Recently, I read an article about the use of dynamic pricing in the fast-food industry, specifically Wendy’s decision to adopt this strategy and the controversy it generated. Dynamic pricing, which mirrors pricing models seen in transport and online retail sectors, involves adjusting prices based on supply and demand dynamics. Too often, dynamic pricing is perceived as negative and seen as just a way of price gouging the customer. However, if you strip away the negative veneer and look under the hood, you can see the true value of dynamic pricing in enhancing the customer experience, and it’s something every small business should consider for their industry.

I recall after the terrorist attacks on America on Sept 11th, 2001, I went to a local flag store the following day to buy a new American flag to show my support for the country. What I discovered was that the store was all out of America flags. Apparently, someone bought up their entire inventory of American flags and was now selling them on eBay for a 1000% markup.

When I was writing my book on Pricing Strategies, I included my flag store experience when discussing pricing for external factors. The unfortunate part of the story is that the flag store owner didn’t capture the price premium to place a new, larger order for flags to meet the high demand or use the extra margin to cover the cost of donating some flags to worthy individuals or organization to demonstrate his commitment to the community. Instead, a resourceful individual captured that margin and undoubtedly used it to fund his own personal consumption.

In the dynamic world of business, pricing strategies play a pivotal role in shaping consumer behaviors and ensuring a company’s competitiveness in the market. Among the plethora of pricing techniques, dynamic pricing stands out as a method of adjusting prices in real time based on various factors such as demand, competition, and even time of day. But what exactly is dynamic pricing, and how does it benefit both businesses and consumers?

Dynamic pricing isn’t a new concept. Its roots go back to the early days of commerce, where sellers would adjust prices based on factors like supply and demand. However, it wasn’t until the digital age that dynamic pricing truly came into its own. With the rise of eCommerce and advancements in computer technology, businesses have gained the ability to collect and analyze vast amounts of user data in real time. This enabled companies to implement dynamic pricing algorithms that could optimize prices on the fly.

Initially, dynamic pricing was mainly utilized by airlines and hotels, where demand fluctuates frequently, and the assets required, such as planes and hotels, were very expensive to produce and maintain. Rather than build a fleet to always meet peak demand, these industries used dynamic pricing to drive consumer behaviors. In this way, they could drive some customers from periods of peak demand to off-peak periods to maximize the utilization of their assets and avoid being forced to bump airline passengers or post no vacancy at hotels.

Let’s face it: an airplane only has so many seats, and in order to meet all consumer demand during the preferred days of the week – which are Monday, Friday, and Saturday – or to meet the preferred travel times of the day – mid-morning and late afternoon – an airline would have to purchase and operate more planes to meet demand during these peak times. Moreover, they would have lots of idle resources during low-demand periods such as mid-week and night, and all the extra assets would drive up ticket prices. Instead, airlines use dynamic pricing, charge more for travelers to fly on peak days and times, and use the extra margin to subsidize fares during traditional and off-peak times. The result is lower prices since assets are used most efficiently.

With dynamic pricing, consumers get to vote with their wallets. If you want more convenience in departure dates and times and can afford to pay more, such as when air travel is a business expense, pay the peak travel premium. In contrast, if the lowest price trumps convenience, as when you’re traveling to see family when retired, opt for a midweek departure or take a red-eye flight when airlines reposition their fleets.

However, as technology advanced and data became more accessible, dynamic pricing permeated other sectors. Today, airlines and hotels are not alone when it comes to dynamic pricing; concerts, car insurance, electricity, gas, Uber, and eCommerce retailers like Amazon all adjust their prices using the abundance of buying pattern data at their fingertips to predict what people are willing to pay at any given moment.

One of the key drivers behind the more recent widespread adoption of dynamic pricing is the advent of artificial intelligence (AI) and machine learning. These technologies enable businesses to analyze vast datasets and predict consumer behavior with unprecedented accuracy.

So, how does dynamic pricing benefit both businesses and consumers? At its core, dynamic pricing is about more than just maximizing profits; it is about driving consumer behaviors and ensuring that companies remain competitive in an ever-changing market landscape.

