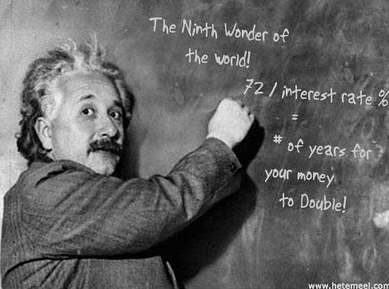

The Rule of 72 is a simple mental math formula that helps you figure out how long it will take to double your money based on a fixed annual interest rate or investment return. The formula is straightforward:

Time (Years) = 72 ÷ Interest Rate (%)

For example, if you’re considering an investment that earns a 10% annual return, divide 72 by 10. The result is 7.2 years. That’s how long it will take to double your money at that rate. If you expect a 6% return, divide 72 by 6, and you’ll get 12 years.

This rule gives you a quick and intuitive way to evaluate the growth potential of various investment opportunities—without needing a spreadsheet or financial calculator.

A Real-World Example: The S&P 500

Let’s take a look at how the Rule of 72 plays out with real numbers from the stock market.

In March 2009, during the depths of the financial crisis, the S&P 500 hit a low of around 676 points. Fifteen years later, by March 2024, the index had climbed to approximately 5,254 points.

That’s nearly an 8-fold increase. To understand what that means in terms of doubling, here’s how it breaks down:

- 1st doubling: 676 → 1,352

- 2nd doubling: 1,352 → 2,704

- 3rd doubling: 2,704 → 5,408

So the index doubled about three times in 15 years.

Now let’s figure out how long each doubling took:

15 years ÷ 3 doublings = 5 years per doubling

Using the Rule of 72, we can calculate the average annual return:

72 ÷ 5 = 14.4% per year

That means the S&P 500 returned approximately 14% annually over that 15-year stretch—a solid performance by most standards. And it helps illustrate how powerful long-term investing can be, especially when compounded over time.

Investing in a Small Business

Investing in a private business involves more risk than putting money into a diversified stock market index like the S&P 500. As such, smart investors often demand a higher return to justify that risk and lack of liquidity.

Let’s say you expect an 18% return from a small business investment. Using the Rule of 72:

72 ÷ 18 = 4 years

So your money would double in about 4 years. If you’re targeting a return of 24%, it would double in just 3 years:

72 ÷ 24 = 3 years

Because small businesses are typically less liquid and more volatile than public companies, an 18% to 24% “hurdle rate” is often used by private investors to evaluate if the risk is worth the reward. Compared to the S&P 500’s historical average return of about 10–12%, this premium makes sense.

Related Post: How To Determine If Your Profits Justify Further Business Investment?

Why It Works: The Power of Compounding

The Rule of 72 works because of compound interest—a phenomenon where your returns earn returns, creating exponential growth over time. This is what makes early investing so powerful.

Even if the Rule is just an approximation (it’s most accurate for interest rates between 6% and 10%), it illustrates how critical the rate of return is to long-term outcomes.

Consider a 24% annual return:

- In 3 years: $1 → $2

- In 6 years: $2 → $4

- In 9 years: $4 → $8

- In 60 years: Over $1 million!

That’s why understanding how to estimate growth time is so valuable—it allows you to spot high-growth opportunities and avoid stagnating capital.

Everyday Ways to Use the Rule of 72

You don’t need to be a financial analyst to benefit from this rule. It’s helpful for a wide range of real-world scenarios:

- Comparing investments: A 6% CD takes 12 years to double. Is that good enough, or could your money work harder elsewhere?

- Evaluating debt: Owe money on a credit card with a 24% interest rate? Your balance could double in just 3 years if left unpaid.

- Setting business goals: Want to double revenue in 5 years? You’ll need to grow 14.4% annually (72 ÷ 5).

- Making retirement plans: Estimate how fast your retirement nest egg will grow based on your portfolio’s average return.

It’s also a great tool for solopreneurs or small business owners reinvesting profits. Ask yourself: Is that reinvestment doubling my value in a reasonable timeframe compared to other options?

Final Thoughts

The Rule of 72 gives you a quick, easy way to estimate when your money will double. It’s perfect for comparing investments, understanding growth potential, and setting return expectations—especially when time is the variable you care most about.

How long will it take to double your money?