When I sold my first company, I got a call from my business broker just before I was packing up to go home one night. He said that there was some interest in my business by a potential out-of-state buyer. He added they were a publicly traded company and wanted to fly out a team to conduct their due diligence on my business and make the offer in person. They wanted to see if my business was a good fit for them. When I asked my broker when were they planning to come, he said they wanted to come out the day after tomorrow because time was of the essence.

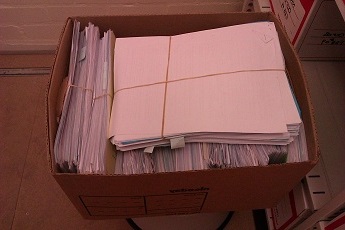

Had I not had a pretty comprehensive collection of due diligence materials beforehand, I would have been in panic mode. I had made copies of every contract, agreement, and three years of historical financial records. I also had copies of my minute books and other corporate governance documents. Finally, I had copies for 3 years of tax returns as well as policies, procedures, and personnel records. The list of documents was pretty extensive and nearly filled a copy paper box.

I learned later that the due diligence team was very impressed with the completeness of our preparation. Had I not had assembled all the information they were looking for, they would not have been able to complete the due diligence to meet their timetable and likely would have passed on the deal. As it was, my due diligence planning was a major factor in selling my first business.

The due diligence team consisted of their CEO, CFO, corporate lawyer, Marketing and Sales VP, and Human Resources representative.

- The CEO’s role was to determine if we were a strategic fit and if our acquisition worked with his vision.

- The CFO examined our finances. He sat down with our bookkeeper and CPA and performed a series of financial analysis to determine how our ratios compared with others in our industry.

- Then there was their corporate lawyer who reviewed all our contacts and agreements to look for potential liabilities.

- Next was their Marketing and Sales VP who grilled my team to determine our market potential.

- Finally, there was a representative from Human Resources who examined our employment and payroll records and spoke to some of our key employees.

When I sold another business, it was to a single high-net buyer. That sale was quite different as he performed much of the due diligence himself. That said, he took copies of a few documents and asked if he could share them with some of his advisers, including his CPA and lawyer. Here again, we presented the buyer with a complete collection of records, which certainly went a long way in convincing the buyer we had nothing to hide.

Your job as the seller is to establish a premium value for your business and close the credibility gap. Being prepared for the onslaught that is the due diligence analysis goes a long way to establish value and credibility.

I have an extensive list of due diligence items that we used when I was part of a public company and we needed to look at acquisition targets. This list is available under “Resources” on SteveBizBlog.com. While the list is over the top for most due diligence process, it’s an exhaustive list of the items that may affect the buyer.

Are you prepared for a due diligence inspection of your business?