Advice About Selling A Business

The following quiz was designed to test your knowledge of selling a business. Are you ready to put your knowledge to the test?

On average, a business owner sells their business after seven years. Not because the business has gone bad but because of what business brokers call “entrepreneurial burnout.”

Is it time to sell your business?

When it comes to selling an existing business, I would recommend that you consider buying my book. Its small price can translate into more than a thousand times its cost in after-tax profits from the sale of your business.

Buying Or Selling A Small Business

What You Need To Know Before You Buy Or Sell

Buying Or Selling A Small Business is a wisdom-packed book that was written for entrepreneurs who are either considering buying someone else’s business or selling their existing business. Throughout the text, there are links to exclusive streaming videos from experts in the Merger and Acquisition (M&A) space as they comment on key aspects and provide valuable insight based on their professional experiences with buyers and sellers.

In the book, the author describes six different ways to value an existing business. Learn the real reasons sellers sell, and buyers buy businesses. As a seller, discover techniques to maximize value, while as a buyer, learn about all the different forms of payment and financing options to make your purchase. Discover how the terms of the deal can be more important than the actual sale price when it comes to taxes both for the buyer and the seller.

As a serial entrepreneur, the author has built, bought, and sold several companies for huge profits using the techniques described in this book. Buying Or Selling A Small Business is a concise and easy-to-read guide packed with solid advice that will help you avoid costly mistakes either when buying or selling a business.

Before we dig too deep into what it takes to sell your business, when it comes to selling a business, I recommend finding and using a business broker. They often charge an upfront listing fee to cover the upfront business packaging effort, plus a back-end success fee. The advantage of using a broker is that they expose your business to more buyers than you can do yourself. Moreover, they act as a voice of reason during negotiations. Since they are a 3rd party, they are not as emotionally attached to the business as you are and can deliver objective feedback when necessary.

I like to think of the business broker as a real estate agent when you are selling a home. They understand not only the industry and the location but also the process. Then can often negotiate a better deal than you can as a seller and sell your business at a higher price that will more than cover their selling fees.

If you think you are ready to sell your baby, here is a list of things that you need to consider before you move forward.

Before we get too deep into the discussion of selling a business, here is an overview of what you can expect if you decide to sell your business.

So why do most owners sell? Here is a quick video from two prominent business brokerage firm CEOs explaining the top reasons sellers decide to sell their businesses.

Why a buyer should buy an existing business

When you sell an existing business, you are selling a business that has a system, employees who know their jobs, and customers who know you exist. Moreover, they start making money for the new owner on day one. That is why, if done properly, buying an existing business is the least risky option when you want to become a business owner.

Another reason a buyer should consider buying your existing business is related to your ability to carry back a note or to structure the deal in such a way that you get paid out of the profits of the business vs. one large upfront payment. Getting paid over time can be good for you as well as the seller since it spreads out the proceeds of the sale, thereby lowering your marginal income tax rate so you get to keep more of your sale price.

The Buyer

The buyer’s perspective is to:

- Take advantage of the fact that a company is undervalued

- Achieve growth more rapidly than by internal effort

- Satisfy market demand for additional products/services

- Avoid the risk of internal startup or expansion

- Increase earnings per share

- Reduce dependence on a single product/service

- Acquire market share or position

- Offset seasonal or cyclical fluctuations in the present business

- Enhance the power and prestige of the owner, CEO, or management

- Increase utilization of present resources (e.g., physical plant and individual skills)

- Acquire outstanding management or technical personnel

- Open new markets for present products/services

So, who buys an existing business? There are several types of buyers that are interested in buying existing businesses.

Here are what two prominent CEOs of M&A firms have to say about the type of buyers they most often encounter.

Selling Considerations

If you are selling the business to:

Competitors or Vendors

Make sure you run credit reports, prioritize whom you are going to see first, and ask them to volunteer a “ballpark” value and criteria.

Employees

Make sure you discuss price and terms before discussing the profits, establish precise time limits for acquisition, be prepared for a special price and special terms, and do not begin discussions with anyone else while employees are in the buying picture.

