Update as of April 2025: If you’re a U.S.-formed business—LLC, corporation, or sole proprietorship—you are no longer required to file a Beneficial Ownership Information (BOI) report with FinCEN. In March 2025, FinCEN quietly reversed course and eliminated the reporting requirement for domestic entities. Only foreign-formed companies registered to do business in the U.S. are still required to comply.

While the rest of this post outlines the now-defunct reporting process, it remains here for a reason: this episode is a prime example of how even well-established businesses can get blindsided by regulatory shifts that aren’t widely publicized. The BOI rule rollout caught millions of business owners off guard—proving just how critical it is to stay informed about evolving compliance requirements, even if you think they don’t apply to you.Many business owners I meet find themselves navigating the intricate terrain of internal challenges, from financial complexities to marketing dilemmas, akin to a driver intensely focused on the dashboard controls of their vehicle. However, amidst this internal turmoil, a subtle menace has stepped onto the business highway, much like a deer standing on the roadway at dusk, capable of inflicting severe damage if not noticed and acted upon in time.

This threat came in the form of a new mandated government Beneficial Ownership Information report that took effect on January 1, 2024. Like a hidden obstacle that goes unnoticed until it’s too late, this obligation has the potential to ensnare many small businesses, catching them off guard and causing unforeseen repercussions.

Just as a driver might unknowingly encounter a hazard that leaves a lasting impact on their vehicle, these businesses may only realize the consequences of neglecting this new requirement when it’s too late to avoid the damage.

The Financial Crimes Enforcement Network, known as FinCEN, has released a Small Entity Compliance Guide to assist small businesses in complying with the new Beneficial Ownership Information Reporting rule requirements. This rule is part of the implementation of the Corporate Transparency Act and mandates most small business entities to file what is known as a Beneficial Ownership Information (BOI) report with FinCEN.

Beneficial Ownership Information reports include information about the entity itself and two key categories of individuals: Beneficial owners, who own or control at least 25 percent of a company or have substantial control, and Company applicants, who directly file or are primarily responsible for filing the document that creates or registers the entity with the Secretary of State.

These Beneficial Ownership Information reports must be filed electronically using FinCEN’s secure filing system, and the information will be stored in a centralized database. They say access will be restricted to only authorized users for specific legal purposes.

While I encourage all my clients to review the Small Entity Compliance Guide and speak to their business lawyer, below is a summary that answers a few key questions for the small business owner who is short of time.

Does your company have to report its beneficial owners?

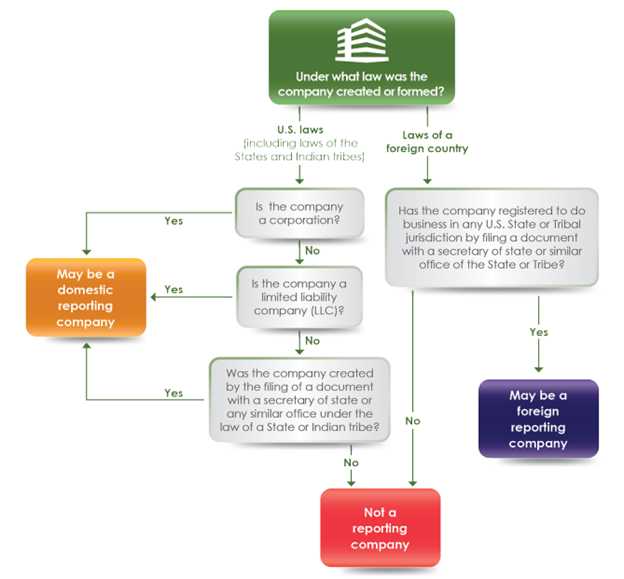

So, what are the Beneficial Ownership Information reporting requirements and the rules set by FinCEN? The following is a flowchart from the guide, used to define what constitutes a reporting company.

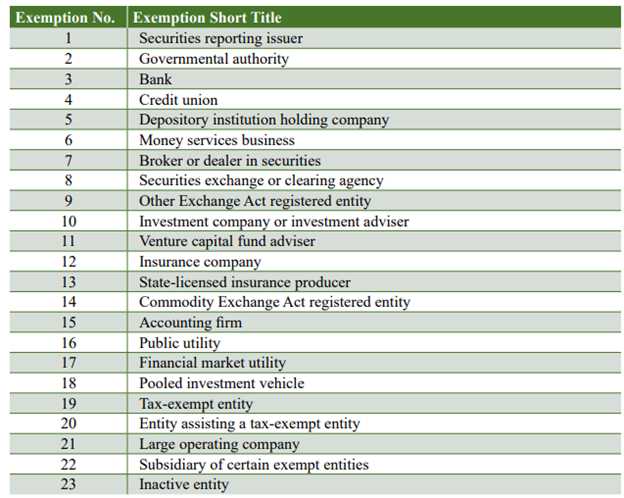

The guide uses the word “may,” indicating that not all companies must report Beneficial Ownership Information. They provided a list of business types that are exempt from the reporting obligations; however, having mentored thousands of clients since 2004, only a handful would be exempt from this reporting requirement. Below is the actual list of exempted entities, taken from the guide. My guess is that your business is not exempt.

