Once a month, I sit on a military transition panel where I speak to service members preparing to separate from the military. Many are considering the entrepreneurial path. When asked why they want to start their own business instead of “working for the man,” I often hear the same surface-level answers: “I want to be my own boss,” or “I want to control my own destiny.” These statements sound empowering, but they miss the deeper rationale that can truly make entrepreneurship a strategic life decision.

To challenge their thinking, I run a little thought experiment.

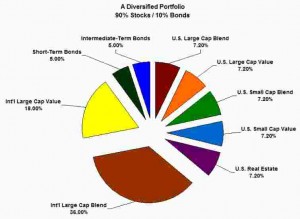

I ask the room, “How many of you own stock?” Almost every hand goes up. Then I ask, “Do you own stock in just one company?” All hands go down. The reason? Everyone understands the power of diversification.

Then comes the kicker: “Is your income diversified?” I ask. “Or does your entire paycheck come from a single employer?” That’s when the lightbulbs start flickering on.

Most people don’t think of their job as an undiversified investment, but that’s exactly what it is. When you work for someone else, 100% of your livelihood hinges on a single income stream from a single employer. If that employer hits hard times, restructures, or simply no longer needs your position, your income vanishes overnight.

By contrast, running a business can be one of the most effective ways to diversify your income. If you’re a freelancer, consultant, or small business owner and you lose one client, it’s not ideal—but it’s not catastrophic either. You still have multiple other clients keeping money flowing in. You might need to tighten your belt or hustle a bit to replace that income, but you’re still afloat.

Let’s say you have 12 clients and one decides not to renew a contract. That’s only 8.3% of your revenue. Compare that to losing your job, which is 100% of your income gone. Which scenario feels riskier now?

Related Post: Income Security: Why Being an Employee is Just too Risky

Of course, business ownership isn’t for the faint of heart. It involves risk, long hours, and the stress of uncertainty. But it also offers leverage—financial, personal, and lifestyle—that employment simply can’t match. And that leverage is built on the foundation of multiple income streams.

Moreover, the idea that owning a business gives you total control is a bit of a myth. You’re still accountable—to your customers, to the market, and to your team if you have one. But what you do gain is agency. The ability to choose your clients, set your priorities, and build something that’s aligned with your values.

Veterans often have a leg up here. Military life teaches resilience, problem-solving, and self-discipline—traits that map perfectly to entrepreneurship. The military trains people to manage chaos, adapt on the fly, and keep going when the mission gets tough. If that doesn’t sound like business ownership, I don’t know what does.

So, when I hear those military members say they want to start a business because they want more control, I get it. But I push them to dig deeper. If they really want to protect their future, build resilience into their finances, and reduce the risk of relying on just one paycheck, then entrepreneurship offers something powerful: diversified income.

As you consider your own path, ask yourself not just whether you want to be your own boss, but whether you want to build a foundation that isn’t tied to a single point of failure.

Because at the end of the day, the real question is:

Is your income diversified?