In June 2018 the US supreme court upheld a lower court’s ruling that the state of South Dakota could force the online retailer Wayfair, a retailer with no nexus, which is a physical location, in the state to collect sales taxes on internet sales. This ruling sent shockwaves through the eCommerce community.

Prior to the court’s ruling, most eCommerce or internet retailers only had to have a sales tax license and collect sales taxes for all jurisdictions for a single location.

Based on the location where the buyer took possession of goods, the seller only had to collect sales taxes for the taxing jurisdictions that the seller and the buyer had in common.

For example, in the old days if a business that sold products via the internet was located in Denver, Colorado and it made a sale to someone in Denver, Colorado they would collect the Colorado state tax, Denver county tax, and the city of Denver sales tax during the sales process. Basically, all the internet sales taxes owed.

If however, they sold to someone in Colorado Springs, Colorado the seller would only collect the state sales tax since the buyer and seller only had the state of Colorado in common. Finally, if they sold a product to someone in Kansas the seller would collect no sales tax.

The taxes that were not collected by the seller was not tax-free for the buyer. The buyer was obligated to still pay sales tax to their local taxing jurisdictions where the seller had not already collected a sales tax. This tax is called a Use Tax. However, few buyers paid their use tax.

That all changed, as many states have used the supreme court’s ruling to impose their own requirements on online sellers to collect internet sales taxes.

Here is what you need to know as an online retailer.

The supreme court’s decision included seven guidelines for compliance and constitutionality. While recommended by the court, each state was free to define which guidelines to implement and what values to apply. The seven guidelines provided by the supreme court are as follows.

1. Safe Harbor

In the case of South Dakota, it exempted businesses with less than $100,000 in sales or less than 200 transactions at the state level from collecting sales tax if the business didn’t have a nexus in the state.

Therefore, if an online seller sold only a keychain online for $1.00, $200 in total sales in the state would trigger the need to get an internet sales tax license and begin collecting of sales taxes. While the $100k sales or 200 transactions safe harbor thresholds was the case with South Dakota, each state was free to set their own minimum limits.

Moreover, the definition of what amounted to a transaction was not clear. If you bought two items from an online retailer in a single sale, was it one transaction or two since there were two items?

Update November 29, 2021 – List of Safe Harbor Thresholds By State.

2. No Retroactive Collection

The states cannot force a business to pay sales taxes on sales made prior to the state’s implementation of the new sales tax collections rules or on sales made prior to the period where internet sales tax collection obligations began.

3. Single State Level Administration Of All State Taxes

Since there are many taxing jurisdictions (state, counties, cities, and even special taxing jurisdictions in some cases) in a state, the court recommended there be only one application process and one point of internet sales tax remittance.

At issue is what we in Colorado call home rule cities. Home rule cities are cities that were established prior to Colorado becoming a state. As such, the state does not collect sales tax from home rule cities. Retailers have to apply for, collect and remit sales taxes separately to each of these jurisdictions. Moreover, it is not clear what safe harbor thresholds apply to these individual jurisdictions or how it may apply to special taxing jurisdictions.

4. Uniform Definitions Of Products And Services

States are encouraged to come up with a uniform definition of what is taxable. For example, some states tax some services and not others.

For example, in Wisconsin, where I used to have

5. Simplified Rate Structure

Each state defines tax jurisdictions differently. Some states like Massachusetts have one sales tax jurisdiction while Texas has 1,515 different sales tax jurisdictions.

6. Software For Access To Rates And Administration

A single place where a retailer can go and enter a buyer’s address to determine all the taxing jurisdictions and rates that apply. TaxJar offers a free Sales Tax Calculator as well as low-cost sales tax automation tools.

7. Immunity From Errors Within The Software

When a state gives you the internet sales tax rates for a specific location and there is an error in the data or the calculation, while the business would still be liable for the interent sales tax, the state should not impose fines and penalties on the business for their error.

In addition to the guidelines provided by the supreme court, here are a few other rules that online retailers need to know.

Collection Periods

Internet sales taxes may have to be remitted differently based on sales volume and other factors. Low sales volumes may require quarterly remittance and higher volumes may require monthly remittance. Each state is different. What is important to understand is the exact date when a business needs to begin collecting internet sales taxes.

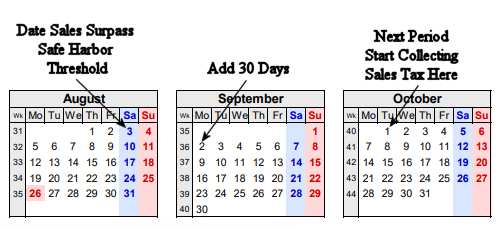

When the sales of an out of state retailer with no nexus or physical location in a state, surpasses either the sales volume or the number of transactions threshold, established by a state, the retailer should add thirty days to that date. Then from that date, the retailer should begin collecting the internet sales tax on all sales beginning on the first day of the next sales tax collection period.

For example, if a business is obligated to remit internet sales taxes on a monthly basis and on the August 3rd they pass either the safe harbor threshold for sales volume or the number of transactions, the retailer should not immediately begin collecting sales tax on any additional sales.

From August 3rd, the retailer would add thirty days, which would place them at September 2nd. Since sales tax collections always start on the first of the month following this date the retailer would not begin to collect the internet sales taxes in that state until October 1st. Then from that date forward, the retailer is responsible for reporting their internet sales tax collections to the state for each period, even if there are no sales. This obligation to report sales to the state would continue until the business is dissolved.

Sales Tax Application

Online retailers are not required to obtain a internet sales tax license until their sales surpass one of the safe harbor thresholds established by the state. While the application process may take several weeks, the eCommerce business should begin collecting sales taxes on the 1st of the month of the collection period, even if the application process is not yet entirely complete.

Register As A Foreign Entity

When a business eclipses one of the safe harbor thresholds and starts collecting internet sales tax, they should also register with the states Secretary Of State as a foreign entity. Since the business is not headquartered in that state, they will also need to hire a registered agent and may need to file a State Income Tax return at year end.

Related Post: HOW TO PROPERLY REGISTER A NEW BUSINESS ENTITY

Here are a few additional links that may prove helpful in understanding and complying to the new interent sales tax collections obligations.

Additional tax-related information located at Tax Foundation

InCorp is a Register Agent that covers all 50 states

TaxJar is a low-cost automated sales tax collection tool that integrates with most eCommerce solutions

Here are a few pieces of sales tax related legislation to keep an eye on:

Related Video: SELLING ONLINE? WHAT YOU NEED TO KNOW ABOUT SALES TAX

Is your business sales tax compliant?

I would like to acknowledge Brad Whitten of Pikes Peak financial group for his gracious assistance as a reviewer to make sure that the sales tax related issues conveyed in this post were an accurate representation of U.S. tax law.