Individual Investor

Be aware that they are often anxious to make a career change. They are willing to risk their personal net worth and are often motivated buyers. About 2/3 will likely be from a different state, and for them, location, which may mean moving to your city, is often more important than the price. Individual investors are more difficult to find, and you may have to carry a note or offer an earnout.

Investment Groups

Be aware that they have available cash as well as lender relationships. They have business relationships, and your business may be a cog in a larger strategy.

Public Company

Be aware that they may have a need to grow that your business can fill or that your business is a strategic fit for them. Be aware that they have available funding, are smart/sophisticated buyers, and most often have merger and acquisition experiences that eclipse yours. They often have a narrow range they are willing to offer for your business, and their deals often include stock for stock. Be sure to do your due diligence and look at their price-to-earnings ratios.

So, where do you find buyers?

You can find potential buyers by searching investor group directories and specialized databases. You may want to consult with your local library to see what resources they may have. Another option is to use targeted mailings and posting blind ads in major newspapers. If you do blind ads, DO NOT post them in hometown papers or trade journals. It is better to post your ads in the Wall Street Journal, New York Times, Chicago Tribune, Los Angeles Times, etc.

Here are a few national websites to list your business for sale:

Of course, you can also list your business on Craigslist in various cities.

Business Valuation

There are lots of ways to value a business. Here are the primary components of value.

Below is a simple and quick valuation method for an existing lifestyle business or micro business with revenues under $1 million and 6 other valuation methods used to value other types of businesses.

And here is a pdf version you can download Business Valuation

There are several factors that can affect the valuation.

To find the best valuation method for your business, I often refer people to an article from Inc. magazine that looks at dozens of industries and includes the 3 best valuation methods for that industry.

Inc. Magazine Business Valuation

Intangible assets such as the seller’s business contracts, employees, and intellectual property also factor into its value.

And here is what they have to say about factors that discount a valuation.

Another factor that affects value is the economy at the time of the sale.

There are several process mistakes that can also reduce value. First and foremost is an uncontrolled disclosure of the sale that can cause key employees to leave, customers to flee to competitors, exclusive suppliers to sell to competitors, and finally, competitors can use the rumor of a sale to pirate your existing customers.

In addition, inadvertent disclosure of proprietary information to competitors/customers in the due diligence process can cause you to lose your appeal.

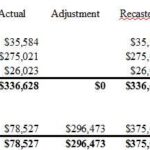

Recasting Financials

Recasting is the practice of taking your P&L and editing it to reflect a more accurate picture of your company’s income potential to a new buyer.

“Private companies tend to minimize profits to avoid income taxes. It is almost impossible to buy a private company without recasting because the owner is understating profits.” The Wall Street Journal.

Recasting from a business broker’s perspective.

And recasting from the CPA’s perspective.

Here is a list of P&L line items that are often recasted.

- Owner-related direct/indirect expenses

- Surplus/deficit staffing

- Inventory write-downs

- Non-trend bad debts

- Discontinued product lines/business

- Real estate

- Professional fees

- Debt/debt service

- Extraordinary expenses

- Bad decisions

Here is what the experts have to say about the items they see most often recasted.

When you are recasting your finances, you should go back 3-years and footnote every change.

Your job as the seller is to explain the past, but your real job is to sell the future.

Buyers buy a well-documented and believable future. Your job as the seller is to prove value, and the buyer’s job is to define the price.

Unlike when you sell a car or a home, where the seller assigns a value or list price when you sell a business, it is often better to prove the value and let the buyer define a price. Because, as Peter Drucker said:

“The buyer rarely buys what the seller thinks he’s selling.”

So, he who mentions price first often is the loser.

Here is what a business broker has to say about listing your business with a price or making the buyer come up with a price after you have proved the value.

So, what contributes to a business’s value? Basically, the balance sheet assets, the business’s cash flow, its contracts and employees, its location, and its intellectual property, such as patents.

However, keep in mind what Justice Holmes said:

“The ultimate value is what a willing and informed buyer will pay a willing and informed seller, neither of whom is under any duress.”

