The following article was written by Tuck Aikin, a former colleague of mine, several decades ago, but it is as true today as it was then. I hope you enjoy it.

“So why do you want to start your own business?” we ask, and invariably the answer is the same: “Oh, so I can be my own boss, answer to no one but me, and uh…(if they’re honest) get rich!”. After pointing out that operating your own business doesn’t mean you have no boss – you just exchange the old one for two new ones, the marketplace, and your business – we explore their definition of being rich. “You know,” they say, “driving a new foreign luxury car, living in a big house on the side of Cheyenne Mountain, having nice clothes, an expensive watch, traveling when I feel like it, belonging to a country club.”

Then, somewhere during our hour of counseling, we find that the new business aspirant has almost no money with which to start their desired business, and they often have minimal or no equity in their home that they can use as security to borrow their required initial startup funding, despite having earned a comfortable income for the past several years. This comes as no surprise to us. The counselee we conclude is a UAW – an Under Accumulator of Wealth, a term devised by Thomas J. Stanley and William D. Danko, Ph.D.’s, who wrote the best-selling book The Millionaire Next Door.

Related Post: This Is Why Many People Should Never Be Entrepreneurs

Why do we know this about our wannabe business owner? Actually, it’s pretty easy – our counselee possesses the common, accepted view of “the rich” and has for years probably been imitating what he thinks rich people do, living a high lifestyle often beyond his means. Unfortunately, these beliefs and behavioral traits automatically make our ward unsuitable for business ownership.

Why is this particularly in light of the fact that Stanley and Danko’s research has determined that a disproportionately high percentage of the 3.5 millionaires in the U.S. are small business owners? Simple. Business ownership requires the same personal attributes that are essential to becoming financially independent (wealthy): a lifestyle of hard work, perseverance, planning, and, most of all, self-discipline.

In fact, the wealthy shun displays of their financial success. According to Millionaire, a typical wealthy American is “…a businessman who has lived in the same town for all of his adult life…owns a small factory, a chain of stores, or a service company…has married once and remains married…lives next door to people with a fraction of his wealth…is a compulsive saver and investor, and has made his money on his own. Eighty percent of America’s millionaires are first-generation rich…and have inherited nothing…”. In addition, wealthy Americans live well below their means, believe that financial independence is more important than displaying high social status, are proficient in targeting market opportunities, and have children who are economically self-sufficient. Quite a contrast to the accepted media view, isn’t it?

Think about it this way: Business cycles always include downturns, and unless money has been socked away for that rainy period (instead of pulling it out to maintain a high lifestyle), failure is almost certain. Business opportunities, too, require funding, and unless there’s cash in the bank, there’s virtually no way to take advantage of such events. In fact, Stanley and Danko report that most successful (wealthy) business owners like business downturns because they know that the undisciplined, high-consumption lifestyle of their competitors makes them weak, and they’re always the ones whom the marketplace weeds out during tough times. That leaves the field open for disciplined firms when the economy turns up, and they often experience rapid growth and healthy profits in the upsurge.

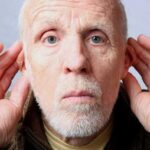

So, look in the mirror. If you aspire to show off your apparent wealth as a business owner, consider a different occupation. Go to Hollywood.

Tuck Aikin was a former SCORE colleague of mine for many years until his retirement. Tuck is a prolific writer and wrote small business-themed articles for the Colorado Springs Gazette for many years. As a co-mentor, Tuck was my inspiration for me starting this blog. The preceding post is reproduced with permission from the author.