The guide outlines what may happen if a company fails to report Beneficial Ownership Information within the required timeframe.

The willful failure to report complete or up-to-date beneficial ownership information to FinCEN or the willful provision or attempted provision of false or fraudulent beneficial ownership information may result in civil or criminal penalties, including civil penalties of up to $500 for each day that the violation continues, or criminal penalties including imprisonment for up to two years and/or a fine of up to $10,000. The guide goes on to say that senior officers of any entity that fail to file a Beneficial Ownership Information report may be held accountable for that failure.

Who are the beneficial owners of your company?

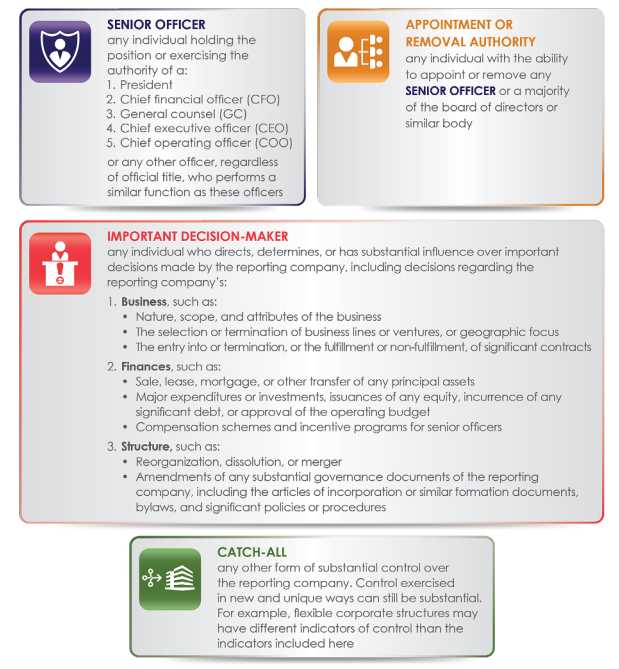

There is a process for companies to identify and report their beneficial owners. The guide defines a beneficial owner as an individual who either exercises substantial control over the company or owns or controls at least 25 percent of its ownership interests.

Determining ownership percentages is easy in the case of a corporation that issues shares to its owners. You can simply divide the number of shares held by any individual by the total number of outstanding shares to determine the ownership percentage.

However, determining the ownership percentage in an LLC is more problematic since LLCs do not issue shares. Unlike a corporation that issues shares where a person’s ownership can be calculated by dividing the number of shares the person holds by the total number of outstanding shares, LLCs simply have members.

While the operating agreement should state how distributions are made to the members, it does not have to be related to the member’s capital account or the money contributed, generally used to determine ownership percentages. Moreover, one LLC may be a member of another LLC or even a series of other LLCs, which can complicate the ownership percentage calculation even more. But as usual, Washington does not really understand how small businesses actually work.

Furthermore, LLCs may have managers who are not owners. As a result, non-owner managers, who exercise control over the company’s direction, would be considered beneficial owners even though they are not technically owners and only employees. Additionally, if you have a board of directors or advisors, they may be regarded as beneficial owners if they hold sway over the direction of the business.

The following two charts are taken from the guide as they attempt to identify the criteria used to define both substantial control and types of ownership interests.

The guide provides several examples based on various company structures, explaining how individuals can be beneficial owners through substantial control, ownership interests, or both.

Does your company have to report its company applicants?

The guide explains whether certain companies must report information about the individual or individuals involved in creating or registering the company with the Secretary of State, whom the guide refers to as “Applicant.”

If the company was registered with the Secretary of State before the calendar year 2024, they do not need to report the applicant(s) when they complete the Beneficial Ownership Information report. However, if the business is registered with the Secretary of State after January 1, 2024, the company must report the applicant(s).

For example, if the founder personally registered the entity with the Secretary of State, the founder is the only applicant needing to be reported. However, if the founder directed his spouse, partner, lawyer, accountant, or anyone else to file the documents with the Secretary of State to register the new entity, the founder who commissioned the other party to file the registration paperwork and the party that filed the actual application with the Secretary of State are each considered applicants and must be reported.

What specific information does your company need to report?

