Starting a business is an exciting, nerve-wracking adventure. As a small business advisor to many entrepreneurs just starting out, I’ve seen the same mistake play out over and over again: founders that invest in things that don’t pay off quickly enough, if at all. Some spend big on a fancy office, a custom-built website, or even a logo redesign before securing their first customer. Others invest in ideas that might be profitable someday but have no clear timeline to generate cash flow. The problem? Cash runs out faster than you think.

This is where understanding the “Internal Rate of Return” (IRR) becomes crucial. If you want to survive as a business, you need to make investment decisions that generate positive returns within a reasonable timeframe. Otherwise, you might wake up one day and realize you’ve poured thousands (or millions) into a financially unsustainable business.

What is IRR, and Why Should You Care?

IRR stands for Internal Rate of Return, and it’s a way to measure how profitable an investment is over time. Think of it like a speedometer for your business investments: the higher the IRR, the faster your money is coming back to you.

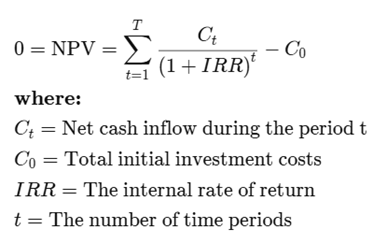

Here’s the textbook definition: IRR is the discount rate that makes the net present value (NPV) of an investment’s cash flows equal to zero. If that sounds like financial jargon, don’t worry—we’ll break it down with a simple analogy.

IRR Explained with a Lemonade Stand

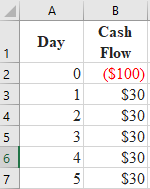

Imagine you and a friend decide to start a lemonade stand. To get started, you need to invest $100 in supplies (cups, lemons, sugar, and a table). Over the next five days, you sell enough lemonade to earn $30 per day in revenue. Here’s what your cash flow looks like:

By Day 4, you’ve already broken even, and by Day 5, you’ve made a total profit of $50 on top of your original investment. That means your IRR is high—your investment pays off quickly, and you’re making real money fast.

Now, compare this to a different scenario. Let’s say instead of selling lemonade, you decide to buy a food truck for $75,000. You make $500 per week in gross profit. Your IRR would be much lower because it would take nearly three years just to break even, and that does not include business expenses such as overhead, taxes, and other operating costs and assumes that nothing goes wrong or breaks.

How IRR Applies to Your Startup

Every dollar you invest in your business should work for you and not tie up precious capital. If you spend $20,000 stocking up on inventory that takes years to sell, your IRR is low (or even negative). But if you invest $240 in buying a paid version of an AI tool like ChatGPT that helps complete projects faster, leading to an extra $1,000 in revenue within a month, your IRR is high.

In practical terms, IRR helps you:

- Decide which investments to prioritize. Should you spend on marketing or product development? Buy new equipment or lease it? IRR helps you determine which will generate the fastest and highest return.

- Avoid cash flow problems. A low IRR means your money is tied up for too long without generating a return. If you run out of cash before making money, you’re in trouble.

- Convince investors to fund you. Investors love startups with high IRR potential because it means they’ll get their money back faster (with profits).

Real-World Mistakes: When Founders Get IRR Wrong

Let’s look at some common IRR mistakes new business owners make:

1. Investing in Vanity Instead of Revenue-Generating Assets

Many startups blow money on things that look impressive but don’t generate immediate revenue.

Bad Investment: A $15,000 conference room table and leather office chairs that impress visitors but don’t bring in new customers.

Better Investment: A $5,000 lead generation campaign that results in $30,000 in new sales within three months.

2. Ignoring the Time Factor

Startups are often chasing ideas that could potentially make money, but they don’t consider how long it will take to see a return.

Bad Investment: Spending a year developing an expensive mobile app with no real monetization plan.

Better Investment: Renting equipment instead of purchasing it upfront allows you to test demand and scale operations without committing significant capital.

3. Not Understanding Off-Balance Sheet Investments

Some startup investments don’t appear directly on financial statements but still impact cash flow and IRR.

Bad Investment: Leasing office space for three years, with a square footage larger than your current needs, hoping to grow into it is tying up capital in rent rather than investing in areas that drive immediate growth.

Better Investment: Using a co-working space or remote setup allows funds to be invested in growth instead.

How to Calculate IRR for Your Startup (Without an MBA)

You don’t need an advanced finance degree to use IRR. Many online tools and Excel formulas (like the “=IRR()” function) make it easy. Here’s a basic method:

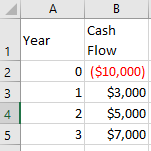

- List your investment costs. Example: You invest $10,000 in new equipment with a three-year expected operational life.

- Estimate future cash flows. Example: You expect $3,000 in Year 1, $5,000 in Year 2, and $7,000 in Year 3.

- Use an IRR calculator. Plug these numbers into Excel using the =IRR() function or an online calculator to find your IRR. In Excel, enter your cash flows in a column, including the initial investment as a negative number, then use =IRR(B2:B5), assuming your cash flows are in cells B2 to B5.

Here’s how it would look in an Excel-style table:

- Compare your IRR to your required return. If your IRR is higher than what you could earn elsewhere (like the stock market), it’s a good investment. In our example, the computed IRR is approximately 20.13%, meaning this investment is generating a strong return over time.

You might wonder why the IRR isn’t 50%, given the cash flow over three years. At first glance, if you invested $10,000 and received $15,000 over three years, it might seem like a 50% return. However, IRR doesn’t work like simple arithmetic. The reason is that IRR accounts for the time value of money—meaning future cash flows are worth less than cash today. The IRR calculation discounts future earnings back to their present value to determine the true rate of return rather than simply adding them up.

Also, because the investment is assumed to have zero residual value at the end of its useful life, IRR only reflects the return from the cash inflows generated during the three-year period. Here is the actual formula for IRR:

Luckily, you don’t have to perform complex mathematical iterations to calculate the IRR manually. Excel does the hard work for you. Just input your cash flows in a column and use the IRR formula, and Excel will return the IRR automatically.

Check out this Investopedia article on IRR for a more detailed explanation.

Final Thoughts: Make IRR Your Best Friend

As a startup founder, your number one priority should be to achieve breaking even before you run out of money. Understanding IRR helps you avoid financial pitfalls, make smarter investment decisions, and increase your chances of success.

So, before you spend another dollar, ask yourself: Will this investment pay off quickly, or am I just burning or tying up valuable cash? If you don’t know the answer, it’s time to start thinking in IRR terms.

What is the IRR of your latest investment?