When you’re getting ready to sell your business, it’s easy to think all buyers are looking at the same thing: your bottom line. But in reality, buyers fall into two very distinct camps—financial buyers and strategic buyers—and knowing which type you’re dealing with can mean the difference between a decent exit and an incredible payday.

Related Free Course: Buying or Selling a Small Business

Financial Buyers: Focused on the Numbers

Financial buyers are your classic investors. Their decisions revolve around one main factor: earnings. They look at your past performance but buy based on the expected return on investment (ROI). These buyers might be individuals acquiring a lifestyle business or, more commonly in larger transactions, private equity groups, venture capital firms, or high-net-worth individuals.

What they care about most is:

- Consistent cash flow

- Clean financial records

- Potential for growth based on operational efficiency

- Return through resale or IPO

For example, if your business nets $300,000 annually, a financial buyer might offer a multiple of that income—say 3x, making their offer around $900,000. Their goal is to buy, optimize, and potentially resell at a higher valuation.

Strategic Buyers: Seeing Value Beyond the Numbers

Strategic buyers—sometimes called synergistic buyers—are playing a different game. Sure, they’ll glance at your past earnings, but what they’re really interested in are intangible assets that fit into a broader vision.

This includes things like:

- Access to new markets

- Proprietary processes or technology

- Loyal customer base

- Key personnel or location

- Brand equity

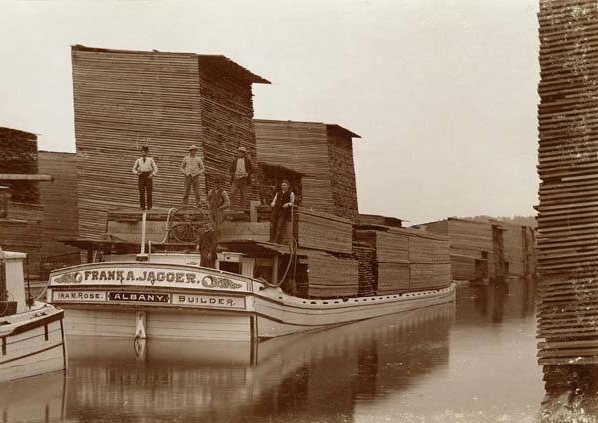

Let’s take the lumber yard story I learned about when selling my first business. On the surface, the business was in decline. A financial buyer would have passed—or lowballed the offer. But a strategic buyer looked past the lumber and saw the gold: a deep-water dock on the property. They had no intention of selling two-by-fours; they needed access to water for an entirely different venture.

Strategic buyers might include:

- Competitors looking to consolidate market share

- Suppliers wanting to move downstream

- Customers aiming to vertically integrate upstream

- Foreign companies trying to gain a foothold in a new geographic region

Why It Matters

The buyer type dramatically affects your valuation, your negotiation strategy, and your exit plan.

- Valuation: Strategic buyers might pay a premium well above financial valuation because they’re buying potential synergies or long-term strategic advantages.

- Negotiation: With financial buyers, negotiations tend to center around multiples, EBITDA, and ROI. With strategic buyers, it’s about aligning visions and future potential.

- Exit Planning: Understanding who your ideal buyer is can help you position your business appropriately. If you’re targeting a strategic buyer, emphasizing operational intangibles like customer data or proprietary logistics might seal the deal more than clean financials.

How to Spot the Buyer Type Early

Ask the right questions during initial conversations:

- “What drew you to this business?”

- “How do you envision the first year post-acquisition?”

- “Are you currently operating in this industry?”

- “What role do you see me (the seller) playing after the sale?”

Their answers can clue you in. A financial buyer might focus on efficiency and margins, while a strategic buyer might talk about integrating teams, entering new markets, or acquiring intellectual property.

Don’t Leave Money on the Table

Too often, sellers make assumptions. They assume a failing business can’t be sold for much—or that a booming business will always fetch top dollar. But if you don’t understand who is buying and why, you may underprice your business or overlook powerful selling points.

So, can you tell the difference between a financial buyer and a strategic buyer? Your ability to do so might just unlock more value than you ever expected.