EBITDA is an acronym for Earnings Before Interest, Taxes, Depreciation, and Amortization. The EBITDA Appraisal Method attempts to remove all the factors that are viable from one owner to the next in privately held businesses. That said, the EBITDA Appraisal Method is most often used for public companies where their enterprise value can be computed.

In privately held businesses, one owner may have to borrow money while the next may pay in cash. Therefore, interest on the debt is removed as a consideration. Likewise, since taxes for any business other than a C-corp can vary based on the owner’s tax bracket, taxes are removed to determine a common earning capacity. Since new depreciation and amortization values will be established after the sale, they too are removed. The EBITDA Appraisal Method is often used to appraise the value of larger businesses than those appraised with the Rule of Thumb Appraisal Method. However, similar to the Rule of Thumb Appraisal Method, the resulting earnings are calculated using the EBITDA Appraisal Method and then multiplied by some value based on comparable companies in that industry based on their earnings numbers.

The EBITDA Appraisal Method is used for many industrial and consumer industries, but not for banks, insurance, oil & gas, or real estate businesses. These industries do not use the EBITDA Appraisal Method because they have extenuating circumstances that affect their value. For these industries, the range of the earnings multiple is adjusted based on the business’s market dominance, lack of stock liquidity if they are private, any long-term debt, and of course risk. Generally, the bigger the company, the less risk there is and the higher a multiple they can command.

When it comes to public companies, you can often see valuations of 20-30 times EBITDA. However, this is generally not the case in privately held companies. One of the reasons for the higher multiple of public companies is size and liquidity. Since the stockholders of public companies can easily buy or sell their stocks, they have more liquidity. In comparison, the buying and selling of stocks are not very easily done with private companies.

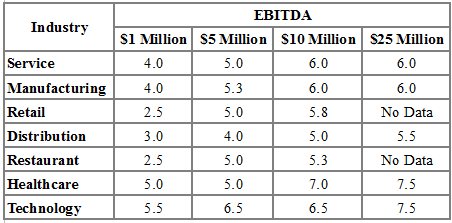

The following table is an estimate of the EBITDA multiple by industry and size.

Does the EBITDA Appraisal Method apply to your business or to your acquisition target?