There is a very disturbing historical correlation between the causes that contributed to the 2007-2008 Financial Crisis and the current state of digital advertising. If your business is monetized by ad revenue or uses digital ads to drive traffic to your business, you should take note of the unstable nature of advertising and not get blindsided when the digital marketing bubble bursts.

Some very useful parallels can be drawn between the causes of the financial crisis and the current path of digital marketing, also known as the Attention Market. Many businesses and websites rely on ads to drive revenue. Just imagine a new world where digital ads were not the go-to source they are today. How would you survive in this new world? The world of digital advertising as we know it is very unstable and at the brink of collapse unless some fundamental changes occur soon. The wise business owner is encouraged to develop a plan B in the likely event that the digital marketing bubble bursts.

A Brief History of the Financial Crisis Of 2007-2008

In the old days, banks made loans to customers they knew intimately well. They issued mortgage loans only to people who could repay the debt and often serviced the debt for the life of the loan.

In 1981, Fannie Mae issued its first mortgage pass-through, called a mortgage-backed security.

Mortgage-backed securities are a financial instrument where a group of individuals, such as Freddie Mac and Fannie Mae, or investment banks, aggregate a bunch of mortgages into a security or package that is then sold to investors. Payments made by the borrower or homebuyer are passed through to the security holder or investor of the mortgage-backed security.

Since buyers of mortgage-backed securities were not able to examine the underlining quality of mortgages that made up the security, the issuers began to divide up mortgages based on risk levels known at tranches. This special type of mortgage-backed security based on tranches, that categorize mortgage-backed securities by risk level, are known as Collateralized Mortgage Obligations or CMOs and are sold as securities on the secondary market. CMOs were comprised of mortgages representing various levels of risk of debt repayment and were offered to investors with increasingly higher interest rates to offset the higher-level risk of default.

Investors felt that the risk associated with mortgage-backed securities was small since the securities were backed with hard assets in the form of real estate, and their appetite for them grew. As the demand grew, banks were pressured to lower their thresholds to be able to feed the market’s appetite for more mortgage-backed securities.

Banks started to grant mortgages to borrowers with low credit ratings and a higher-than-average risk of defaulting on loans. These were known as subprime mortgages. Lenders charged much higher interest rates to compensate for the risk, which was sorted into tranches and packaged as mortgage-backed securities that pay even higher returns. The higher returns offered by many mortgage-backed securities, compared to government securities, fueled the demand even more.

The fever continued to grow, and banks started offering adjustable-rate mortgages, known as ARMs, to mitigate interest rate risk for the securities. Rating agencies were pressured to apply attractive ratings to these many mortgage-backed securities.

Soon, banks started offering interest-only loans with a balloon payment to cover the unpaid principal so the borrower had lower payments and did not have to worry about paying the principal for several more years. Since real estate values continued to escalate, many borrowers thought that when the balloon payment came due, the property’s equity would be there to cover the loan’s principal. As the fever grew, some lenders even began to offer negative amortization loans, where even the unpaid interest was tacked on as an additional principle to be covered when selling or refinancing. Mortgages were given to speculators and individuals who were in no position to make sustained payments.

Then the housing bubble POPPED!

Home prices started to drop, leading to more mortgage delinquencies. Borrowers with little or no skin in the game walked away from their debt, causing the banks to foreclose on the properties. Mortgage-backed securities were devalued, and investors were held holding the bag as the bottom dropped out of the market.

A significant contributing factor to the financial crisis was the fact that the underlying quality of mortgage-backed securities could not be evaluated directly by the investor. The investor had to rely on the word of the rating agency as their only means of evaluating the quality of the investment. Moreover, the deflated value of the securities created a crisis of confidence that sent ripples throughout the entire financial system, leading to the financial crisis of 2007-2008.

The History of the Modern-Day Attention Market

In the old days, there were content providers like newspapers and TV stations and businesses that wanted to rent the eyeballs of their audience by placing ads with them. It was a simple yet symbiotic relationship. Businesses that ran ads had data about the content providers’ audience size and demographic, and once an ad was placed, it was easily verified.

Even though the Internet was birthed into existence in the 1960s, it was not recognized as a content provider worthy of capturing ad dollars until 1994, when AT&T became the first company to pay a website $30,000 for the first banner ad.

