Pricing can feel like walking a tightrope for small business owners. Raise your prices too high, and customers may go elsewhere. Lower them too much, and your margins might fail to sustain your business. This delicate balance is where price elasticity of demand (PED) becomes your compass. Understanding how customers respond to price changes can transform how you price your products or services, leading to smarter strategies and more profitable decisions.

Let’s dive into the price elasticity of demand, unpack its nuances, and explore a real-world example—my experience as an Invisible Fencing dealer—to see how pricing experiments can teach invaluable lessons.

What Is Price Elasticity of Demand?

Price elasticity of demand measures how sensitive customers are to price changes. In simple terms, it asks: If I raise or lower my prices, how will my customers react?

Elastic Demand

- Definition: Demand is considered elastic when a small change in price leads to a significant change in the quantity demanded.

- Key Characteristics: Customers are highly sensitive to price changes.

- Example: Luxury items, such as designer handbags or gourmet desserts. If prices rise, many customers will opt out or find substitutes.

Inelastic Demand

- Definition: Demand is considered inelastic when a price change has little to no impact on the quantity demanded.

- Key Characteristics: Customers are less sensitive to price changes.

- Example: Necessities, such as gasoline or life-saving medications. Even if prices rise, people will still buy these products because they’re essential and have few substitutes.

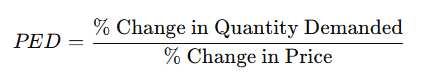

Here’s the formula for the math-minded:

- If PED > 1, demand is elastic, meaning customers are highly responsive to price changes.

- If PED < 1, demand is inelastic, meaning customers are less sensitive to price changes.

- If PED = 1, demand is unit elastic, where the percentage change in price equals the percentage change in demand.

Invisible Fencing: A Case Study in Price Elasticity

When I was an Invisible Fencing dealer, we sold a self-install kit for one dog, designed to cover a typical acre property, for $750. My direct costs to corporate were about $300, which covered the transmitter (installed in the garage), the dog’s receiver collar, and some additional margin for corporate’s national marketing campaigns, such as ads in Dog Fancy magazine. Additionally, I purchased the necessary wire locally for about $100, bringing my total direct costs to $400.

Corporate assured me that $750 was the “sweet spot,” which allowed for healthy profit margins while maintaining steady sales. However, I wasn’t entirely convinced. To test whether we could generate higher revenue, I decided to experiment with pricing for two months. Here’s what I discovered:

Lowering the Price: I reduced the price by $100 below the $750 recommended price for the first month, hoping to attract more customers. While I did sell a few more kits, the smaller gross profit margin per unit didn’t generate enough additional sales volume to compensate for the reduction in margin. For example:

- At $750, my gross profit per kit was $350.

- At a lower price, let’s say $650, my gross profit per kit dropped to $250.

Even though sales increased slightly, the total gross profit was lower because the increase in sales volume wasn’t sufficient to offset the reduced $100 profit per unit. This revealed that demand for the self-install kits was only moderately elastic—customers responded to the lower price, but not significantly enough to make the price reduction profitable.

Raising the Price: The following month, I increased the price by $100 above the $750 recommended price to test whether a higher gross profit per unit could offset a potential decline in sales volume. Unfortunately, the opposite occurred: demand decreased significantly, and the additional profit per kit wasn’t enough to compensate for the reduced number of units sold. This outcome demonstrated that demand for the self-install kits was price elastic at higher price points, meaning customers were highly sensitive to price increases.

Through these experiments, I learned that $750 was indeed the equilibrium price—the point at which revenue and profit margins were maximized.

Why Some Products Are More Elastic Than Others

Not all products behave the same way when prices change. The elasticity of demand depends on several factors:

Availability of Substitutes: The more alternatives customers have, the more elastic demand becomes. For example, with Invisible Fencing, if our prices increased, customers could choose options like a wood stockade or chain-link fence, narrowing the cost difference.

Necessity vs. Luxury: Products perceived as necessities—like gasoline or prescription medication—tend to have inelastic demand. Conversely, luxury items, like high-end tech gadgets or gourmet food, are more elastic because people can live without them.

Proportion of Income Spent: Price sensitivity increases when a product represents a significant portion of a customer’s budget. For my fencing kits, $750 was a substantial investment for most pet owners, making demand more elastic.

Time Frame: Elasticity can change over time. Initially, a price hike might not affect sales, but demand could become more elastic as customers find alternatives.

What My Experience Taught Me About Pricing

My pricing experiments with Invisible Fencing highlighted some key lessons about how businesses can apply price elasticity of demand:

Beware of Extreme Adjustments: Small price changes might reveal how sensitive your customers are without dramatically affecting revenue. In my case, the sharp drops in price and increases above $750 exaggerated the elasticity curve, making it harder to optimize profits. In hindsight, $50 price changes to test price elasticity of demand may have been more appropriate.

Value Perception Matters: Lowering the price of the kits didn’t just reduce margins—it also risked diminishing the product’s perceived value. Customers may associate higher prices with higher quality, especially for specialized products like Invisible Fencing.

Know Your Cost Structure: My fixed costs, of about $400, played a significant role in determining the profitability of each price point. However, since we were creating a new product category, I had to spend heavily on advertising just to get potential customers to understand what it was and why they needed it. Any price changes had to account for these expenses.

Segment Your Market: Elasticity isn’t uniform across all customers. Some might prioritize price, while others value quality or brand reputation. Offering tiered pricing or bundled packages can appeal to different customer segments without compromising overall profitability.

Applying Price Elasticity in Other Industries

Price elasticity isn’t just for Invisible Fencing—it applies to nearly every industry. Here are a few examples:

- Retail: Amazon constantly tests elasticity using dynamic pricing, adjusting prices in real-time to optimize revenue and stay competitive.

- Hospitality: Hotels and airlines charge premium rates during peak times when demand is inelastic and offer discounts during the off-season when demand becomes more elastic.

- Tech: Apple leverages inelastic demand when launching new products—fans are willing to pay top dollar for the latest iPhone, but demand becomes more elastic as the product ages and alternatives become available.

Strategies for Managing Price Elasticity in Your Business

If you’re a small business owner, here’s how you can leverage price elasticity to make smarter pricing decisions:

Test Incrementally: Instead of making large price adjustments, as I did, experiment with smaller changes to gauge customer reactions. For instance, try raising prices by 5% and tracking sales before making further adjustments.

Add Value Without Cutting Prices: Rather than lowering prices, consider bundling services, offering free perks, or highlighting premium features. This can make your product feel like a better deal without reducing margins.

Focus on Loyal Customers: Inelastic demand often comes from loyal customers who value your product’s uniqueness or quality. Investing in customer retention can make your revenue more resilient to price changes.

Monitor Competitors: If competitors drop prices, your customers may become more elastic and start seeking alternatives. Keep an eye on the market to stay ahead of pricing trends.

Final Thoughts

Understanding the price elasticity of demand allows you to predict how customers will react to price changes and adjust your strategies accordingly. My Invisible Fencing experiments taught me that price adjustments could have outsized impacts on both revenue and perception.

Before changing your prices, take a moment to assess how sensitive your customers might be to those changes. Finding the sweet spot where value, costs, and demand align can position your business for lasting profitability.

Are you ready to find your pricing sweet spot?