One of my former SCORE colleagues, Tuck Aikin, wrote the following article grants several decades ago. Some of the data links contained in the original article have become stale with time, but the message remains as true today as it was when Tuck penned them. To ensure the message continues to resonate with readers today, I took the liberty to update some of his original data links but kept the intended message intact.

“Yeah, I used SCORE when I started my business back in ‘93”, the store owner said. “But they didn’t really help me at all. They just gave me this huge financial spreadsheet I was supposed to fill in, and then I had to borrow money from friends and family to get my business started.” As I stifled a smile, I thought to myself, “Guess SCORE did its job yet again: providing a dose of reality while simultaneously dissipating an unrealistic level of expectation about what SCORE does” (we advise and counsel – the client does the work and secures his or her own financing). Yet this casual conversation brought to mind one of the most common false beliefs about business startups: that there are ‘grants’ somewhere out there to help individuals start their for-profit businesses or prop up a failing one.

Here’s a quote from a handout publication from the Colorado Springs Small Business Development Center:

“There are virtually no grants available to start or expand a business. If it sounds too good to be true, it probably is. A grant is a direct financial contribution made without expectation of repayment but with very specific expectations about outcomes. Organizations who give grants have criteria to meet that, by and large, excludes for-profit businesses.”

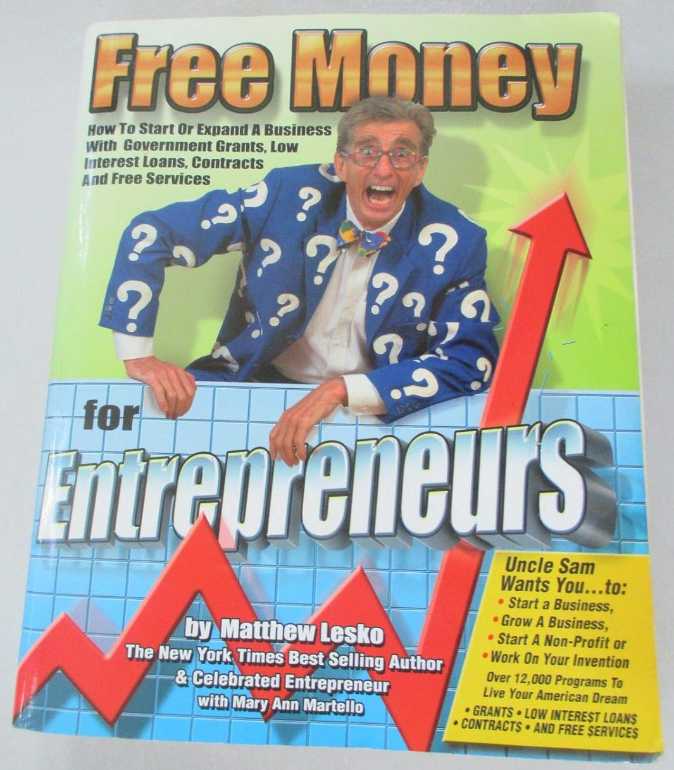

This perhaps discouraging fact is nonetheless continuously obscured by shady for-profit businesses who claim that for an application fee (typically ranging from $20 to $3,000), they will connect budding entrepreneurs with widely available grant funding sources to start their businesses or fund expansion. Such entities are actually scams but often are not illegal. Who can say, for example, that the seeker didn’t get his or her money’s worth when they paid $100 or $250 for a legitimate list of special government grant programs available to targeted ‘disadvantaged’ citizens under extremely restricted conditions?

It’s easy to get drawn into paying for the promise of “free money.” After all, if say, $10,000 or more could be garnered as a startup ‘grant’, the fee looks like a great return on the application fee, so many victims take the gamble and lose. These grant-finding outfits really don’t care and don’t worry about being hauled into court. Who is going to take legal action to recover such fees when they discover they’ve been taken? The cost of legal action, the scammers know, far outweighs the loss. Below is a revealing NBC investigative report on these ‘finding’ services.

Agency calls TV money man’s claims deceptive.

A TV pitchman’s claims to help people get free government money are deceptive and take advantage of downtrodden consumers, a New York state agency says.

And now for the caveat. As with most general rules, there are a few exceptions, such as special programs for identified minorities, women, special economically depressed geographical regions, and certain kinds of socially desirable services. Even here, though, such funding is usually offered to not-for-profit organizations only. Here is a sampling of a few such programs:

- Colorado Housing and Finance Authority

- Colorado Minority Business Office

- Women’s Business Center

- Colorado Enterprise Fund

- Colorado Small Business Development Center

We’ve all heard about Small Business Administration (SBA) guaranteed loans, too. Be aware, though, that the SBA doesn’t really loan the money – your local authorized SBA lending bank does, and the SBA merely guarantees payment. Even here, though, you normally must invest at least 30% of your own money, have thorough experience in the type of business you wish to start, pledge your assets to secure the loan (typically your house), and go through an exhaustive application process.

Related post: What You Need To Know About The Role Of The SBA

Who was it that said, “There’s no free lunch”? Well, there’s no free launch either.

Tuck Aikin was a former SCORE colleague of mine for many years until his retirement. Tuck is a prolific writer and wrote small business-themed articles for the Colorado Springs Gazette for many years. As a co-mentor, Tuck was my inspiration for me starting this blog. The preceding post is reproduced with permission from the author.