We can all agree that some business ventures are inherently riskier than others. A product-based business, focused on a new product in a brand-new category, is far riskier than say, a service-based cleaning company, that operates in an established service category. Small business risk comes in many different forms. Some, you’ll be able to prepare for, and others you will not.

A PESTEL analysis allows a business to consider macro-environmental conditions that can alter the risk profile of a business.

Porter’s Five Forces allows a business to consider the micro-environmental forces that can alter the risk profile of a business.

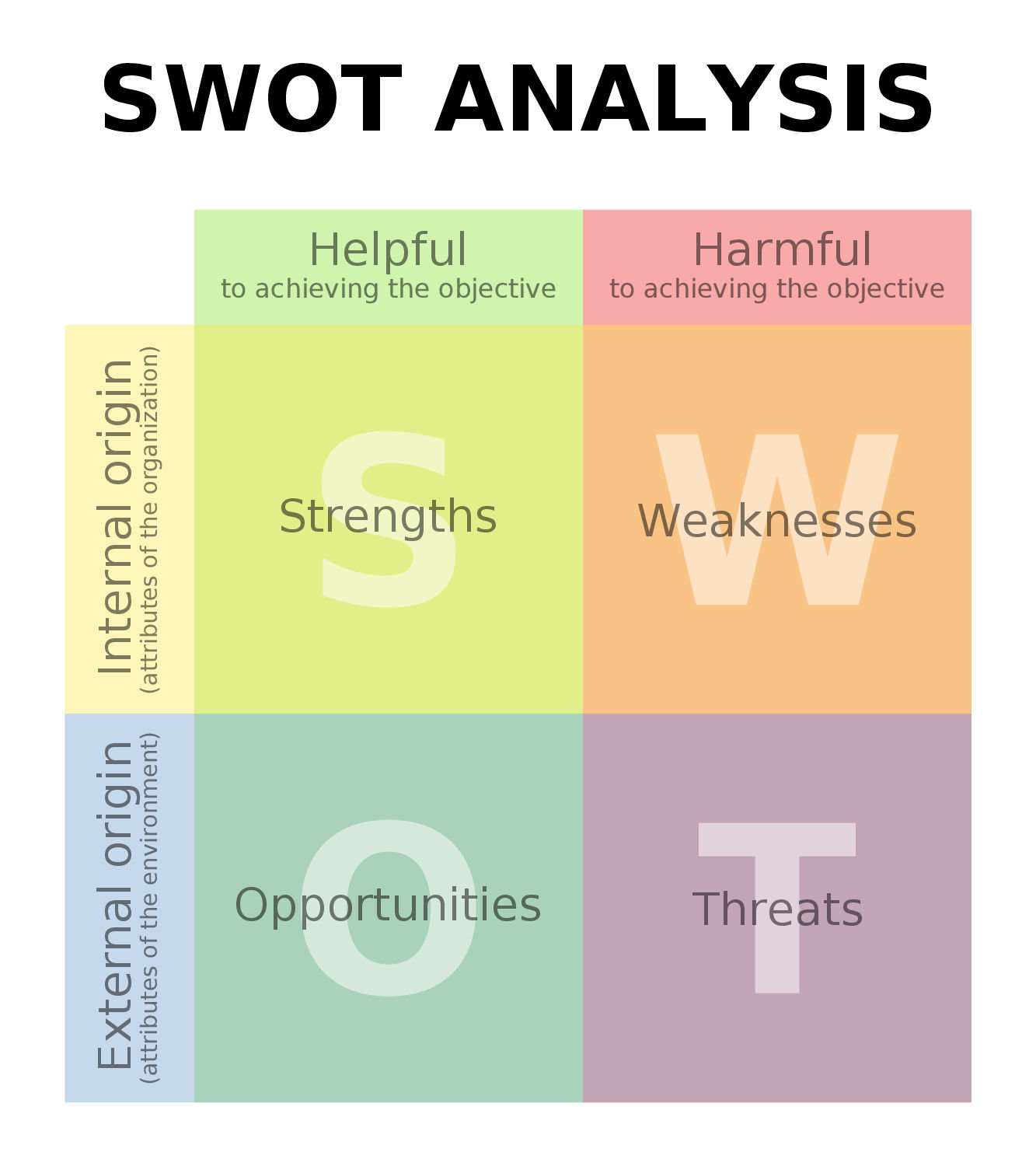

While a SWOT analysis is a tool to help assess the strengths of an organization as well as identify opportunities, it also assesses an organization’s weaknesses and potential threats.

Operational business risks are failures related to day-to-day operations that can impede a company’s ability to earn revenue. Often, operational business risks are the result of insufficient or failed processes. There are six types of operational risks.

In addition to operational risks, there are also financial and governmental risks that a small business must be prepared to deal with.

Most businesses would be well served to develop a risk matrix to assess their level of risk, by considering the probability or likelihood of an event against the severity of the consequences to the business if it were to occur.

Today, hackers are one of the biggest threats to a business.

Occasionally, external factors like the housing bubble collapse or the coronavirus pandemic, happen. Here is some advice to make sure you don’t get crushed by them.

Insurance

For the most part, I personally believe insurance can create gravity for a lawsuit. Here is an excerpt from a video lesson from Boot Camp: Steps to owning your business that discusses the role of insurance.

By definition, insurance is a hedge against catastrophic loss. Too many businesses start out in a defensive position and secure all kinds of insurances long before they have something to protect.

One of the cheapest ways to protect your business from being sued is to make your lawyer the registered agent for your business. This way, you look lawyered up and only truly legit lawsuits will make it through your legal filter.

While it is never good to have too much insurance, once you have something to protect, here is a list of the most common forms of business insurances.

Insurance can compensate the business when the unforeseen happens, but there are three primary areas that a business needs to proactively make sure they protect if they want to stay in business and maintain a competitive edge.