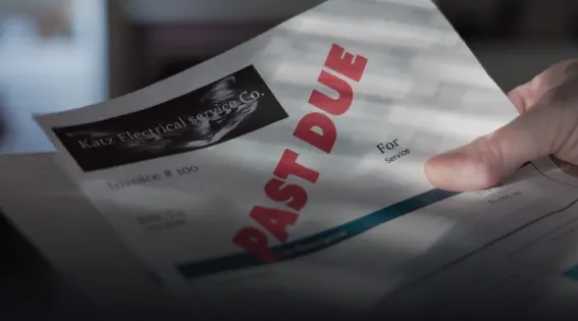

Many businesses these days have a lot of invoices that their clients have left unpaid. According to Entrepreneur, the estimated amount of outstanding invoices across the US is somewhere around $825 billion. This puts every small business’s average amount of unpaid invoices at $84,000. It is not uncommon that some of these debts are paid so late that they’re written off by the business. If you own a small business, it is likely that you don’t have the staff you can dedicate to debt collection. If there’s a considerable amount of outstanding debt from your clients, you can consider hiring the services of a debt collection agency for the job. You should consider hiring a debt collector if you want the following things:

- If you want the debts to be recovered fast – Debt recovery does involve a lot of complications. If you hire a debt collector for the job, your debtors are more likely to pay up swiftly.

- Avoid unnecessary problems – Reaching out to your debtors to recover unpaid invoices can indeed be unpleasant. Thus hiring a debt collector for the job can help you focus on your business while taking care of debt collection.

- Let the pros take care of your debt collection needs – The field of debt collection is governed by a huge number of federal as well as state laws. If you break the law while collecting your debt, you might get sued by a debtor, and thus it is best to leave the task to a debt collection agency.

If you look online, you’ll find that there are a lot of collection agencies that you can hire; however, finding the one that’d be just right for your business can be a bit tricky. Below are a few tips you should keep in mind while choosing a suitable debt collector:

1, Research

Each debt collection agency has its specialization area. Some agencies specialize in collecting money for comparatively larger businesses, while agencies specialize in collecting for comparatively smaller businesses. Make sure that the company you’re going to go with will be able to do what you need.

2, See if they have the necessary qualifications.

Obviously, before you hire the services of a debt collection agency, you should check whether they have the necessary qualifications or not and whether they have the necessary licenses.

Debt collection agencies are required to be licensed in most states, barring a few exceptions. Before you start searching for a debt collector, you should learn about what it takes to earn a license to be a debt collector in your state. Doing this will help you interview debt collection agencies keeping your state’s legal requirements in mind. If the agencies you’re speaking with are from some other state, you should check whether they’re qualified to operate in your state according to your state’s licensing requirements. Another thing that you should check is whether they follow the Fair Debt Collection Practices Act, also called FDCPA, or not.

The Commercial Collection Agency Association or Better Business Bureau should be able to help you out with the names of debt collection agencies that have a good reputation.

3, Understanding how they work

Although you’ll be entrusting a debt collection agency with collecting your clients’ debts, you should keep in mind that they’ll represent your company. You should know how you’ll be represented and the way they’re going to work with you. It is also prudent to ask about their experiences in this field.

When you’re in the process of hiring a debt collector, you should ask what the ways they use to collect money are? You may find their ways too harsh or otherwise not suited for your business. A good debt collector will consult with you regarding how you’d want them to approach the matter; they should be able to treat your former clients well and still get the debts recovered.

In many cases, you’ll find that the debtors will leave the town without giving their forwarding address. To collect their debt, the strategy a debt collection agency typically uses is called skip tracing. Using this method, the debtors are traced by accessing different databases. Before hiring a debt collector, ask specifically if they offer this option.

You should also inquire about the debt collector’s experience before hiring them. You should ask them whether they have any experience in dealing with clients from your industry. You should also ask whether your situation is familiar to them or not. You should only hire a debt collector with experience in your field because that’d ensure a high success rate.

Before you hire a debt collector, you should have a clear idea about how they plan to work with you. You should have a contact person to get in touch with whenever required. The debt collection agency should be able to tell you clearly what you’ll need to do from your end. They’ll also tell you when and how frequently they’ll contact you. The company you choose to go with should communicate as per your requirements and not make it mandatory to accept their terms in this regard.

4, The insurance factor

If a collector has been less than candid about how they collect a debt and you find out afterward that they use aggressive methods, then the debtor can take legal action against both you and our debt collector. You don’t want that to happen, irrespective of whether you stand a chance at winning such a lawsuit or not. To ensure such a problem never arises, you should get the collection agency’s proof of insurance; this is also known as the “errors and omissions” insurance policy.

5, Payments

The services of a debt collection agency do not come cheap. Hiring a debt collector is the last thing you can do before giving up on what you are owed entirely. It would help if you kept this in mind while hiring a collection agency. There are mainly two payment options that they can offer you

Payment on collection – In this method, the collecting agency recovers what is owed, and they are paid on a per-bill basis. You should know that even if the collecting agency settles for a lower amount than what is owed, you still have to pay them the same fee. They can do this through debt settlement. A debt settlement is where the debtor seeks to make a partial payment to the collecting agency and get the remaining amount written off. The debtor’s credit history is severely affected in this case.

Purchase of debts – According to this method, the debt collector purchases your debts by paying you a certain amount, usually a percentage of the total amount that is owed. After the purchase, any amount that they manage to collect is theirs.

Conclusion

Hiring a debt collector will help you recover the money owed to you. It can be costly, but if recovering money from unpaid invoices is crucial to you, it’ll be well worth it. While hiring a debt collector, be sure to check if they have the proper licenses. Try to hire a company that is experienced in your field and whom you can trust with your brand’s image.

Lyle Solomon has extensive legal experience as well as in-depth knowledge and experience in consumer finance and writing. He has been a member of the California State Bar since 2003. He graduated from the University of the Pacific’s McGeorge School of Law in Sacramento, California, in 1998, and currently works for the Oak View Law Group in California as a principal attorney.

Related Post: When your business has lots of unpaid invoices, and you’re low on cash to meet your financial obligations, you need to consider accounts receivable factoring.