Today there is no such thing as Job Security. Instead, ask how you can create Income Security.

I participate regularly on a panel at the Air Force Academy for veterans transitioning from active duty to the civilian workforce. On the day before my panel, participants are taught how to write a resume and how to network as a way to improve their odds of getting hired by an employer.

When I arrive at the end of day two for my piece of the program, I always look around the room at the many flip charts taped to the wall by previous presenters. One of those flip charts lists what the participants are most excited about in a post-active duty career and what they fear the most. Always near the top of the list of fears is “job security.”

When it is my turn to speak, my goal is to completely change the narrative. To make my point stand out and be memorable, I use a bit of mystery. I place a white ribbon across the table that separates my end of the table from the other panel members.

When it is my turn for introductions, I point to the ribbon and say, “The ribbon represents the difference between the far end of the table where the panelist’s role is to help you get a job, while my end is about creating a job(s).”

I then add that “Being an employee should be the last resort for income, not your first.”

Being a counter-argument to everything they have heard so far, many participants are caught a bit off guard by the statement.

I then add that “While you were on active duty, the civilian job market has changed dramatically, and the old rules that applied to employment are no longer valid.”

I share that “The narrative has changed from job security to that of income security” as I launch into how entrepreneurship or being self-employed is about income security.

According to a 2016 report, today’s jobs are no longer very secure.

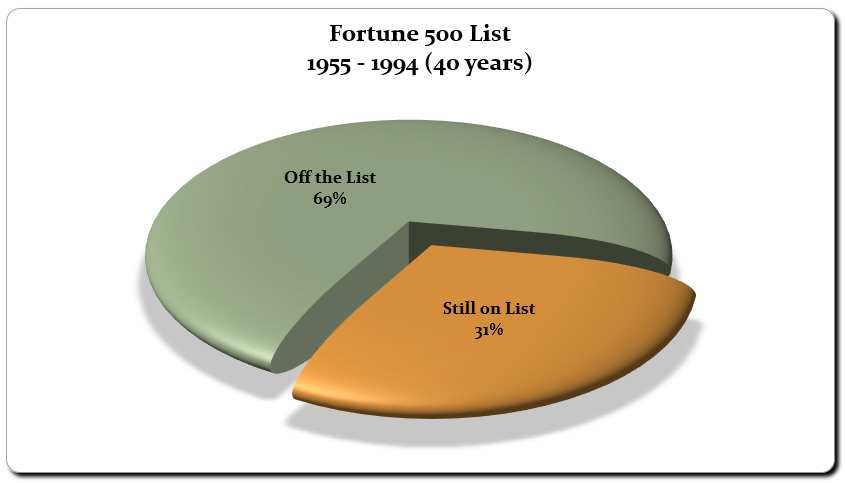

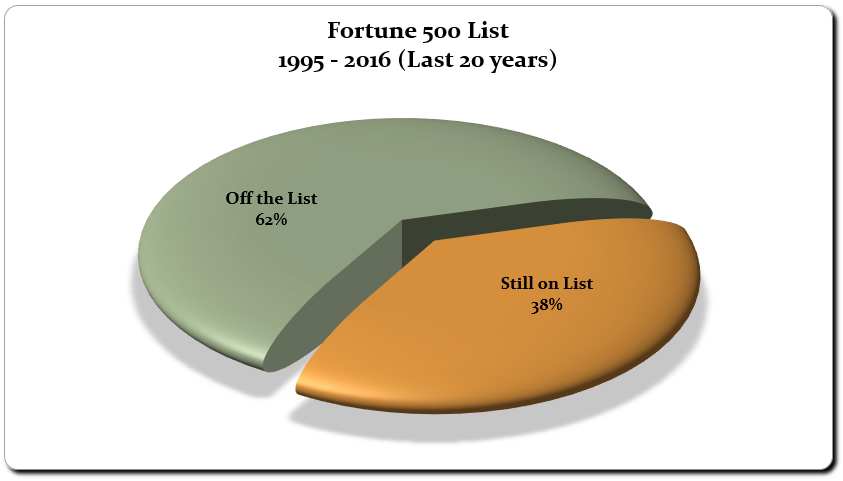

In fact, if you compare the numbers of companies that made up the Fortune 500 companies in 1955 with those today, which covers a span of 60 years, only 60 or 12% of the firms from 1955 are still on the list. In fact, the pace of Fortune 500 companies departing the list is accelerating at an ever more rapid pace in recent years.

