When a business owner finally decides it’s time to sell, they often feel a sense of relief. The decision has been made—now it’s just a matter of finding the right buyer. Unfortunately, that’s where many sellers make a critical mistake: they wait.

Time, as it turns out, is not on your side.

Many things outside of a seller’s control can dramatically impact the value of a business. While the internal operations may be running smoothly, external forces don’t wait for your perfect buyer to show up. They shift, evolve, and sometimes collapse altogether—taking your asking price down with them.

Let’s break down some of the most common ways delay can chip away at your business’s value.

1. Industry Shifts Can Leave You Behind

Industries change fast—especially in today’s hyper-connected, innovation-driven world. What was once a cutting-edge offering can become outdated almost overnight. Consider how quickly streaming services disrupted cable television or how e-commerce upended retail giants.

If your business relies on technology, methods, or customer preferences that are currently in flux, any delay in selling could render key assets obsolete. Even if you’re not in a tech-heavy field, shifts in customer behavior, regulatory policies, or emerging competitors can reduce the perceived future viability of your business.

2. Interest Rates Could Price Out Buyers

In recent years, interest rates have become one of the most volatile factors in the business buying environment. When rates go up, the cost of borrowing increases. This doesn’t just affect buyers looking for loans—it affects valuations. A buyer may have previously been able to afford a higher price based on cash flow projections, but when loan payments spike due to rate hikes, that offer might drop significantly or vanish altogether.

3. The Stock Market and Liquid Capital

Many buyers—especially high-net-worth individuals or investor groups—rely on stock portfolios to fund acquisitions. But what happens when the market takes a nosedive?

Suddenly, the buyer who was ready to make a down payment is rethinking everything. They may hesitate to liquidate investments at a loss or worry about holding too much debt in a shaky market. Your perfect buyer might become your lost opportunity.

4. Tax Law Changes Can Affect Deal Structures

Another common threat to your ideal sale timeline? Tax policy.

Capital gains taxes, depreciation schedules, and small business tax incentives can shift with the political winds. What looks like a good deal today could become far less attractive tomorrow—either to you, the seller, or the buyer. For example, if capital gains taxes increase, your net take-home from the sale could be substantially reduced unless you close before the new rule takes effect.

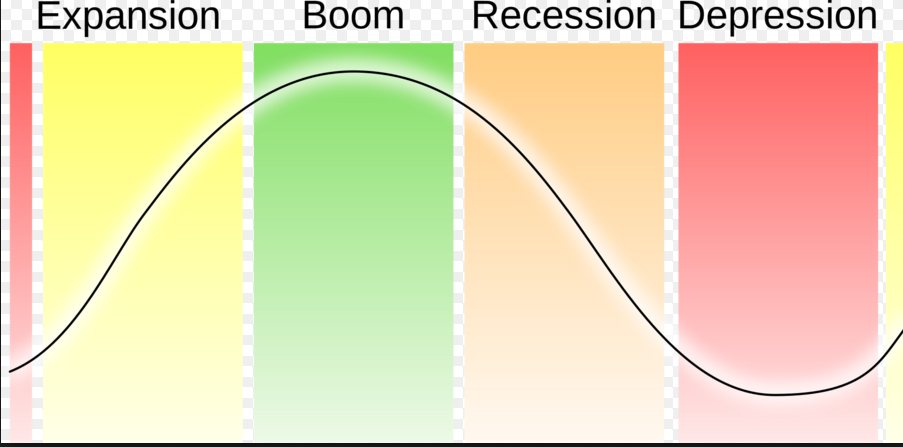

5. The Economy Doesn’t Care About Your Plans

A recession. A supply chain crisis. An unexpected war or pandemic.

If we’ve learned anything over the past decade, it’s that the global economy is more interconnected—and more unpredictable—than ever. Waiting too long to sell puts your business in the crosshairs of economic forces that could shrink customer demand, raise input costs, or damage your margins. All of which reduces the attractiveness of your business to potential buyers.

Bonus Threat: The AI Disruption Factor

If your business relies on organic traffic or content marketing, you should also be paying attention to how artificial intelligence is transforming SEO. With search engines like Google and Bing using AI-powered summaries in their results, users are less likely to click through to your website. This is already leading to a decline in organic traffic and could negatively affect customer acquisition and valuation metrics.

For more on how AI is changing SEO and reducing website traffic, check out this In Kieran Flanagan’s YouTube video, where he walks through what many marketers have been dreading for some time.

What Sellers Should Do Instead

If you’ve made the decision to sell, the time to act is now—not later.

Here are some proactive steps to take:

- Engage a business broker or M&A advisor immediately to start lining up qualified buyers.

- Prepare your financials and operations for due diligence to ensure the process doesn’t drag on.

- Set a timeline and sales process instead of “waiting to see what happens.”

- Create a list of factors that could erode value, and work to mitigate them early.

- Be flexible and responsive when buyer interest comes—speed is your ally.

The Bottom Line

Selling a business is often an emotional decision, but once the choice is made, hesitation can be your biggest risk. Every day you wait is a day the market might turn, interest rates might climb, or a competitor might innovate past you.

Don’t leave your future up to chance. The faster you move after deciding to sell, the more control you have over the outcome.

Are you doing everything you can to sell your business before time erodes its value?