When people think about selling a business, the most common assumption is that it’s an all-cash transaction — the buyer cuts a check, and the seller rides off into the sunset. But in the real world, it rarely works that way.

In most cases, a business sale is a combination of several different payment components. While some cash is usually involved, the rest of the purchase price is often made up of creative financial instruments and negotiated agreements. Understanding these options is key for both buyers and sellers to get the best deal possible.

Seller Financing: Secured and Unsecured Notes

A very common structure includes the use of seller financing, where the seller allows the buyer to pay over time via a promissory note.

- Secured Notes: These are backed by collateral, such as business assets or personal guarantees. Since the seller has a claim on specific assets if the buyer defaults, the buyer may have to pay a higher price (or interest rate) for the added security.

- Unsecured Notes: These rely purely on the buyer’s promise to pay, without any collateral. They represent a greater risk for the seller but can be used to bridge gaps in negotiations.

Seller financing helps deals close when bank loans or SBA funding fall short — and can generate ongoing income for the seller in the form of interest.

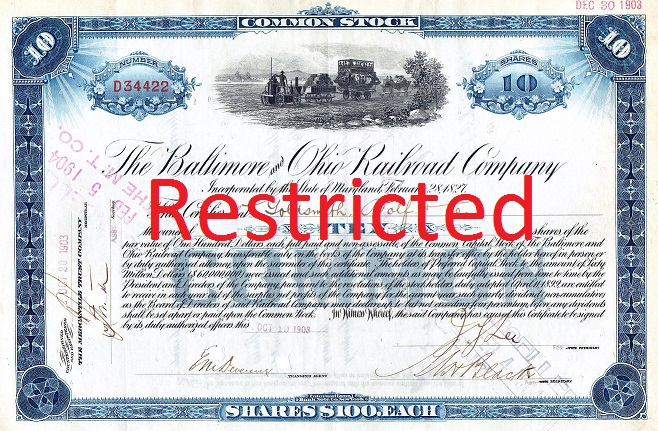

Stock Compensation – Liquidity and Tax Considerations

When the buyer is a corporation, part of the purchase price may be paid in stock rather than cash.

However, stock in a private company is not the same as stock in a publicly traded firm. It lacks liquidity — you can’t simply sell it on the open market. Even more important, you need to ask:

- Is the stock restricted or unrestricted?

- Are there vesting schedules or lock-up periods?

- How will the stock be valued for tax purposes?

Restricted shares usually come with limitations that prevent the seller from offloading stock immediately after the sale. These restrictions are meant to prevent the market (or internal ownership structure) from being disrupted by a mass sell-off.

If stock is part of your deal, consult with a financial advisor and tax professional to understand how it impacts your capital gains and overall tax liability.

The Earn-Out: Tying Price to Performance

An earn-out is a smart way to bridge valuation gaps between buyers and sellers. This structure allows the seller to receive additional compensation based on the business’s post-sale performance.

It’s common in businesses where future revenue is uncertain or where the seller remains involved post-sale. Earn-outs can be based on:

- Revenue targets

- Profitability metrics

- Customer retention rates

While attractive in theory, earn-outs can become contentious if metrics aren’t clearly defined. Be sure to include detailed language in the agreement that explains how performance will be measured and paid.

Non-Compete Agreements: Protecting the Buyer’s Investment

After buying a business, the last thing a buyer wants is to compete with the former owner.

That’s where a non-compete agreement comes in. To make this enforceable, a portion of the purchase price is often allocated specifically to the seller’s agreement not to start a competing business for a defined period and geographic area.

This agreement protects:

- The buyer’s investment

- The continuity of employee and customer relationships

- The value of the business’s goodwill

From a tax perspective, amounts allocated to non-compete clauses may be treated differently from capital gains, so legal and tax guidance is essential here as well.

Consulting or Employment Agreements

Sometimes buyers want the seller to stick around — at least for a while. This is especially common in businesses with complex operations or where the seller has strong customer relationships.

In these cases, buyers may offer a consulting agreement or even a short-term employment contract. These arrangements provide:

- A smoother transition for the business

- Reassurance for employees and clients

- Additional income for the seller

However, it’s important to clarify the seller’s new role, decision-making authority, and compensation structure to avoid confusion and conflict.

Royalties and Licensing Agreements

In businesses where intellectual property or proprietary methods are part of the value (such as branded content, software, or patented processes), the seller might agree to a royalty or licensing structure.

Instead of a large up-front payment, the buyer pays the seller over time based on usage or revenue generated from the intellectual property. This creates an ongoing income stream and ensures the seller benefits if the business continues to thrive under new ownership.

It also helps reduce up-front capital needs for the buyer — a win-win scenario when structured correctly.

The Takeaway: More Than One Way to Get Paid

Every business sale is unique. While cash is king, savvy buyers and sellers recognize that creative deal structures can benefit both parties. By incorporating tools like earn-outs, seller financing, equity, or consulting agreements, a deal can be crafted that balances risk, reward, and transition needs.

Just make sure everything is backed by solid legal and tax advice. These aren’t just financial decisions — they’re strategic moves that can shape your future income and lifestyle.

What forms of payment are you willing to accept when you sell your business? Are you open to future upside, or do you want to walk away with as much cash as possible?