An essential business function that I attribute to the CEO role in a small business is to look outside of the organization at external factors to steer the business away from dangers or challenges and toward opportunity. This is why I recommend business owners keep up with current events to better predict the future. Demographic changes at both micro and macro levels are vital inputs that CEOs need to consider when charting the direction of their organization.

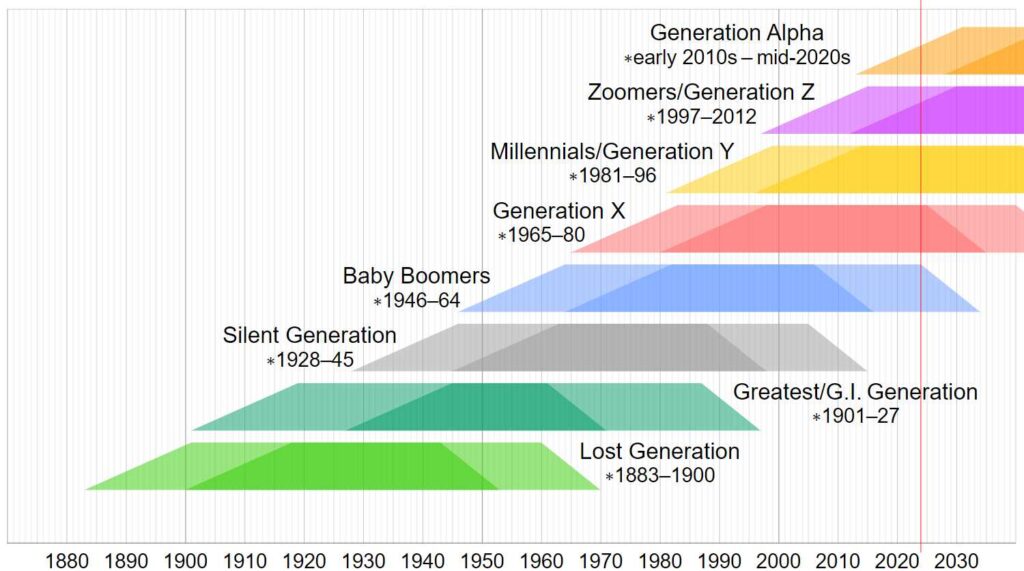

We often discuss populations based on their generation. For example, I’m a Baby Boomer, and my kids are Millennials. Unfortunately, that is only half the story. When we categorize our customer segments according to their generation, we consider how they think about things based on their attitudes and behaviors.

Related post: You Need To Know The Attitudes And Behaviors Of Your Target Demographic

However, to really understand how demographics influence the economy and, ultimately, how they create challenges and opportunities for businesses, we need to look at the US population by age and not by birth years.

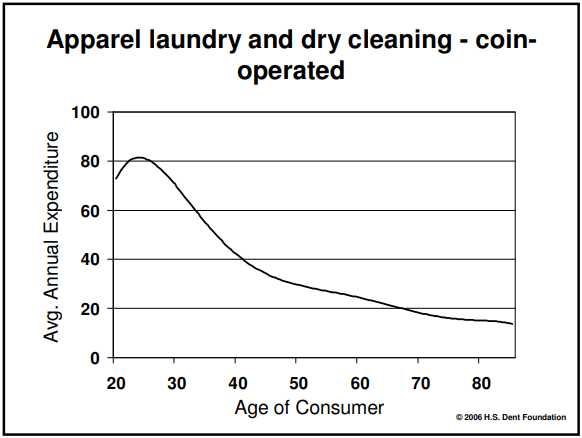

Many years ago, Harry Dent developed his Demand Curves, in which he compares the age of consumers with their annual expenditures on various products or services. Consumer spending is very predictable because people buy things based on age and life stage.

For example, people in their 20s are more likely to go to a coin-operated laundry because they live in dorm rooms or apartments that do not have a washer/dryer. Eventually, as they age, these same people get married, buy a house with a washer/dryer, and stop using coin-operated laundries. This pattern is so predictable that Harry Dent published an entire book about it called Spending Waves. While understanding Spending Waves and Demand Curves is helpful in marketing, overlaying population age brackets can paint a compelling picture of the future of an industry and the economy as a whole.

