My wife and I operate several closely held LLCs, of which we are the only members. Since all our financial interests are comingled, we simply state in our operating agreement that each of us is a 50% owner. But what do you do when the financial interests of the members of an LLC are not comingled? In these cases, many LLCs utilize capital accounts.

Related Post: The Truth About a Husband-and-Wife LLC

Limited Liability Companies (LLCs) have gained significant popularity due to their flexibility and supposed simplicity. With multi-member LLCs, the operating agreement serves as the principal document to determine how decisions and income distribution are made to the members. However, many multi-member LLCs use capital accounts to augment the operating agreement. Unfortunately, capital accounts mystify many LLC owners.

Capital Accounts 101

Corporations have shareholders. Ownership is reflected in the number of shares a shareholder owns vs. the corporation’s total number of outstanding shares. For example, if you own 100 shares and the company has issued 200, you own half of the business. When decisions are to be made at shareholder meetings, shareholders vote the sum of their shares. The more shares a shareholder has, the more influence they have. When it is time to offer cash distributions to shareholders, the portion of cash a shareholder is entitled to is based on the number of shares they own. So, the more shares a shareholder owns, the greater the cash distribution is. Pretty straightforward.

However, LLCs do not issue shares. Instead, LLCs simply have “members”. So, how can multi-member LLCs determine a member’s ownership percentage when it comes to influencing critical decisions or providing cash distributions to members? The answer for many LLCs is to maintain capital accounts for each member.

So, what is a capital account? Capital accounts within an LLC serve as individual ledgers to track each member’s financial stake in the company. Essentially, these accounts represent the member’s ownership and financial contributions to the business, which is often used to determine cash distributions from operations and to make decisions in support of the LLC’s operating agreement.

A member’s capital account represents a combination of the member’s initial investment, additional contributions to the business, their share of the LLC’s profits and losses, and any cash or property distributions or draws they received from the business.

Unlike the number of shares a stockholder of a corporation controls, which remains constant unless the person sells or buys more shares, capital accounts are dynamic entities subject to constant adjustments to reflect the changing financial conditions of the LLC. These adjustments typically encompass additional contributions, profit or loss allocations, and withdrawals made by members. Each transaction, whether injecting capital or taking a profit distribution, leaves its mark on the member’s capital account ledger.

Maintaining accurate capital accounts is a meticulous task typically entrusted to the company’s accountant or bookkeeper. Regular reconciliations ensure the integrity and consistency of these accounts. Any discrepancies are promptly addressed and rectified to maintain the accuracy of financial records.

However, the changes to capital accounts aren’t set in stone. They can be negotiated and documented in the LLC’s operating agreement. This flexibility allows members to revisit and adjust ownership percentages and allocation mechanisms as the business evolves. Renegotiations provide a platform for aligning the interests of all stakeholders with the company’s objectives.

The initial capital account balance generally corresponds to the market value of the member’s contribution, whether it’s cash, property, or services. Subsequent contributions augment this balance, while distributions or owner draws, representing withdrawals, reduce the member’s capital account accordingly.

Capital accounts are a vital barometer of each member’s investment and financial influence within the LLC. More than a simple record-keeping mechanism, they are instrumental in decision-making, calculating distributions, assessing tax implications, and determining the allocation of profits and losses among members.

Funding the LLC

To better understand how capital accounts can be used, let’s use a fictitious company and see how each member’s capital account evolves over time as specific milestones are encountered.

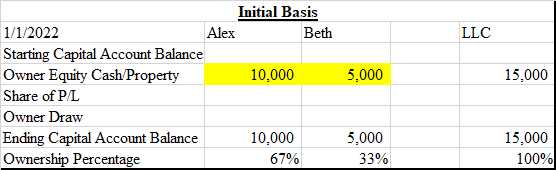

When an LLC is created, the members contribute money or property so the business can begin operations. Let’s consider our example of an LLC with two initial members, Alex and Beth. Alex contributes $10,000 in cash, while Beth contributes tools and equipment with a market value of $5,000.

In this simplified scenario, Alex’s capital account reflects his $10,000 cash contribution, while Beth’s capital account mirrors the $5,000 valuation of her tools and equipment contribution. These initial capital account balances serve as the starting point for tracking each member’s investment in the LLC.

Accounting for Annual Gains and Loses

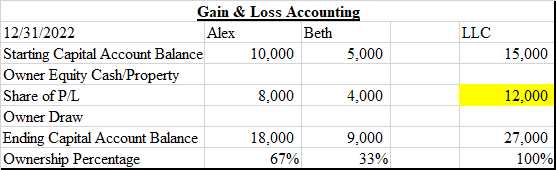

At the end of the first year, the LLC records a profit of $12,000. According to the operating agreement, profits are to be allocated based on the member’s capital account balances. Alex would receive two-thirds of the $12,000 since his capital account was $10,000, while Beth would receive the other one-third.

After adjustments based on their respective capital account balances, Alex’s capital account now stands at $18,000, while Beth’s is at $9,000. These adjustments ensure that profits are allocated proportionally to each member’s capital contribution, reflecting their ownership interests in the LLC.