Benefits of Dynamic Pricing for Businesses

Businesses can benefit significantly from implementing dynamic pricing strategies. Here are some fundamental ways in which dynamic pricing can benefit businesses:

Maximizing Revenue: Dynamic pricing allows businesses to adjust prices in real time based on various factors such as demand, competition, and inventory levels. By optimizing prices to match market conditions, companies can maximize revenue by capturing additional revenue during periods of high demand and avoiding excess inventory during slow periods.

Increasing Profit Margins: Dynamic pricing enables businesses to identify pricing opportunities that can increase profit margins. By adjusting prices based on factors such as product popularity, seasonality, and customer segments, companies can optimize pricing to maximize profitability without sacrificing sales volume.

Responding to Market Changes: Markets are constantly evolving, and dynamic pricing allows businesses to react quickly to changes in market conditions. Whether it’s a sudden increase in demand, a competitor’s price change, or shifts in consumer preferences, businesses can adapt their pricing strategies in real time to stay competitive and maintain market share.

Optimizing Inventory Management: Dynamic pricing helps businesses optimize inventory management by adjusting prices to match supply and demand. By monitoring inventory levels and adjusting prices dynamically, companies can prevent stockouts, minimize excess inventory, and ensure that products are priced competitively to move inventory quickly.

Driving Customer Behavior: Dynamic pricing can be used strategically to influence customer behavior and drive desired outcomes. For example, businesses can offer discounts or promotions during off-peak times to encourage customers to make purchases when demand is low. Similarly, companies can implement pricing strategies that encourage upsells, cross-sells, and repeat purchases.

Improving Competitiveness: In competitive markets, businesses need to stay agile and responsive to changes in the market. Dynamic pricing allows businesses to remain competitive by adjusting prices in real time to match or beat competitor pricing. By continuously monitoring competitor prices and adjusting their own prices accordingly, companies can maintain a competitive edge and attract customers looking for the best value.

Overall, dynamic pricing offers businesses a powerful tool for optimizing pricing strategies, maximizing revenue, responding to market changes, and staying competitive in a dynamic marketplace. By leveraging data analytics, machine learning, and real-time pricing algorithms, businesses can unlock new opportunities for growth and profitability.

Benefits of Dynamic Pricing for Consumers

But perhaps most importantly, dynamic pricing allows businesses to serve their customers better.

While some may initially be wary of the concept, fearing that they will just end up paying more, the reality is often quite the opposite. Here are a few ways consumers can benefit from dynamic pricing:

Lower Prices During Off-Peak Times: Dynamic pricing allows businesses to adjust prices based on demand fluctuations. During off-peak times when demand is lower, companies may offer discounts or lower prices to attract customers. This means consumers can enjoy lower prices for products or services during periods when demand is typically lower.

Fairer Pricing: While some consumers may perceive dynamic pricing as price gouging, businesses often use it to maintain fair pricing in response to changes in market conditions. Fair pricing, also known as equitable pricing, is a strategy aimed at setting prices that are transparent, reasonable, and justifiable for both the business and the consumer. It involves considering factors such as market conditions, competition, and societal norms to ensure that prices reflect the value offered by the product or service while avoiding exploitative or discriminatory practices. Fair pricing fosters customer trust and goodwill, contributing to long-term satisfaction, loyalty, and positive brand perception.

Tailored Discounts and Promotions: Dynamic pricing allows businesses to offer personalized discounts and promotions based on individual consumer behavior and preferences. Companies can tailor discounts and promotions to match each consumer’s interests and needs by analyzing past purchases, browsing history, and demographic information. This can result in more relevant offers that provide genuine value to consumers.

Increased Availability: Dynamic pricing helps businesses optimize inventory management by adjusting prices to match real-time supply and demand. This means consumers are more likely to find the products or services they want, even during peak demand periods. Additionally, by adjusting prices dynamically, businesses can prevent becoming “sold out” or “fully booked” and ensure that popular options remain available to consumers.