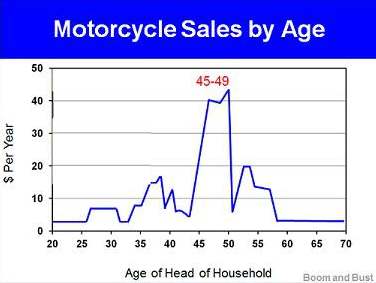

One of the compelling examples that I share with my clients is motorcycle sales based on age. Money is tight when raising a family, and most of a family’s income is spent on children, who are very expensive. When the parents reach their mid-40s, their kids are grown and leave the nest. This means that the family has discretionary income that they never had before. The parents splurge a little and indulge themselves with items they could not afford when the kids lived at home. This explains the rise in motorcycle sales among 45-year-olds. The window to splurge is soon replaced as they realize they need to save for retirement. Spending slows considerably, and investing for retirement and paying off debt becomes a priority, which is why motorcycle sales drop so precipitously at 49. This is all very predictable.

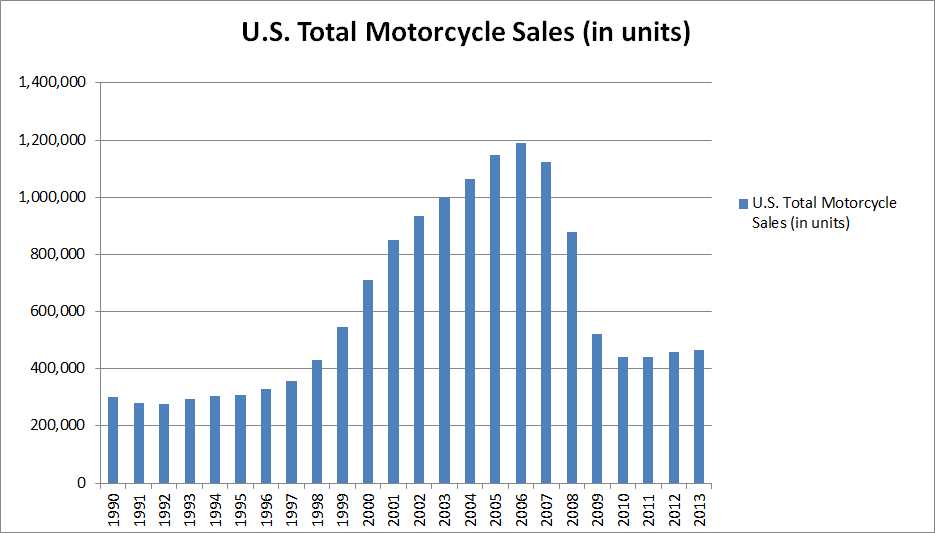

So how does knowing at what age people buy stuff help predict the motorcycle industry’s future? Since we now know that motorcycle sales peak around age 45-49, let’s look at motorcycle sales in the US. Baby Boomers were born between 1945 and 1964. The oldest Boomers, born in 1945, turned 45 in 1990, and the last, born in 1964, turned 45 in 2009.

Now, if we look at motorcycle sales between 1990 and 2009 when Baby Boomers were 45, we can see how US motorcycle sales tracked the Baby Boomer Wave.

Clearly, age drives consumption, affecting the demand side of the economy, and is very predictable. However, age can also predict how money flows in and out of the economy more broadly.