If you compare the list of Fortune 500 in 1955 to 1994, or the first 40 years, only 153 firms of the 500 remained. Said another way, 347, just shy of 70%, fell off the list in the first in 40 years.

If you look at just the last 22 years, from 1995 to 2016, only 188 firms remain on the list, and 312 are gone. If you do the mental math, that means that more than 62%, or just shy of 2 in 3 of the firms on the Fortune 500 list in a span of just 22 years, are no longer on the list.

Turnover at blue-chip Fortune 500 firms is accelerating as new technology renders many of them irrelevant. Using the Fortune 500 list as a bell, weather evidence suggests there is very little chance that even if you work for a large Fortune 500, it is highly unlikely that you will do a career with a single company anymore as an employee. In fact, according to the Bureau of Labor Statistics, most people will change jobs or careers over 10 times in their working life. That does not bode well for job security. In many cases, that job with a company will end with a layoff at a time when it may not be very good for you.

One often cited reason for working for a larger company is the benefits. However, corporate benefits are shrinking too. Fewer companies other than the government provide a pension or defined benefit retirement package. Even fewer companies are providing health care coverage for employees, and if they do, much of the costs are being passed along to the employee in the form of higher monthly premiums, deductibles, co-pays, and co-insurance plans.

As I shared in Are Large Corporations Past Their Prime, the days of the large corporation are reaching their twilight.

Let’s consider the taxicab industry. Drivers were once employees of a taxi company, but today there are Uber and Lyft, who are essentially freelancers. Even large institutions such as colleges and universities are changing from tenured professors to adjunct professors. The evidence of these changes is everywhere.

With the rapidly changing business landscape, companies that are beholden to their shareholders and not their employees are shifting their risk from the business to the employee. It used to be that as an employee of a Fortune 500 company, you had little risk of losing your job. In fact, when I worked for Digital Equipment Corporation after I transitioned out of the Coast Guard, their big selling point was that I would have a job for life. That all changed when their market evaporated, and they were acquired, and with realignments, there were mass layoffs flooding the local markets with talent that made it hard for even the most qualified to get re-employed.

In the old days, the company bore the lion’s share of the risk. If the company did poorly, the employee still got a paycheck, while the company and the shareholders absorbed the losses. This is no longer the case. With the rapid changes in business fortunes and the emerging gig economy, that risk is being pushed to sub-contractors.

As I continue my narrative about income security vs. job security at the Air Force Academy, I ask the room, “How many have a stock portfolio of some kind.” Nearly every hand goes up.

Then I ask, “Are you invested in the shares of just one company or in many companies”.

They all respond in unison, “Many.”

I follow that up with “Why”

and they recite “Diversity”.

At that point, I make a gesture to scratch my head and ask in my best Columbo impression, “Why does it make sense to derive the vast majority of your income from a single source, a job, but for your portfolio income, you want diversity?”

At that point, I can almost see the light bulbs above their heads light up.

Today we live in a world of rapid change. As a result, shareholders are demanding that corporations pass along more of the business risk to employees and sub-contractors. Today, the prospect of long-term employment is less secure than ever and getting worse every year. Moreover, the traditional reasons for working for the man or the woman, such as benefits, are losing traction.

Just as with our investment portfolios, to mitigate personal risk, people should diversify their portfolio and invest in securities across a range of different industries and even countries, so you too should consider diversifying your income stream from relying on a single source, your job, to multiple sources of income from a host of different customers by becoming a business owner or self-employed.

Are you more focused on job security or income security?