As a business coach, one of the single most common issues I see with new entrepreneurs is their lack of understanding of gross profit, gross margin, and the impact of operating expenses. Their focus is almost always exclusively on the revenue gained from sales. I often refer to this as the “drug dealer mindset.”

Petty street-level drug dealers are often fronted a bunch of product they are expected to sell by a distributor level drug dealer. As the street-level dealer sells their product, they are left with a fist full of cash. A wad of cash in their hand makes the drug dealer feel rich and leading them to believe that being a drug dealer is a great gig.

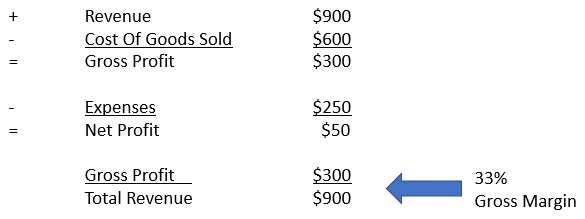

Unfortunately, what the drug dealer has in his hands is called revenue. Revenue is the result of sales and is not what makes you rich. A business needs to subtract their Cost Of Goods Sold or COGS from their revenue to establish their Gross Profit. Gross profit is what is used to pay operating expenses, including wages. When you subtract expenses from gross profit you get Profit which is what you have left.

The ratio of gross profit to revenue is known as gross margin. Gross margin and net profit are much more important measurements of a business’s health than revenue.

The drug dealer sees the cash generated from his sales but forgets that the cash is not all his. From that cash, he still owes the distributor the cost for the product he was initially fronted or he risks “getting fitted for a pair of cement overshoes,” as my dad would say.

What the drug dealer is left with after paying his distributor is gross profit. Gross profit is what he can use to cover any expenses and pay himself for his efforts. According to a study by the National Bureau of Economic Research, the typical petty drug dealer’s average wage is only $6.00 to $11.00 per hour and many earn far less.

Many books on small business say that businesses live and die based on making sales. However, this is a very misleading statement. Small businesses live and die based on their gross profit not from sales. After all, I can always make sales if I sell my product or service for less than my actual cost.

Even big businesses struggle with this distinction. My business was acquired by a publicly held company during the dot-com era for our revenue alone. It was not bought for our gross profits, gross margins, or even the free cash we could provide. In fact, after the acquisition of my company, their business model doubled down on the “revenue only” drug dealer mindset. After we were acquired we got new customers by agreeing to charge them less than the sum of our COGS and expenses.

We did this even if it meant our reduced price resulted in a tiny gross profit that did not cover even a small fraction of our operating expenses resulting in a negative net profit. We only offered this reduced price if the customers agreed to outsource their entire department’s work to our company. Since we were essentially giving away our services in the name of growing sales, it was no surprise that the division I managed grew from eight to thirty-two million dollars in sales in only eighteen months.

Let me say that this is no way to run a small business. It was in the dot-com era and wall street had the drug dealers mentality and only cared about revenue growth. The company’s strategy to lose money on every service job was only acceptable since the company had other product lines that made it revenue too. It needed the revenue from the service business to meet wall street revenue expectations for the company. Moreover, we wanted to displace the competition by creating an oligopoly.

Successful entrepreneurs know that it is not revenue or sales that count, but the gross margin you can produce from your sales. Without a healthy gross margin, your sales will not produce enough gross profit to cover your operating expenses and return a profit to the owners.

Do you suffer from a drug dealer mindset and think only about growing sales or are you focused on how much gross margin your sales will produce?