One of the most common questions I ask new clients is what makes them unique or different. I share that if their business is just like everyone else’s in their industry they will be viewed as a commodity. Because commodity businesses compete on price, it will mean low or often negative margins, especially for a new small business. I explain that unless they have a war chest full of cash and a desire to fight for scraps that there are better ways.

Instead of just following the crowd, I encourage them to look for ways to identify and appeal to users on the fringe, or to look for noncustomers that might benefit from their offering to find an uncontested market that similar businesses in their industry are ignoring.

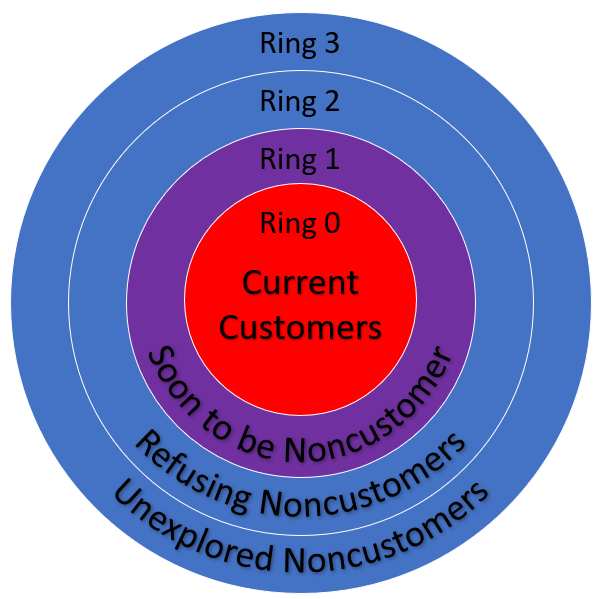

I begin by drawing a series of circles to create a bullseye on the board that I call the Customer Segment Bullseye Model.

Ring 0 – Current Customers

At the center of the bullseye, I add the label “0” and add that this is the red ocean where their competitors seek to find prospects, and where they focus their efforts at one-upping or one downing the competition to appeal to this existing customer segment.

I explain that because many small businesses are started by what I call the technical persona, most are not great at spotting new opportunities or dealing with industry changes. I add that by employing a different approach they can find customers that the completion is ignoring.

Ring 1 – Soon to be Noncustomers

The next ring I label as “1” and explain that in this ring resides customers that are currently using their product or service only because there is really no other viable or more attractive alternative. However, if a better option were to present themselves these customers would leave in a heartbeat.

To drive the message home, I use the example of Squareup.com.

For decades merchant accounts offered by banks were the only way to process credit card payments. These systems were designed for higher volume merchants and for years were the only viable credit processing option for a business on the market. Accepting credit card payments involved buying a point of sale terminal as well as paying for a host of fixed monthly fees such as Gateway, Statement, and PCI Security fees. These accounts also came with a required monthly minimum on charges. Moreover, there were discount fees based on the value of the purchase as well as transaction and address verification fees applied to each transaction. All these fees took a huge bite out of a small businesses margin and made the acceptance of credit cards a complicated process. However, if a business wants to accept credit cards they really had no other option.

Assuming that a business was a low volume business such as a pop-up shop, and accepting credit card payments was important to the business, it had no real choice but to accept these fees if it wanted to accept credit cards. However, using a merchant account credit card procession platform was not an ideal solution for the business. These businesses were always looking for a better alternative.

Businesses that grudgingly use ill-fitting solutions because there are no better options reside in ring 1.

Ring 2 – Refusing Noncustomers

The next two rings contain non-customers that I label “2” and “3”. In ring 2, your customers have researched your offerings but have chosen either another alternative or have just chosen to simply just do without it.

In our low volume pop-up shop business example above, the prospect would be in ring 2 if, in fact, they looked into opening a merchant account but decided after their research to just not accept credit cards. Perhaps the business might provide their prospects with directions to a nearby ATM instead.

Prospects who are currently non-customers but have the potential of becoming a customer if a few of the pain points were removed reside in ring 2.

Ring 3 – Unexplored Noncustomers

In this outermost ring exists prospects that could benefit from your offering but fail to consider your offering because they perceive it as irrelevant or out of their reach.

In our low volume pop-up shop business example above, the prospect would be in ring 3 if in fact they just assumed that merchant accounts were only for large retail businesses like Wal-Mart or Home Depot and were not an option for a small volume pop-up shop.

Prospects that are currently non-customers and are either not aware of your offering or who dismiss it as an option out of hand or feel it is inappropriate for their needs reside in ring 3.

Building an Uncontested Market

Building upon our pop-up example, Squareup.com saw the merchant account systems as an opportunity. Rather than accept the fact that credit card processing was a system offered exclusively by banks for large volume businesses, it recognized that there was an entire market of low volume business looking for a better credit card processing option.

Square introduced a reader which plugged into the audio jack of a smart phone and developed a phone app that it gave away to customers. Its simple plan with no monthly minimum or fixed expense and only a small swipe fee made its offering appeal to prospects in rings 1 and 2. Moreover, increased awareness brought about by the floodgate opening for prospects in rings 1 and 2 made prospects in ring 3 consider square as a viable option for their business as well.

By considering the buyer’s journey, Square was able to identify that there was an unserved market for a new kind of credit card processing system. It did not replace the credit card processing system offered by banks and used by the more traditional large volume business. Instead, Square located and created a new uncontested market.

Uncontested markets do not last forever and now there are many options including Stripe and PayPal that offer similar options. However, opening of the credit card process options to small low volume business also opened a new window to peer to peer electronic funds transfer applications like Venmo and Zelle.

In another example, Phillips Electronics Company, a producer of kitchen appliances, considered creating yet another deep fat fryer as it competed in its red ocean. Its options were to create a bigger fryer, a more expensive one with more features or a cheaper one with fewer features. However, it chose a different option. Rather than accept the red ocean for what it was, it chose to look for fringe and noncustomers to find an uncontested new market.

By studying these potential fryer consumers, they discovered that many potential consumers in ring 1 considered fried foods as not very healthy, were messy, were dangerous, and made the house smell. Therefore many consumers used then sparingly. In ring 2, they discovered potential customers that simply dismissed buying a deep fat fryer because of the hassle associated with dealing with them based on lack of frequent usage. And in ring 3 they identified potential consumers that just figured deep fat fryers only made sense for large restaurants and not for the consumer market.

So, rather than offer yet another red ocean deep fat fryer product, it introduced the air fryer that eliminated the pain points associated with oil-based fryers and created its own uncontested market.

When I meet with new business clients these days, I encourage them to explore the prospects journey and using the Customer Segment Bullseye Model, map out their market to aid them in spotting uncontested markets where they can offer a unique offering.

How can you use the Customer Segment Bullseye Model to leave your red ocean and find your own uncontested market?