Do you offer your customers a convenient way to purchase from you? Is it possible to provide financing so the customer can pay in little chunks rather than one big chunk?

12 easy payments of $12 each ($144) sound a whole lot more affordable than one large payment of $130. This perception remains even though paying $130 upfront rather than $144 is more cost-effective, spread across 12 payments, which is 11% more.

Businesses can boost sales by offering customer financing options and making their products and services more accessible through manageable payment plans.

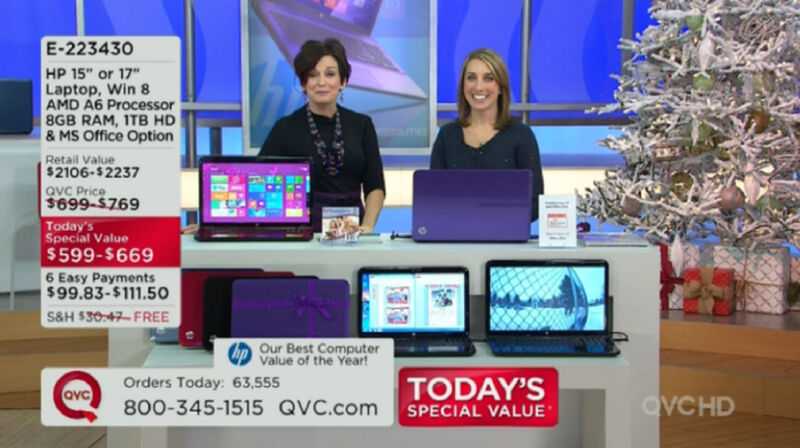

For example, my wife is a big QVC fan. On QVC, they offer many of their products based on six easy monthly payments. Car dealers also sell you a monthly payment rather than focus on the total price of the vehicle.

Major retailers like Best Buy offer financing through branded credit cards or partnerships with financial services like Affirm. This approach allows customers to purchase high-end electronics, which might otherwise be unaffordable, through small monthly payments.

Companies like Home Depot provide project loans and lines of credit, enabling homeowners to undertake substantial home improvement projects by spreading costs over a longer period. This increases customer purchase capacity and satisfaction.

Dental services often use companies like CareCredit to offer patients zero-interest financing for procedures not covered by insurance, thereby easing the financial burden and encouraging more frequent visits.

Platforms like Udemy or Coursera offer installment payments for professional courses, making career advancement opportunities more accessible to individuals without immediate financial means.

As a carnivore who had just relocated to Colorado about 40 years ago, I was keen on purchasing an entire side of beef from a butcher. A side of beef at that time was selling for about $1,200. However, this amount exceeded my budget. Upon discussing my budget constraints with the butcher, he proposed a manageable financing option. He asked if I could afford monthly payments of $62, facilitated through a prearranged two-year financing plan with Beneficial Finance at an interest rate of 21%. This plan didn’t require the butcher to hold any of the loan paperwork as he sold the debt directly to Beneficial. Thus, the butcher received his $1,200 upfront, and Beneficial Finance stood to earn a 21% return on their investment, totaling $288 in interest over the life of the 24-month loan. This arrangement provided a win-win-win situation for myself, the butcher, and the financing company.

Businesses with high-priced offerings should integrate financing options seamlessly into their sales processes. Businesses that offer financing often see increased average order sizes and improved customer loyalty, as customers who might not have purchased due to cost concerns take advantage of the ability to pay over time.

Not only should you offer financing, but you should advertise what you do to intensify your offerings.

Clearly, state the payments by giving people the option of either one lump sum payment or multiple payments. Today, programs such as PaySimple, Stripe, or WooCommerce Subscriptions will automatically bill your customer each month, so you don’t have to remember to do it.

Could offering installment payments improve your revenue potential?