Many business owners I work with dream of landing a “whale”—that one major client who can transform their revenue overnight. The logic goes something like this: “Since it takes effort to land a customer, why not make it worth it by going after a few large ones instead of lots of small ones?”

It seems like sound thinking at first glance. After all, less admin, fewer customer service hours, and larger invoices sound pretty great. But in reality, chasing and depending on big clients can undermine the long-term health of your business. Let’s explore why.

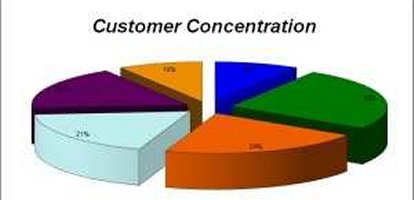

Risk Concentration: When One Loss Wrecks Everything

The most obvious danger of having a few large clients is that if one leaves, you’re in trouble. But it’s hard to fully appreciate the consequences until you live through it.

I’ll never forget what happened in the third year of running my documentation and training company. We had built up $2.5 million in annual revenue when we landed a $1.2 million contract—our biggest win yet. At the time, we felt like we had made it.

With the new client on board, we leased bigger office space, invested in new equipment, and hired 10 employees. Then, midway through the contract, the client was acquired and abruptly canceled the project. That single event decimated our cash flow. The lease, the equipment, the salaries—those fixed costs didn’t go away just because the revenue did.

Without the safety net of a diversified client base, our business was bleeding money. It took a lengthy and expensive legal battle to win a settlement that ultimately saved the company. But the experience left scars—and a clear lesson: no one customer should ever account for more than 10% of your revenue.

Margin Squeeze: Power Shifts in Price Negotiations

Another hidden downside of large customers is how much power they wield over your pricing. The bigger they are, the more they know it. Large clients often demand volume discounts and special terms. They’ll leverage their size to negotiate better rates, putting pressure on your profit margins.

This kind of margin squeeze reduces the profitability of your business. And here’s the kicker—it also makes your business less valuable to investors, potential buyers, and even lenders. A company with slim margins and revenue heavily concentrated in just one or two clients is seen as a high-risk proposition. Investors worry about volatility, buyers see limited upside, and lenders may hesitate to extend credit, fearing the business lacks stability. This risk perception lowers your valuation, restricts your borrowing power, and significantly limits your future growth options.

Smaller Clients, Bigger Stability

The healthier approach is to spread your revenue across many smaller clients. Yes, it’s more work to manage 10 clients than 2, but the benefits are substantial:

- Risk is distributed. Losing one client won’t put you out of business.

- Margins are typically higher. Smaller clients don’t have the leverage to demand steep discounts.

- Your business is more agile. You can pivot, adapt, and grow without being held hostage to one client’s demands.

Even more important, when you diversify your customer base, your business becomes more resilient—able to weather economic shifts, leadership changes at a client company, or shifts in industry regulations.

A Better Path to Growth

Instead of going after whales, focus on building a steady stream of viable customers—clients who value your service, pay fair prices, and stay loyal over time. You can always use the capital and stability from many smaller accounts to eventually go upstream and service larger contracts from a position of strength.

And if you do decide to pursue a large client? That’s fine—but only once you’ve built a solid base that can absorb the blow if things go south.

What percentage of your revenue comes from your top customer? From your top three? If any one of them walked away tomorrow, would your business survive the shock? If not, it’s time to rethink your strategy and build a more balanced, diversified client portfolio.