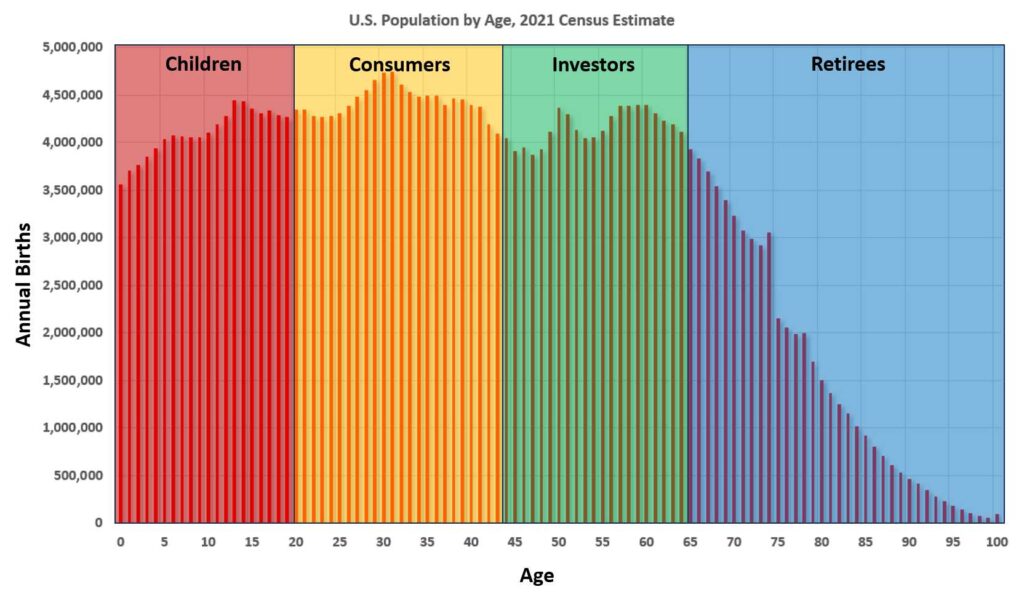

To examine this aspect, we can break the population of the US into four life stages based on their contribution to the economy. As the US population passes through each life stage, we can see how it directly correlates to a business’s future opportunities and challenges.

I believe that you can estimate a person’s contribution to the economy based on four life stages.

| Life Stage | Age | 2021 Population (Million) | Percentage |

| Children | 0-19 | 81.07 | 24% |

| Consumers | 20-44 | 111.9 | 34% |

| Investors | 45-64 | 82.51 | 25% |

| Retirees | 65+ | 57.88 | 17% |

Children Life Stage

In the first life stage, we encounter Children aged 0-19 years, with a population of 81.07 million as of the 2021 census. While this life stage doesn’t have a direct economic contribution, its presence plays a crucial role in shaping consumer behavior. Children act as catalysts, influencing their parents to become high consumers, and driving demand for various goods and services such as childcare, education, clothing, and entertainment. Although Children life stage members do not actively participate in economic transactions, their indirect impact cannot be overlooked.

The Children life stage represents a 20-year period that places a financial burden on the next life stage, their parents, whom I call Consumers, as the primary responsibility of Consumer life stage members is to raise and provide for these children and themselves. The expenses associated with raising a family contribute to the economic landscape, influencing the types of products and services in demand.

Consumer Life Stage

In the second life stage, we encounter the Consumer life stage, who are now parents. These individuals are between the ages of 20 and 44 and have a population of 111.9 million as of the 2021 census. As parents, Consumers play a pivotal role in the economy, driving the economic engine with their high-consumption lifestyle. This life stage represents the demand side of the market, influencing various sectors through their purchasing behavior.

This life stage spans approximately 25 years. Consumer life stage members often live paycheck to paycheck as they allocate a significant portion of their income to meeting their own needs and those of their growing children. Their spending habits primarily focus on goods, such as homes, cars, RVs, clothing, and toys, and specific services, such as education, healthcare, and vacations. It should be noted that spending includes both earned income and borrowed money. This inclination towards expenditure on the things necessary to raise a family is shaping the market landscape, creating business opportunities to cater to the diverse demands of parents raising children.

Investors Life Stage

Entering the third life stage, we encounter Investors aged 45 to 64, with a population of 82.51 million as of the 2021 census. If Consumers are the engine of the economy, Investors are the crucial fuel of that engine. Investors represent the supply side of the economy, contributing to the economy through their high work output and investing capital into various systems.

Having raised their children, child-related expenses have declined, as has their overall consumption. Simultaneously, they are at the peak of their earning potential, leveraging their extensive professional experience and skills. Over approximately the next 20 years, the Investor life stage members focus on preparing for retirement, investing their discretionary income in stocks and bonds, and often in their own businesses. This life stage emerges as a prime time for business ownership, as individuals in this life stage have acquired a wealth of technical expertise in their respective fields and are accumulating capital with lower expenditures.

During this life stage, spending on goods and services takes a back seat as their emphasis shifts towards investing for a comfortable retirement. Members of the Investors life stage actively contribute to the economy by aggressively investing in stocks and bonds, providing the essential capital businesses need. Stocks offer equity capital for startups and innovation-led businesses, while bonds provide debt capital for mature businesses to expand and grow. Moreover, this life stage pays the most in payroll and income taxes, which are used to fund government programs and services.

Retiree Life Stage

In the final life stage, we encounter Retirees, individuals over 65 years of age, with a population of 57.88 million as of the 2021 census. Having ceased working, members of the Retirees life stage undergo a significant shift in economic dynamics, transitioning from contributing to the workforce and acting as Investors to recipients of government assistance, mainly through programs such as Social Security and Medicare.