Competitive Pricing: Dynamic pricing enables businesses to remain competitive by responding quickly to changes in pricing strategies adopted by competitors. By monitoring competitor pricing and adjusting their prices accordingly, businesses can ensure that consumers receive competitive prices and have more choices.

Overall, while dynamic pricing may initially raise concerns among consumers, it ultimately benefits them by offering lower prices during off-peak times, fairer pricing based on market conditions, personalized discounts and promotions, increased availability of products or services, and competitive pricing. By understanding how dynamic pricing works and its potential benefits, consumers can make more informed purchasing decisions and take advantage of the value it provides.

Overcoming the Challenge of Dynamic Pricing

Unfortunately, as alluded to earlier, dynamic pricing can sometimes be perceived negatively by some customers. Overcoming the negative association of dynamic pricing can be challenging, but with some planning and proper messaging, mitigating these concerns and building customer trust is possible.

Transparency is important when it comes to dynamic pricing. Small businesses should strive to be as transparent as possible about their pricing strategies, explaining to customers why their prices fluctuate and how they benefit from dynamic pricing. Being transparent can help alleviate concerns about price gouging and create a sense of trust and understanding.

Additionally, small businesses can implement strategies to make dynamic pricing feel fair and equitable to consumers by reframing the idea of raising prices during peak demand to offering discounts during off-peak periods. For example, offering discounts or rewards during off-peak times can incentivize customers to shop during these periods, balancing out the fluctuations in pricing. Similarly, providing clear and consistent pricing policies can help customers feel confident in their purchasing decisions.

Moreover, small businesses can leverage dynamic pricing as an opportunity to provide value to customers. For example, offering personalized discounts or promotions based on customer behavior can make customers feel appreciated and valued, fostering loyalty and repeat business.

Finally, communication is crucial. Small businesses should proactively communicate with customers about pricing changes and the reasons behind them. This can help to manage expectations and prevent misunderstandings, ultimately strengthening the relationship between the business and its customers.

While overcoming the negative association of dynamic pricing can be challenging, small businesses can take steps to mitigate these concerns and build trust with customers. By prioritizing transparency, fairness, and communication, small businesses can leverage dynamic pricing as a tool to drive growth and provide value to customers.

Executing Dynamic Pricing Strategies

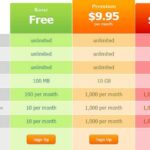

For small businesses, the concept of dynamic pricing might seem daunting at first glance. However, when it comes to implementing dynamic pricing, companies have access to a range of software tools designed to streamline the process and maximize effectiveness.

These dynamic pricing software tools are typically cloud-based, providing businesses with flexibility and accessibility to manage pricing strategies from any location with an Internet connection. They are often tailored to support specific types of industries and can handle everything from bookings to products sold through e-commerce platforms such as Amazon and eBay.

Many of these tools offer a free trial period, allowing businesses to test their features and functionality before committing, followed by a monthly subscription model that aligns with the scalability and budget of the company.

By leveraging these software solutions, businesses can harness the power of dynamic pricing with ease and efficiency, gaining insights and making data-driven pricing decisions to generate revenue and stay competitive in the marketplace.

Conclusion

By embracing dynamic pricing strategies, small businesses can unlock many benefits. From maximizing revenue during peak periods to offering lower prices during off-peak times, dynamic pricing can help small businesses stay competitive in a crowded marketplace.

Moreover, with technological advancements making dynamic pricing more accessible than ever, there’s never been a better time for small businesses to explore this pricing strategy. Whether through simple adjustments based on the time of day or more sophisticated algorithms powered by AI, small businesses can tailor dynamic pricing strategies to suit their unique needs and goals.

Ultimately, dynamic pricing isn’t just reserved for large corporations – it’s a tool that small businesses can use to drive growth and attract customers in today’s dynamic business environment. So, if you are a small business owner, take the time to consider how dynamic pricing could benefit your business and help you achieve your goals. With the right approach, dynamic pricing could be the key to unlocking new opportunities and staying ahead of the competition.

How can you incorporate dynamic pricing into your business?