quadrants:

The top two quadrants have your income coming from only one source, your job or your business. As such the top quadrants have limited income diversity and you, therefore, have a greater business risk and market risk. If the business you work for goes bust, your income stops.

Of course, if you are in the “B” business owner quadrant and you design your business property, you will have multiple customers from multiple business sectors so you can mitigate much of the risk associated with income coming from a single company.

Bottom Quadrants:

If designed properly, the bottom two quadrants have your income coming from multiple sources. As such, if a single customer or investment fails you have a diversity of income that will not cause you to lose 100% of your income.

Employee – Cash Flow Quadrant

This quadrant represents people who work for someone else and receive a regular salary or hourly wage. They typically have limited control over their income and depend on their employer for financial security.

When you are an employee, you know you will get a paycheck as long as you continue to work for the business, even if the business is not profitable.

Earning a consistent wage each month is important when it comes to paying off debt, like home or car loans. However, full-time employees get their income from this single source, their job, and if they lose their job they lose 100% of their income. They have to rely on unemployment to bridge any employment gaps.

This overall lack of control over income is the primary problem of the E quadrant. The employee’s financial destiny, security, and freedom are dependent upon the whim and the success of their employer.

Moreover, in terms of Income taxes, employees pay the highest percentage of their income. The more you earn as an employee the higher your tax bracket, and you have few options to reduce your income through deductions or tax credits. Most Americans get their income from this quadrant.

Self-Employed – Cash Flow Quadrant

This quadrant represents people who work as freelancers or contractors. They have more control over their income and expenses than employees, but they also bear more risk and are responsible for finding customers and generating revenue.

Many employees, especially after the COVID-19 Pandemic, got tired of their lack of control and chose to work for themselves. When you are self-employed, you own a job.

The government also refers to this group as non-employer businesses, where the owner is the only employee. When you are self-employed, you trade one boss for several bosses, known as your customers. While you have the flexibility to work the hours you want, you get paid only when you are under contract. The more you work, the more you get paid. There are no paid vacations or holidays for the self-employed.

The self-employed are often skilled trade workers who left a corporate job as an employee and include occupations such as dentists, insurance agents, freelancers, realtors, handymen, and many other trade workers. While many self-employed individuals can earn very large incomes, just like employees, when they stop working, so does their income. What differentiates the self-employed from business owners is the fact that they are the brand of the business. Without them, there is no business.

Many self-employed individuals derive income from several concurrent contracts, thereby achieving some level of diversification in their income. However, many self-employed workers simply work for a previous employer or for a single customer as a contractor and do not achieve any income diversification. In fact, many self-employed individuals have undertaken more income risk by becoming self-employed, with little, if any, additional compensation.

In terms of taxes, the self-employed person will have to pay the employer portion of FICA in addition to the employee portion, which is known as self-employment or SE tax on all taxable income. However, many business expenses such as cell phones, travel, etc., can be paid for using pre-tax dollars, providing the self-employed opportunities to reduce their taxable income. Savvy self-employed individuals price their services to adequately cover all their indirect expenses, including the additional employer-paid FICA share as well as any downtime experienced between projects.

Business Owner – Cash Flow Quadrant

This quadrant represents people who own a business that runs itself, even when they are not actively involved. They have a team of employees and systems in place to generate income, and they can leverage their time and resources to create passive income streams.

Being a business owner is different from being self-employed in that, as a business owner, you have employees to do the work. That is not to say that the business owner does not work in the business also, but it means that they are getting paid for their effort as an employee in the business PLUS for being an investor in the business.

When you have a business, the business is the brand, not the owner. As such, when you own a business, you own an asset that you can sell. This is not the case with employees and the self-employed that occupy the left side of the quadrant.

Business owners can also scale up their businesses, which is not possible for the self-employed. As the business hires more and more employees, a fraction of each employee’s bill rate is the owner’s return on investment for the start-up capital, as well as for undertaking the additional risk of business ownership. As the business grows, it generates more and more wealth for the owner. Like being self-employed, as a business owner, you have several bosses, your customers, but you are also the boss of your employees.

The wealthiest individuals in the world typically own businesses. These include Elon Musk of Tesla and SpaceX, Bill Gates of Microsoft, Jeff Bezos of Amazon, and Mark Zuckerberg of Facebook.

Business owners own systems that allow the owner to be absent for long periods and still generate income. Income diversification and taxes for business owners are similar to those of the self-employed. However, if the business is a corporation (S-Corp or C-Corp), not all income is subjected to the combined 15.3% FICA contribution, as is the case for the self-employed. For corporations, wages from working in the business are subject to FICA. However, the profit that is left after all expenses and salaries are paid is not subject to FICA.

Investor – Cash Flow Quadrant

This quadrant represents people who invest their money in assets that generate passive income, such as rental properties, stocks, or businesses. They are not actively involved in the day-to-day operations of these assets, but they receive a return on their investment through the income they generate.

As an investor, it is all about having your money work for you. Investors generally have accumulated money from one or more of the other three quadrants. As an investor, you can spread your investment money around to achieve greater income diversification, while lowering overall risk through less investment concentration.

Investors often purchase shares of companies owned by those in the B quadrant. The capital from the investors helps to fuel the systems created by the business owner, and this fuel can lead to even greater growth and more income for everyone involved.

There is an investment continuum related to taxes. On one end of the

However, moving along the continuum, there are qualified dividends and long-term capital gains that benefit from special tax treatment. Rather than being taxed based on how much you make, these investment vehicles are taxed for most investors at a fixed 15% rate. One exception is for the

Next on the continuum is federal income tax-free interest income known as municipal bonds.

Beyond that, there is income from real estate, which allows for depreciation to lower taxable income. Further capital gains, which are normally taxed when the property is sold, can be deferred indefinitely using what is known as a 1031 exchange. This allows the investor to grow their assets without paying capital gains on each successive transaction.

Finally, there is direct participation in oil and gas programs. Investing in oil and gas programs allows the investor to write off most of his investment against other sources of income, such as wages. Also, a depletion allowance makes only 85% of the income subject to taxes. However, to play in this game, most investors need to be accredited. This means that they have a net worth in excess of one million dollars or earn in excess of $250,000.00 per year. To learn more about this asset class check out our sponsor Learn About Oil and Gas.

Conclusion

The key to financial success is to move from the left side of the quadrant to the right side. This requires taking on more risk and responsibilities, but it also provides the opportunity for greater financial reward and independence.

In summary, the Cash Flow Quadrant is a useful framework for understanding how people make money and each approach’s potential rewards and risks. By understanding the quadrant that they are currently in and the quadrant they aspire to be in, individuals can make informed decisions about their career path and financial goals.

What quadrant do you get most or all of your income from today? Is this the quadrant you want to continue to get all or most of your income from?