Retirees now rely on government funds and no longer contribute payroll and income taxes from earned income. Instead, they draw from their accumulated savings, including the sale of stock and bond positions, and receive benefits from the government. While essential for their financial well-being, this process reverses capital flows within the economy. As retirees liquidate their investments, there is a reduction in the available capital businesses need, driving up capital costs. This economic impact highlights the importance of understanding demographic trends in business planning.

Regarding spending habits, Retirees allocate a significant portion of their income to services, with a lesser emphasis on tangible goods. Business owners should consider these consumption patterns when tailoring products or services to this demographic. Despite the shift in their role within the economy, Retirees remain a considerable market segment with significant amounts of accumulated wealth and specific needs and preferences that businesses can address.

Understanding and adapting to the unique characteristics of each life stage is crucial for entrepreneurs seeking to navigate the ever-changing landscape of the US economy.

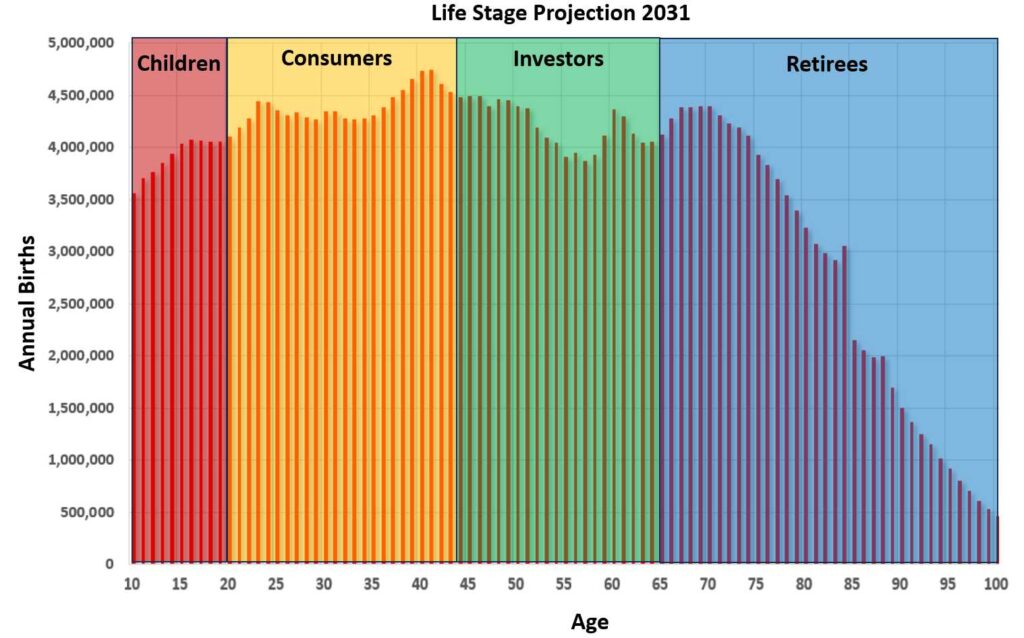

2031 Projections

Now, let’s take the population curve from the 2021 census and project it over ten years, into 2031.

Children

The population in the Children life stage is projected to continue to decline. While Children do not directly affect the economy, they act as a catalyst for consumption. As their population declines, it will affect their parents’ consumption. Moreover, employment issues will arise as their dwindling population continues to move through the other three life stages. We are beginning to see how entry-level service jobs remain unfilled as employers fight over this scarce resource, driving wage inflation. This will only get much worse as the average family today has about 1.66 children, according to the Congressional Budget Office, which is significantly below the “replacement rate” of 2.1 children needed to sustain a stable population.

Consumers

The Consumers life stage will peak by the mid-2030s. With fewer children to support, consumption will continue to decline over the next ten years. With less demand for the goods and services Consumers generally purchase, businesses should expect a decline in such goods as homes, cars, RVs, clothing, and toys, as well as services such as education and family vacation destinations. As consumer spending is the driving force behind the economy, sectors that cater to this life stage will see inflation-adjusted revenues decline.

Investors

The Gen X demographic dip will mean there will be fewer Investors to inject money into the economy, which businesses need to produce the goods they sell to members of the Consumer life stage. The good news is that the Consumer life stage members will support fewer children and, therefore, will potentially need fewer goods. The bad news is there will be less members of this life stage paying income and employment taxes starving the government of income.