The Internet continued to evolve as a free tool for users, much like network TV, because businesses were willing to monetize content providers (website owners) with ad revenue. In the early days of the Internet, businesses wishing to advertise and content providers who owned the eyeballs based on their content directly negotiated prices for ads, just like newspapers and TV stations. Ad placements were specific, deliberate, and verifiable in this model.

Over time, the Internet took on a more prominent role as the purveyor of content. Recognizing the trend, businesses started to direct more of their ad budgets to digital marketing at the expense of more traditional marketing. As more ad dollars started to flow into the digital marketing space, it encouraged more content providers to come online, expanding the number of ad placement options for businesses. It didn’t take long for businesses looking to advertise to start feeling overwhelmed by their options.

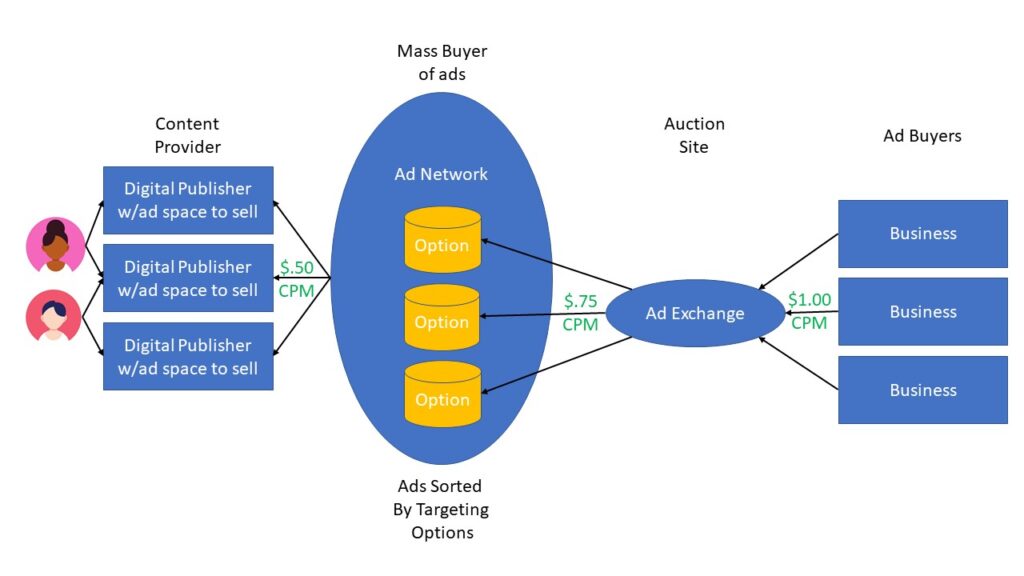

To overcome the problem of dealing with an overwhelming number of ad placement options faced by businesses, the digital ad network emerged. Ad networks emerged as a way to help advertisers buy ads from the growing number of websites, making it no longer necessary for a business to directly work with every content provider. Ad networks existed to buy ad space from thousands of content providers and sell them to businesses looking to advertise. Ad networks acted as a middleman in brokering ads between ad buyers and an ever-growing number of content providers. While ad networks eased the pain that businesses were experiencing locating and managing ad placements, they also reduced the transparency of the process and made businesses more reliant on the word of the ad networks.

Ad networks also offered a very different value proposition for the business looking to advertise. Rather than leaving the targeting problem to individual businesses, who had to choose the content providers to place their ads, ad networks promised to deliver ads to the business’s ideal customer.

This was a significant pivot in terms of how ad placements were selected. Ad networks chose where to place ads not by the type of content as businesses were used to, but by user attributes such as age and gender. This meant that the business was no longer able to know where the ads they paid for would appear. The lack of transparency from businesses about their ad placement was mitigated by ad networks, promising that ads would only be delivered to the ideal customer, making the process more efficient through better targeting.

The promise that ads could be delivered to the ideal customer was an attractive alternative, especially to small business owners who could not afford to buy ads in national newspapers and magazines, prime-time TV commercials, or radio spots like big advertisers could. The problem was that the business was no longer able to know where the ads would appear since it was based on the user and not the content provider.

While ad networks acquired ad space from content providers, they needed a better way to sell this space to businesses, and ad exchanges were born. While ad networks codified their ad inventory through targeting options, ad exchanges used demand-side economics to establish ad pricing based on consumer behavior, time of day, device, and even ad position. Ad exchanges created real-time auctions based on competition and availability to dynamically establish ad costs.