Distributing Cash to Owners (Owner Draw)

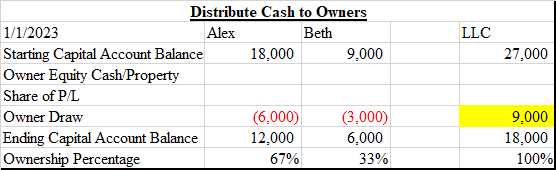

Now that there is cash in the bank account, the LLC has decided to distribute $9,000 from the LLC’s cash account. The distribution will be allocated to each member in proportion to their respective capital account balances. Here again, Alex is entitled to two-thirds, and Beth is entitled to the other third.

After the distribution of $9,000 based on their capital account balances, Alex gets a check from the LLC for $6,000, and his capital account balance decreases to $12,000, reflecting his share after the distribution. Similarly, Beth receives a check from the LLC for $3,000, and her capital account balance decreases to $6,000 after receiving her distribution portion.

Just as with withdrawing cash or property from the business, owners can also contribute additional cash or property to the LLC. When a member contributes cash or property to the business, the value of their contribution is added to their capital account.

NOTE: Remember that the Operating Agreement is the document that describes how decisions and profits are distributed. In our example, we assumed that the capital account dictated how ownership and distributions were established, but it could just as easily have said that Beth, by virtue of the fact of not having contributed cash when the LLC was formed, had chosen to give Alex the first $3,000 of profits and that the remainder of any distribution to members would be distributed on the basis of the member’s capital account.

If this were the case, when the company agreed to distribute the $9,000, Alex would have received the $3,000 defined in the Operating Agreement, leaving just the remaining $6,000 to be distributed based on the member’s ownership percentage. Therefore, Alex would have received an additional two-thirds of the remaining $6,000 or $4,000 for a total of $7,000 in his capital account, while Beth would have been entitled to her one-third of the remaining $6,000 or $2,000. The key here is that the capital accounts are supporting documents for the Operating Agreement, which takes precedence.

Additional Owner Draw

A few months after the LLC did its first distribution, Beth expressed her desire to take an additional capital distribution of $3,000 from the LLC’s cash account. While Alex does not seek a further distribution, the business’s discretionary income can accommodate Beth’s request, but the additional cash distribution to Beth will affect her capital account balance.

Beth’s capital account balance decreases to $3,000 after the additional distribution of $3,000, reflecting her withdrawal from the LLC’s funds. Meanwhile, Alex’s capital account balance remains unchanged since he did not opt for an additional distribution. As a result, Alex’s ownership is now 80%, while Beth’s has dropped to 20%. This adjustment ensures that each member’s capital account accurately reflects their financial stake within the LLC.

LLC Gets New Member

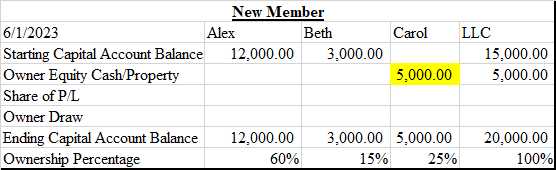

The LLC welcomes a new member, Carol, who contributes $5,000 to the business. This contribution marks the beginning of her journey as an integral part of the LLC.

Carol’s capital account is established with an initial balance equal to her contribution of $5,000. This balance is a testament to her financial investment and membership in the LLC. With Carol’s capital contribution, the LLC’s capital account went from $15,000 to $20,000. As a result, Alex’s ownership stake dropped to 60%, and Beth’s ownership stake dropped to 15% to account for Carol’s 25% stake in the business. These adjustments ensure that each member’s capital account accurately reflects their financial stake in the LLC, paving the way for collaboration and growth within the business.

Related Post: The Ugly Truth of Employee Ownership Without Capital Contributions

Sale of the LLC

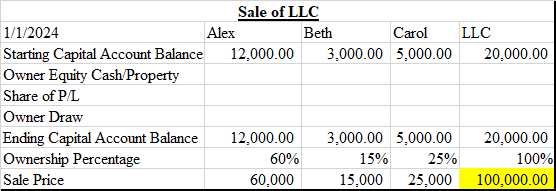

After another six months of operation, the LLC receives an enticing offer from a buyer interested in acquiring the business. The agreed-upon purchase price is $100,000, marking a significant milestone for the LLC and its members. According to the Operating Agreement, any proceeds from the sale of the business are to be distributed based on each member’s ownership percentage as defined by their capital accounts.

Following the sale of the business for $100,000, the distribution of proceeds is allocated to each member based on their capital account balances. Alex receives 60% or $60,000, Beth receives 15% or $15,000, and Carol receives 25% or $25,000. These distributions reflect the proportional ownership interests of each member in the LLC, ensuring equitable treatment and a fair division of the proceeds from the sale.

NOTE: Occasionally, a member’s capital account may go negative. This may not be a problem unless a liquidation or sale event occurs or the member leaves the LLC. When that happens, the member with the negative capital account is expected to repay the amount owed to the LLC.

Conclusion

In closely held LLCs where all the members’ financial interests are comingled, such as in a husband-and-wife LLC, simplicity often prevails, with members splitting ownership based solely on the Operating Agreement. However, when financial interests are not comingled, as in many multi-member LLCs, capital accounts are frequently used to augment the Operating Agreement. Capital accounts track each member’s financial stake, dictating distribution rights and decision-making. Unlike shares in corporations that remain constant unless the person sells or buys more shares, capital accounts reflect contributions, profits, and withdrawals, with adjustments made for financial changes. As such, capital accounts ensure accurate and fair representation of members’ interests over time.

Do you need to create a capital account for your business?