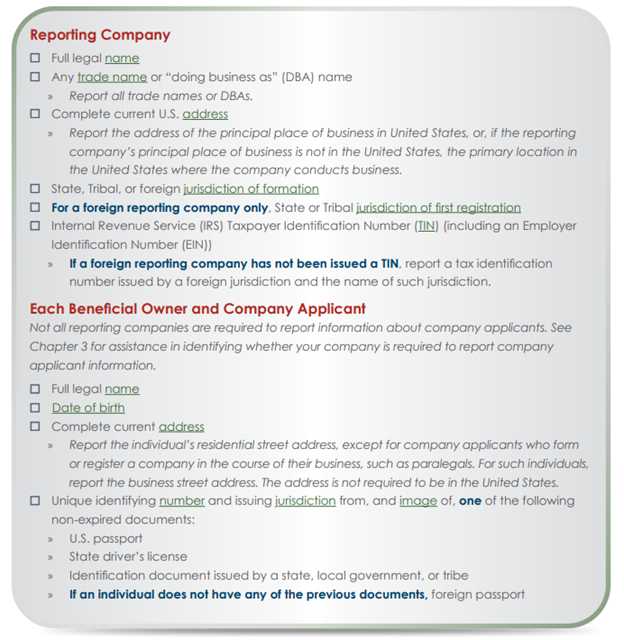

The guide provides guidance on what information needs to be included in a Beneficial Ownership Information report submitted to FinCEN. The reported information includes specific details about the company, its beneficial owners, and, if applicable, the company applicants.

The following checklist is taken from the guide and lists the information you must have on hand to complete the Beneficial Ownership Information report.

As you can see, the checklist requires that you report legal names, addresses, jurisdiction of formation, tax identification numbers, and other identifying information, including official images of beneficial owners and applicants.

The guide also discusses some special reporting rules that may apply to your company, such as whether an exempt entity owns your company, or a minor child is a beneficial owner. Minors are not allowed to be members of an LLC in Colorado, Illinois, Minnesota, and Oregon. The guide identifies the specific reporting considerations for these outliers as well as a few examples to illustrate how these rules work in practice.

The guide also delves into the scenario where the beneficial owner of a reporting company is another business. In such cases, the owners of the second business may be deemed beneficial owners in the reporting company. To streamline the process and avoid the reporting company gathering extensive information from the other business, any business can request a FinCEN identifier.

By obtaining a FinCEN identifier, businesses can use them instead of providing specific details of the other company’s beneficial owners or applicants in the Beneficial Ownership Information report. The guide provides insight into the process of requesting a FinCEN identifier, along with instructions on updating or correcting the associated information. This approach simplifies and clarifies the reporting process while ensuring compliance with the necessary regulations.

When and how should your company file its initial report?

On January 1, 2024, the Reporting Rule took effect, and companies are required to submit a Beneficial Ownership Information report to FinCEN. Companies registered before January 1, 2024, have until January 1, 2025, to file their initial Beneficial Ownership Information report. On the other hand, companies registering their entity with the Secretary of State after January 1, 2024, must file their initial Beneficial Ownership Information report within 90 days of registering.

A company that previously qualified for an exemption but no longer does must also file a Beneficial Ownership Information report within 30 days of the date on which it no longer meets the exemption criteria.

FinCEN uses a secure online system to facilitate the filing process, and the FinCEN website provides detailed instructions and technical guidance on completing the Beneficial Ownership Information report. In cases where the reporting company faces challenges in electronically filing its Beneficial Ownership Information report, there is an option for getting assistance through a FinCEN contact form.

What if there are changes to or inaccuracies in reported information?

In addition to submitting the initial Beneficial Ownership Information report, companies must remain vigilant about keeping their information accurate and up to date. The guide provides information on the steps to be taken by a business in the event of changes or inaccuracies.

Let’s suppose there is a change to the information about your company, or one of its beneficial owners filed in a previous Beneficial Ownership Information report. In that case, the company must file an updated report within 30 days of the change. It’s important to note that there’s no requirement to file an updated report for changes in a company applicant’s personal information.

Some examples of changes that necessitate an updated Beneficial Ownership Information report include modifications to the reporting company’s information, such as registering a new “doing business as” (DBA) name, changes in beneficial owners, such as a new Chief Executive Officer, changes in ownership exceeding 25 percent, or the death of a beneficial owner.

Additionally, suppose your company qualifies for an exemption from the reporting requirements after filing its Beneficial Ownership Information report. In that case, an updated report must be submitted to indicate the new exempt status.

- Here is a link to the full guide. Small Entity Compliance – Beneficial Ownership Information

- Here is a link to the Online Beneficial Ownership Information E-Filing System

Have you completed your Beneficial Ownership Information report?

UPDATE, Steven Imke, 2025/03/21: FinCEN Removes Beneficial Ownership Reporting Requirements for U.S. Companies and U.S. Persons, Sets New Deadlines for Foreign Companies. Click on the following URL to read more. https://www.fincen.gov/news/news-releases/fincen-removes-beneficial-ownership-reporting-requirements-us-companies-and-us