And remember that:

“Knowing when and how to sell your company is an essential aspect of entrepreneurship.” SUCCESS Magazine

Deal Structure

Remember that it is not how much you make but how much you keep in the end that is important. Therefore, a deal structure is a key ingredient in reaching a workable equation.

A business sale can be structured as either an asset or a stock purchase.

The deal structure is often more important than the actual sale price.

There are three forces that play into the deal structure. They are tax issues, business issues, and your personal needs.

Tax Issues

When it comes to taxes, your business entity affects how you are taxed on the proceeds from the sale.

Business Issues

There are three primary business issues to consider that include economic, legal, and technological issues.

Some economic issues include your willingness to accept a note or stock from the buyer in lieu of upfront cash.

Some legal or contractual issues may be the need to offer warranties, representations, and indemnifications to the buyer.

Lastly, some technological issues include using earnouts, royalties, or an employment agreement as part of the deal.

Personal Needs

As the seller, your personal needs might include health and retirement considerations. Other personal needs include estate planning issues like using the proceeds of the sale for a trust for your kids or spouse. Additionally, other personal needs are debt resolution, a need to continue your involvement in the business, or the need to retire completely.

Type of purchases

Forms of payment

Here is an M&A lawyer describing the forms of payment he often sees in M&A transactions.

So, the allocation of the sale price can govern tax consequences.

If the buyer is a public company, you can consider a tax-free reorganization.

If you are a C-Corp, here is how double taxation will affect the net proceeds you will receive from the sale.

If the seller’s business future is at risk, then a savvy buyer will want to structure the deal as an earnout.

The players

A more detailed look at the role of an M&A CPA.

A more detailed look at the role of an M&A Lawyer.

From the buyer’s perspective, expect to see six personas, each with a different agenda.

- CEO – focuses on the vision

- CFO – focuses on financials, ratio analysis

- Legal – focuses on liability potential

- Marketing – focuses on market potential

- Sales – focuses on distribution

- Human resources – focuses on employee benefits, salaries

The Process

Here is a quick overview of the documentation you will deal with when selling a business.

When an owner has a business they want to sell, they generally produce a one-page ad that speaks about the opportunity without disclosing the business by name. If, after reading this one-page ad, the prospective buyer wants to know more about the business opportunity, they generally contact the phone number/email on the ad or the listing broker and express their interest in learning more about the offering. Frequently, they may be asked to sign a Non-Disclosure Agreement (NDA) or Confidentiality Agreement at this point. Here is a sample of a confidentiality agreement I used when buying a business.

Sample Confidentiality Agreement – Business Purchase

Once you verify the seller’s intent and make sure that they are not just a competitor trying to get some dirt on your business, you provide the prospective buyer with a numbered copy of your Confidential Business Review (CBR) document. The CBR is a kind of business plan tailored to provide enough additional information to convince the buyer to make an offer. Here is an outline of a Confidential Business Review document I have used and shared when I teach people how to sell their business.

Confidential Business Review Outline

To make an initial offer, the buyer will submit what is known as a Letter Of Intent. Similar to buying a house, making an offer is not binding but gives the seller a basic idea of what you are willing to offer, provided all their claims check out. Here are two sample letters of intent that you can download to give you an idea of what to expect from a letter of intent.

Sample Letter of Intent with Earn Out – Asset Purchase

Sample Letter of Intent – Stock Purchase

If you accept the prospective buyer’s letter of intent, the next step is for the buyer to perform a proper due diligence.

Here is what to expect in the due diligence process.

When I sold my first business to a publicly held company, I had the extensive resources of a pool of in-house lawyers to help me draft a VERY comprehensive due diligence checklist. While it may be overkill for most small business purchases, it will give you some idea of the kind of information you should be prepared to provide to the potential buyer.

If, at the end of the buyer’s due diligence effort and assuming everything that you said checks out and the buyers want to move forward with the acquisition, they will prepare a Definitive Purchase Agreement. Here is a Sample Purchase Agreement Outline.

Sample Purchase Agreement Outline

With the price and terms acceptable to all parties, your lawyer will draft the final documents and set a closing date where the final documents are signed, and money changes hands.