Selling and buying programmatic ads using ad exchanges is very different from directly buying ads associated with traditional marketing on TV, newspapers, billboards, etc. Ad exchanges added an additional layer between the business and the content provider, further reducing the transparency of the flow of ad dollars.

Confidence in the entire premise of digital marketing is now being questioned by many industry experts. According to Dr. Alessandro Acquisti, a Professor of Information Technology and Public Policy at Heinz College, Carnegie Mellon University, “It is unclear that data-driven targeted ads produce significant results.”

Nico Neumann, assistant professor and fellow for the Center of Business Analytics at Melbourne Business School, said in a recent presentation at programmatic I/O that audience targeting and AI-driven campaigns undermine brand growth. He argued the targeted ads cost more, but their performance does not justify the cost difference.

Experts share that data attributed to the success of targeted ads does not take into account that, in many cases, the people who received the ads would have more than likely bought the product or service anyway.

Recently, the bottom line suggested by many business analytics experts is that the data used in targeting is often inaccurate, as are the underlying algorithms used to tailor ads to the user and determine pricing. Therefore, the old spray-and-pray approach of traditional marketing often creates a better return on ad investment.

Added to all of the systemic issues with digital marketing are three additional factors that create additional headwinds and a lack of confidence that digital marketing will continue to produce the desired results.

One is Ad Blindness, i.e., the fact that visitors to a website consciously or unconsciously ignore information in the form of banners.

Two is the rapid rise in Ad fraud. Ad fraud affects not only banner ads but also click-through ads as well.

And three, content providers who rely on digital ads for their own revenue are reluctant to accurately cover the systemic issues associated with digital advertising and the growing lack of business confidence in digital marketing.

Taken as a whole, digital marketing is beginning to show real signs of suffering from a crisis of confidence that will likely change the nature of the Internet the same ways that the crisis of confidence in mortgage-backed securities led to the global financial crisis.

Comparing Financial Markets to Attention Markets

| Financial Markets | Attention Markets |

| Originally, mortgages were issued directly to borrowers who knew each other and often serviced the loan throughout its life. | Originally, ad space offered by content providers was offered directly to businesses and negotiated in person. |

| The financial crisis occurred when investor appetite for mortgage-backed securities caused the value of the underlining security to decline to meet demand. | The impending crisis in the attention market began when the appetite for digital ads led to too many options and businesses were forced to accept a new value proposition of targeted ads offered by ad networks and ad exchanges. |

| To compensate for the variability in the quality of the mortgage-backed securities, tranches were used to sort securities into groups, and ratings were assigned based on risk and sold on the secondary market. | To compensate for the variability in content providers and user demographics, targeting options were used to sort sites and users into groups, and prices were assigned based on real-time auctions and sold on the secondary market. |

| Rating agencies were complicit in not assigning appropriate risk levels to securities due to industry pressure. | Content providers that rely on income from ads have no motivation to accurately cover the systemic issues associated with digital advertising. |

| The transparency of the actual quality of the securities continued to erode as layers of complexity were added. | Transparency of the actual ad quality and presentation continues to erode as ad networks and ad exchanges become more complex. |

| This led to a crisis of confidence in mortgage-backed securities, causing devaluations that spread across the entire global financial markets. | The growing crisis of confidence in digital advertising to ensure a return on investment will cause businesses to reduce digital ad dollars spending, which will spread across the entire Internet. |

Conclusion: Alternative Internet and Digital Marketing

If businesses continue to lose confidence in digital marketing and there is a serious reduction in digital ad spending, the Internet as we know it will be rocked to its core. Many content providers will cease to receive sufficient revenue from ads to continue to exist in their present form as free products. Thousands of websites dedicated to news, opinions, and entertainment that currently provide free content will either cease to exist or exist behind a paywall, much like cable TV today. Much of the freely accessible knowledge that has been accumulated throughout the Internet, such as this blog, that users rely on to learn and discover new things, will evaporate and be lost forever when there is no more money to support their continued existence. The majority of websites that will remain will be big brands, eCommerce, and review sites that generate revenue, not from ads but directly from sales.

Do you have a plan B for when the digital marketing bubble bursts?