A cost structure is the way a company allocates its expenses among the various activities and products that it produces. It is a crucial element of a company’s financial planning and can significantly impact its profitability. There are several types of cost structures that companies may use, including fixed costs and variable costs.

Fixed costs are expenses that do not change based on the level of production or sales. These costs are typically related to the company’s overhead, such as rent and insurance. Fixed costs remain constant regardless of the number of units produced, sold, or delivered.

Variable costs, on the other hand, are expenses that change based on the level of production or sales. These costs are typically related to the materials and labor needed to produce a product or service. As the level of production or sales increases, the variable costs also increase.

Your cost structure as it relates to the Business Model Canvas is closely related to your value proposition. A company’s cost structures represent the specific costs that the business will incur while operating under a particular business model to create and deliver the business’s value proposition, as well as maintaining its customer relationships. These costs have to be allocated across all products or services offerings to minimize costs.

A company’s cost structures can be calculated after it considers the key resources, key activities, and key partners it will require. For a vertically integrated business, such as one of the big six Japanese Keiretsus who are able to allocate their fixed costs from one business unit to another business unit, these businesses control all the key resources, activities, and its partner business units to pick which industry it wants to dominate. For the small business owner, however, the best option when it comes to understanding cost structures is to look at the contact area between the company and its customers, buyers, and suppliers using Porter’s Five Forces model.

At its highest level, cost structures are either cost-driven or value-driven.

Cost-driven structures

Cost-driven structures are focused on keeping costs or expenses down.

Companies that embrace a cost-driven structure use automation or outsourcing to keep internal costs low, resulting in competitive pricing. Operational excellence is often at the core of the business model of cost-driven structures and are exemplified by Walmart and McDonald’s. Since margins are small, a business that is cost-driven has to rely on economies of scale and scope to achieve satisfactory returns.

Economies of scale represent cost-saving that a business enjoys as it grows. For example, a larger company like Walmart benefits from volume discounts on the items it purchases, resulting in lower costs per unit.

Economies of scope represent cost savings that a business enjoys as the scope of its operation grows. For example, a large online retailer like Amazon used its market leadership in online book delivery to expand into other consumables.

Value-driven structures

Value-driven structures are focused on providing more value or revenue through premium offerings or services.

Companies that embrace a value-driven structure use customer intimacy and high-end components to create premium products. Customers that buy value-driven products and services are less price-conscious and value quality, performance, and convenience over price. Nordstrom and Rolex are examples of companies that have value-driven structures.

Operating Leverage

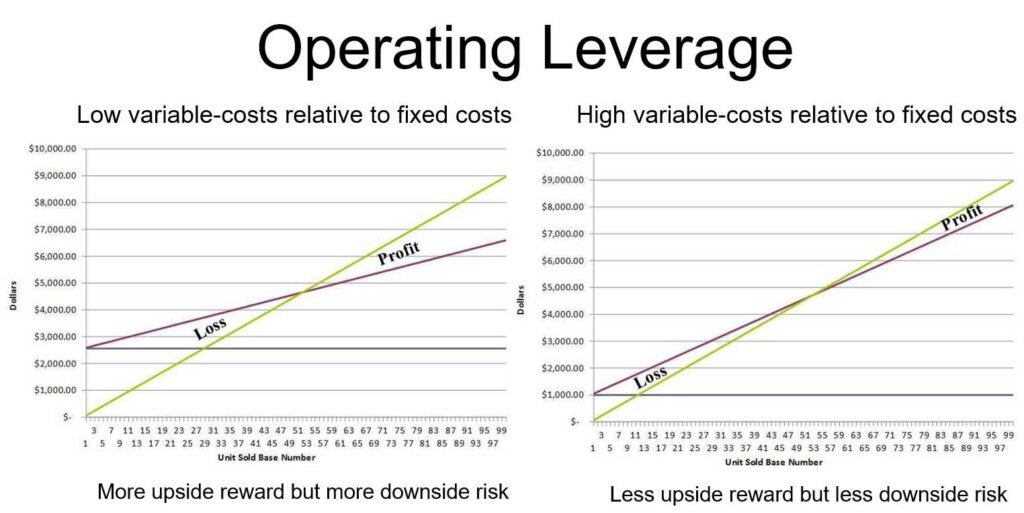

Another element of a company’s cost structure is the ratio of fixed to variable costs they have and are known as Operating Leverage.

High variable-costs relative to fixed costs have less upside reward but also less downside risk. In contrast, low variable-costs relative to higher fixed costs have high upside rewards but have substantially higher downside risk if break-even volumes are not reached.

When considering cost structures, you should consider what your most important costs are that need more attention and which have less impact on the quality of your product or service. You should also consider which key resources and activities are the most expensive and whether you benefit from moving up or down the value chain.

Do you understand your cost structures?