Retirees

With the relatively large demographic bubble, often associated with the Baby Boomers, now transitioned to the Retiree life stage, much of the investment capital businesses used to grow and innovate will be no longer available. The economy will undoubtedly contract due to less consumption by Consumers, who have fewer children, and less capital in the systems, due to the Wave of Boomers now retiring.

Moreover, as the population transitions from Investors to Retirees, they move their investment portfolios from equities (stocks) with higher returns but more volatility to bonds (debt) with lower returns and less volatility. This will impact how businesses can raise money since new startups or innovative companies generally use equities to raise capital, unlike established companies that issue bonds to buy tangible assets. As a result, many innovative startups will be starved of necessary capital, and mature businesses will see greater access to capital.

Consumption Projections

The demographic shift with fewer people in the Children life stage and more in the Consumer life stage, is expected to bring about significant changes in buying habits and economic dynamics. The reduction in the child population suggests a potential decrease in spending on child-related expenses, such as education and childcare, among Consumers. This demographic shift implies that Consumers may redirect their income toward different areas, leading to changes in traditional spending patterns. The larger demographic of Consumers and the smaller number of Children will lead to higher disposable income, prompting an increased focus on personal consumption, luxury goods, travel, and experiences.

This transformation in consumer behavior will likely impact various economic sectors differently. Industries associated with child products and services will experience a decline in demand. At the same time, those catering to adult-centric markets, such as travel, leisure, and luxury goods, will witness an upswing.

The changing demographics can act as an economic stimulus for sectors aligned with the preferences of the Consumer life stage. Businesses that traditionally targeted child-related products and services may need to adapt their strategies to meet the evolving needs of this shifting demographic. This adaptation could involve diversifying product lines or adjusting marketing approaches to align with the changing consumer landscape.

Additionally, changes in demand for goods and services may influence employment patterns, with growing sectors creating new job opportunities and declining sectors witnessing shifts in employment dynamics. In summary, the changing demographics are poised to reshape the consumption landscape, presenting challenges and opportunities for businesses that can effectively understand and respond to these evolving market dynamics.

Government

By 2031, the entire Boomer population bubble will have reached the Retiree life stage. This shift will profoundly affect government-sponsored programs, government spending, and inflation.

For one, the Boomer population bubble has gone from being the largest contributor to Social Security and Medicare via payroll taxes to being a non-contributor. At the same time, this same cohort is collecting Social Security and Medicare benefits. This transition will strain these programs, potentially requiring adjustments to funding structures and benefit distributions to ensure sustainability.

Moreover, the Boomers, now retired, are paying less income and payroll taxes. At the same time, the Gen X population dip lowers overall income and payroll tax collections. The combination of these factors will have an impact on the financial resources available for vital government social safety nets. As a result, policymakers may be prompted to explore alternative revenue sources or consider reforms to program structures.

The demographic imbalance between the surge in Retirees now consuming government resources and the dip in Investors primarily providing the money for these programs may necessitate policy changes, potentially including modifications to eligibility criteria and contribution rates. Moreover, the strain on funds allocated to retiree benefits might also impact other government services, with policymakers facing decisions on resource prioritization.

The potential for inflation arises from increased demand for government-funded programs and a reduced tax base to support them as the government copes with the financial demands of the growing retiree population. Inflation could erode the currency’s purchasing power, affecting both Retirees and those in the Consumers and Investors life stages.

Central banks have already responded by adjusting interest rates to counteract inflation, influencing borrowing costs and overall economic activity. The demographic shift presents policymakers with a complex set of challenges to balance the needs of an aging population with the economic realities of funding essential programs and managing potential inflationary pressures.

Conclusion

Understanding demographic trends is pivotal for business owners seeking to navigate demographic-induced changes to the business landscape. CEOs, particularly in small businesses, play a crucial role in analyzing external factors to anticipate challenges and capitalize on opportunities.

Demographics influence consumer preferences and shape economic patterns, affecting demand for goods and services across various life stages. As the demographic composition evolves, businesses must adapt to meet changing consumer needs and market demands. Moreover, demographic projections offer valuable insights into future market trends, allowing businesses to anticipate shifts in demand and adjust their offerings accordingly. By understanding the implications of demographic changes, entrepreneurs can position their businesses to capitalize on emerging opportunities and mitigate potential risks.

How will your industry fare in the next ten years?